From August 2023 the comments on statistics, a short description of selected, recently issued statistical data in the area of monetary statistics and the non-residents sector statistics, are no longer published. They are replaced by Statistical releases.

Comments on monetary developments for October 2018

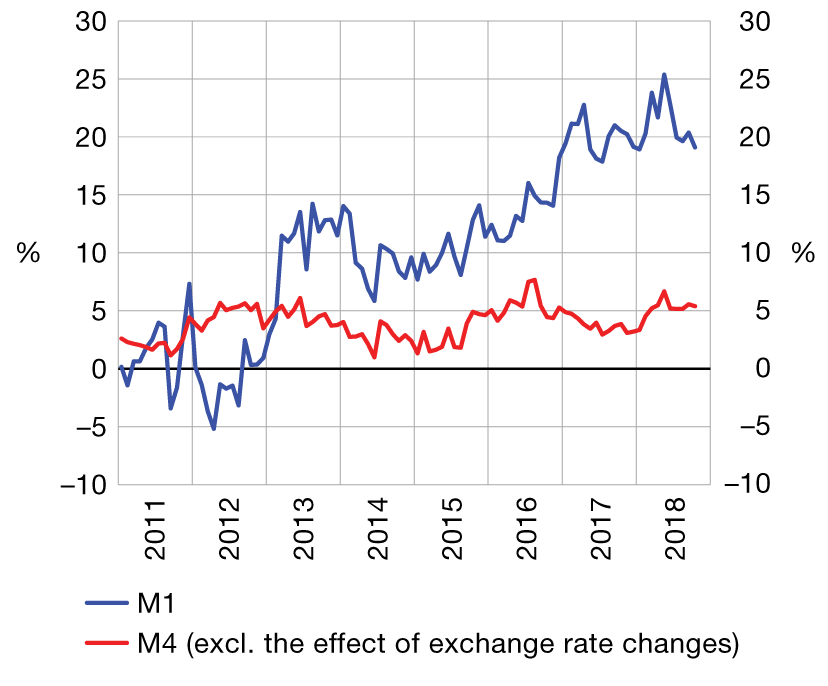

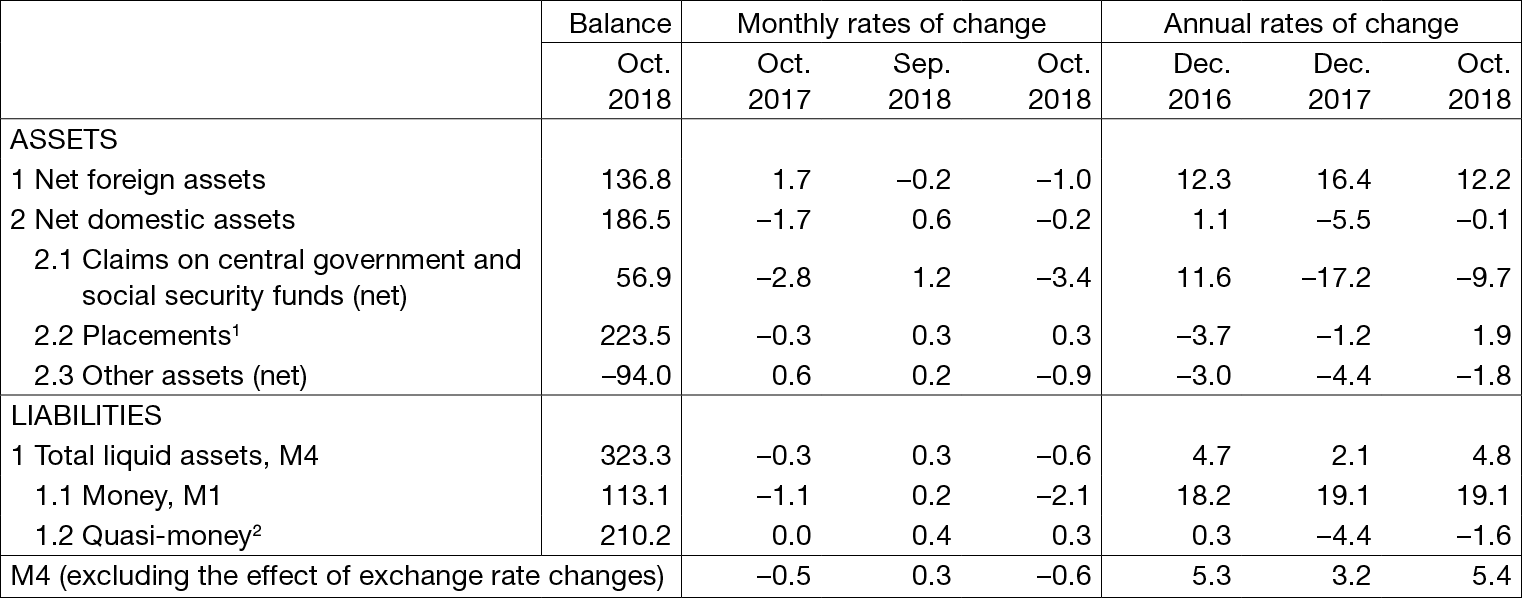

At the end of October 2018, total liquid assets (M4) stood at HRK 323.3bn, down by HRK 1.8bn or 0.6% from the end of September (Table 1). The monthly fall in this broadest monetary aggregate was mostly driven by a fall in net foreign assets (NFA) of the monetary system, and to a smaller degree, by the decrease in net domestic assets (NDA). On an annual level, the growth in total liquid assets (M4) slowed down to 5.4% in October, excluding the effect of exchange rate changes (Figure 1). As regards the components of total liquid assets, the annual growth in money (M1) slowed down to 19.1%, while the annual fall in quasi-money slowed down, standing at 1.6% at the end of October.

| Figure 1 Monetary aggregates annual rates of change |

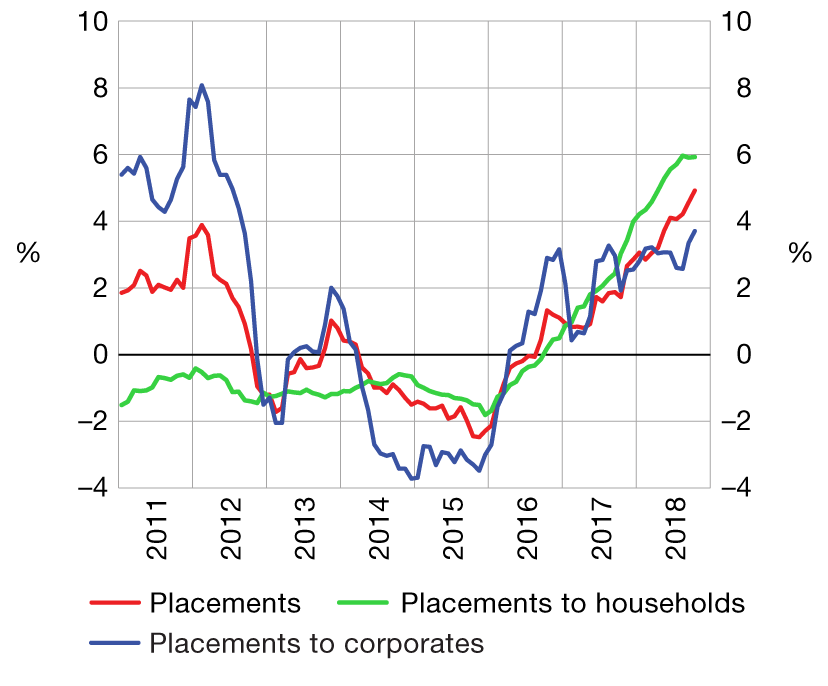

Figure 2 Placements annual rates of change based on transactions |

|

|

| Source: CNB. |

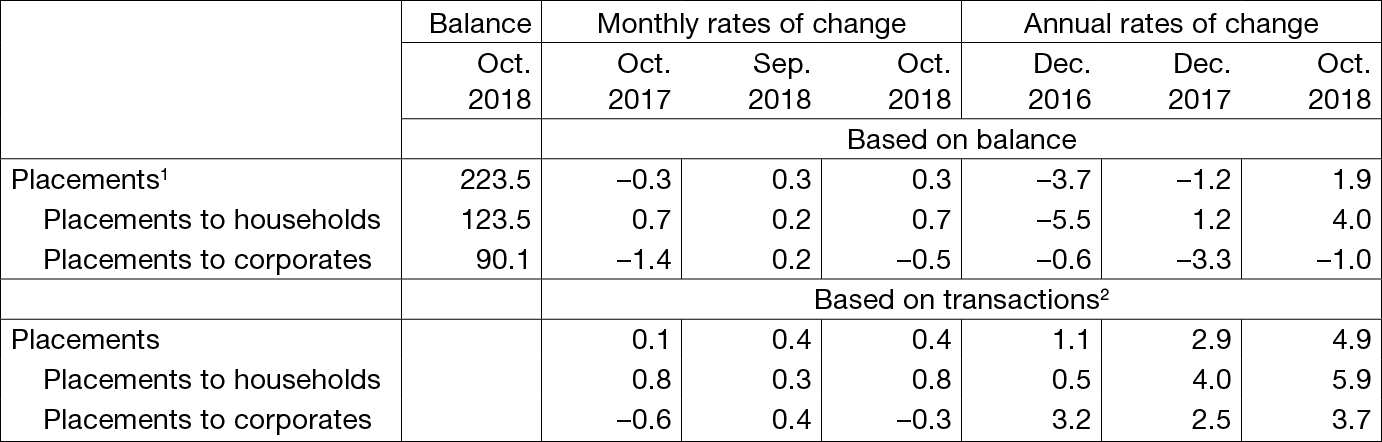

Total placements of monetary institutions to domestic sectors (excluding the government) increased in October by HRK 1.0bn or 0.4% (transaction-based), standing at HRK 223.5bn at the month's end, while their annual growth rate accelerated to 4.9% (transaction-based, Figure 2). The annual growth of corporate placements accelerated, totalling 3.7% at the end of October, while the annual growth of household placements stagnated at 5.9% (Table 2). In the structure of household loans, the annual growth of non-purpose cash loans accelerated to 11.8% and the annual growth of home loans slowed down to 3.2% because a more significant effect of this-year's programme of subsidies to home loans has not yet become visible. As for the nominal stock of total placements, their annual growth stood at 1.9% in October and was significantly slower than the transaction-based growth, primarily as a result of the sale of non-performing placements.

Table 1 Summary consolidated balance sheet of monetary institutions

in billion HRK and %

1The sum total of asset items 2.2 to 2.8 of Bulletin Table B1: Consolidated balance sheet of monetary financial institutions.

2The sum total of liability items 2 to 5 of Bulletin Table B1: Consolidated balance sheet of monetary financial institutions.

Source: CNB.

Table 2 Placements (except the central government) and main components

in billion HRK and %

1In addition to placements to households and corporates, they also include placements to the local government and other financial institutions.

2The transactions show changes that exclude the effects of exchange rate changes, securities price adjustments, reclassification and write-off of placements, including the sale of placements in the amount of their value adjustment.

Source: CNB.

For detailed information on monetary statistics as at June 2018, see: