Statistička priopćenja daju sažet pregled najnovijih objavljenih vrijednosti i smjera kretanja serija statističkih pokazatelja koje objavljuje Hrvatska narodna banka.

Statistika

- Kalendar objava

- Statistička priopćenja

- Pokazatelji poslovanja bankovnog sustava

- Glavni makroekonomski indikatori

-

Statistički podaci

-

Financijski sektor

- Doprinos Republike Hrvatske monetarnim agregatima europodručja

- Konsolidirana bilanca MFI-ja

- Središnja banka (HNB)

- Druge monetarne financijske institucije

- Druga financijska društva

- Sektor opće države

- Sektor inozemstva

- Financijski računi

- Vrijednosni papiri

- Odabrane nefinancijske statistike

- Platni sustavi

- Platne usluge

- Gotov novac

- Promet ovlaštenih mjenjača

- Arhiva

-

Financijski sektor

- SDDS

- Regulativa

- Informacije za obveznike izvještavanja

- Informacije za korisnike statističkih podataka

- Korištenje povjerljivih statističkih podataka HNB-a za znanstvene svrhe

- Anketna istraživanja

- Eksperimentalne statistike

Statistička priopćenja

Objava statističkih pokazatelja duga opće države za lipanj 2023.

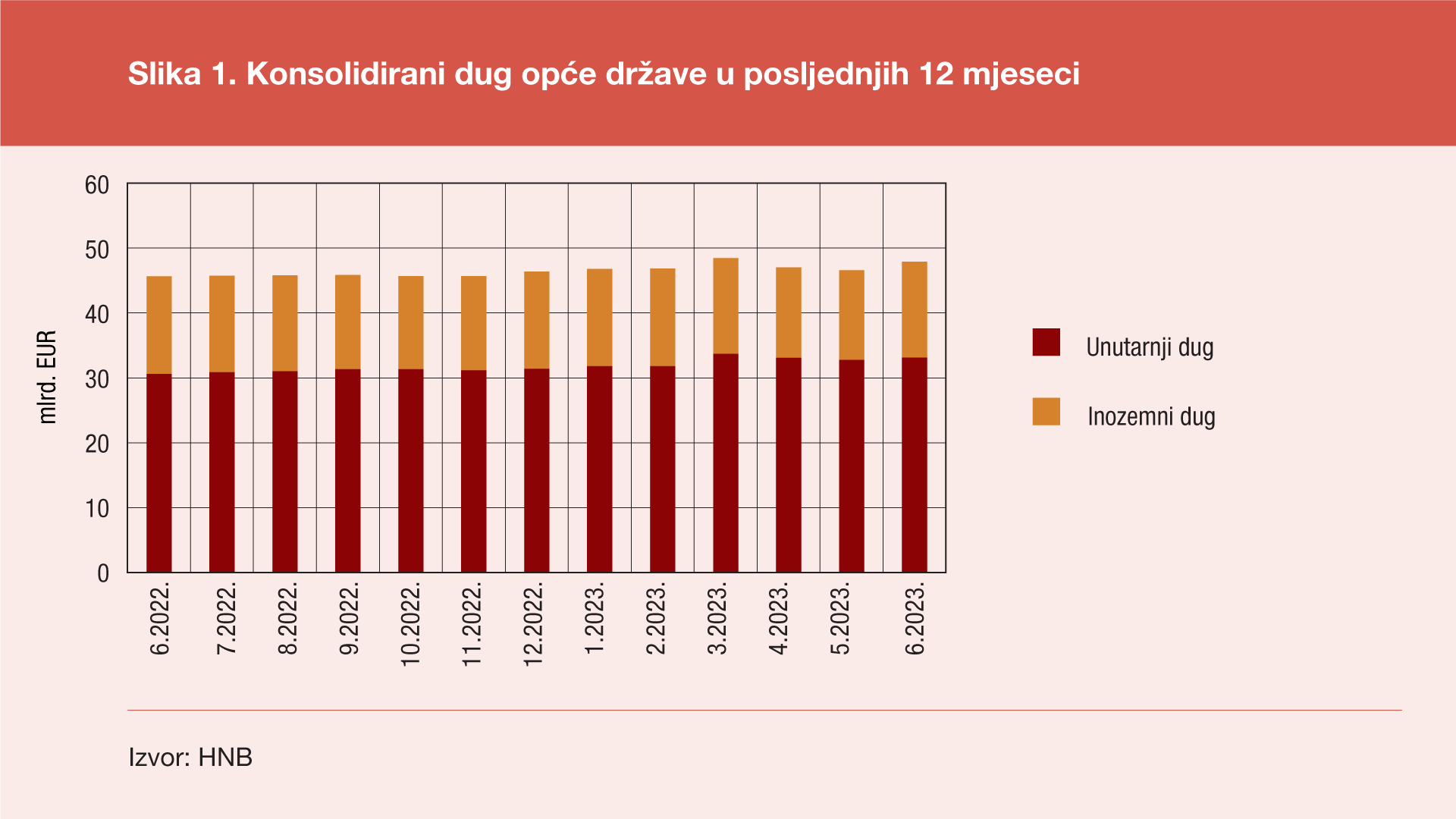

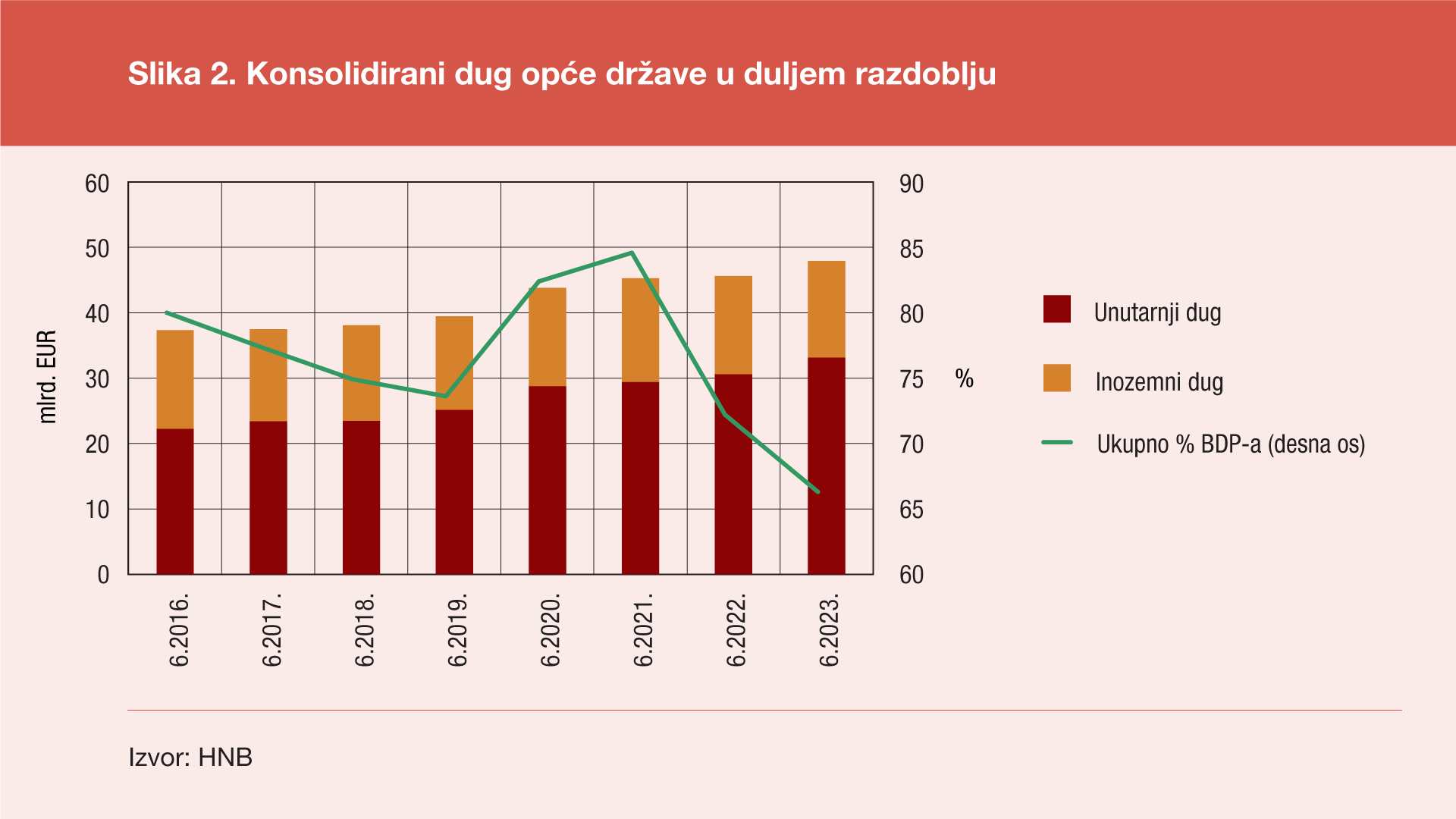

Prema konačnim[1] podacima statistike državnih financija za drugo tromjesečje 2023. ukupno stanje konsolidiranog duga svih podsektora opće države[2] na kraju lipnja 2023. godine iznosilo je 47,9 mlrd. eura, pa je u odnosu na kraj ožujka 2023. ostvaren pad od 0,5 mlrd. eura (ili 1,1%), a u odnosu na kraj lipnja 2022. taj je dug veći za 2,3 mlrd. eura (ili 5,0%). Taj rast duga na godišnjoj razini uzrokovan je kombinacijom pada inozemnog duga za 0,27 mlrd. eura (ili 1,8%) i porasta unutarnjeg duga za 2,54 mlrd. eura (ili 8,3%). U odnosu na kraj prethodnog tromjesečja unutarnji je dug pao za 0,57 mlrd. eura (ili 1,7%), a inozemni dug porastao je za 0,05 mlrd. eura (ili 0,4%).

Promatrano u odnosu na godišnji BDP[3], ukupni dug na kraju lipnja 2023. godine iznosio je 66,5% BDP-a, a na kraju lipnja prethodne godine taj je udio iznosio 72,4%, što je smanjenje od 5,9 postotnih bodova na godišnjoj razini i smanjenje od 2,6 postotna boda u odnosu na kraj prethodnog tromjesečja, kada je taj udio iznosio 69,1%.

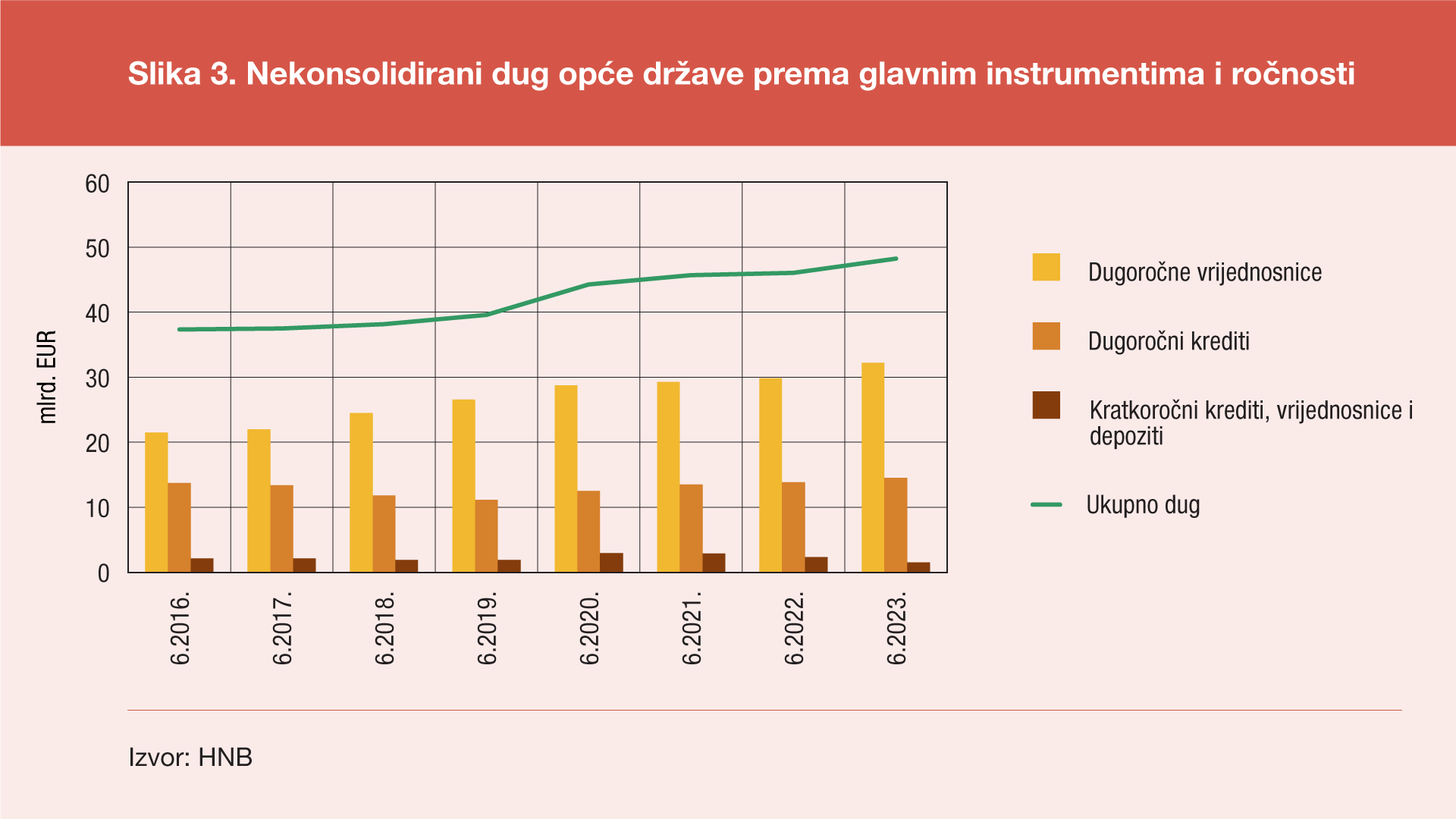

Podaci o strukturi duga opće države po glavnim dužničkim instrumentima i ročnosti duga dostupni su samo za nekonsolidirani dug[4] opće države. U njoj prevladavaju dugoročni dužnički instrumenti, pa tako na kraju lipnja 2023. godine najveći udio u tom dugu imaju obveznice (66,8%), drugi su po važnosti dugoročni krediti (30,1%), a posljednji su kratkoročni krediti, vrijednosnice i depoziti (zajedno 3,1%). Pritom je kratkoročni dug na kraju lipnja 2023. godine bio za 0,8 mlrd. eura (ili 35,3%) manji u odnosu na kraj lipnja 2022., a dugoročni se dug u istom razdoblju povećao za 3,0 mlrd. eura (ili 6,9%).

Vremenske serije statističkih podataka: Tablica I3 Dug opće države (ESA 2010).

-

Podaci su potvrđeni od strane EUROSTAT-a u sklopu procesa notifikacije fiskalnog izvješća. ↑

-

Dug koji isključuje međusobna potraživanja institucionalnih jedinica unutar istog podsektora i između podsektora, tzv. maastrichtski dug. ↑

-

Izračunat kao zbroj prethodna četiri tromjesečna BDP-a ↑

-

Nekonsolidirani dug čini maastrichtski dug uvećan za međusobna dužnička potraživanja između jedinica u sektoru opće države. ↑