Makroprudencijalna dijagnostika, br. 14

Introductory remarks

The macroprudential diagnostic process consists of assessing any macroeconomic and financial relations and developments that might result in the disruption of financial stability. In the process, individual signals indicating an increased level of risk are detected, according to calibrations using statistical methods, regulatory standards or expert estimates. They are then synthesised in a risk map indicating the level and dynamics of vulnerability, thus facilitating the identification of systemic risk, which includes the definition of its nature (structural or cyclical), location (segment of the system in which it is developing) and source (for instance, identifying whether the risk reflects disruptions on the demand or on the supply side). With regard to such diagnostics, instruments are optimised and the intensity of measures is calibrated in order to address the risks as efficiently as possible, reduce regulatory risk, including that of inaction bias, and minimise potential negative spillovers to other sectors as well as unexpected cross-border effects. What is more, market participants are thus informed of identified vulnerabilities and risks that might materialise and jeopardise financial stability.

Glossary

Financial stability is characterised by the smooth and efficient functioning of the entire financial system with regard to the financial resource allocation process, risk assessment and management, payments execution, resilience of the financial system to sudden shocks and its contribution to sustainable long-term economic growth.

Macroprudential policy measures imply the use of economic policy instruments that, depending on the specific features of risk and the characteristics of its materialisation, may be standard macroprudential policy measures. In addition, monetary, microprudential, fiscal and other policy measures may also be used for macroprudential purposes, if necessary. Because the evolution of systemic risk and its consequences, despite certain regularities, may be difficult to predict in all of their manifestations, the successful safeguarding of financial stability requires not only cross-institutional cooperation within the field of their coordination but also the development of additional measures and approaches, when needed.

Systemic risk is defined as the risk of events that might, through various channels, disrupt the provision of financial services or result in a surge in their prices, as well as jeopardise the smooth functioning of a larger part of the financial system, thus negatively affecting real economic activity.

Vulnerability, within the context of financial stability, refers to the structural characteristics or weaknesses of the domestic economy that may either make it less resilient to possible shocks or intensify the negative consequences of such shocks. This publication analyses risks related to events or developments that, if materialised, may result in the disruption of financial stability. For instance, due to the high ratios of public and external debt to GDP and the consequentially high demand for debt (re)financing, Croatia is very vulnerable to possible changes in financial conditions and is exposed to interest rate and exchange rate change risks.

1. Identification of systemic risks

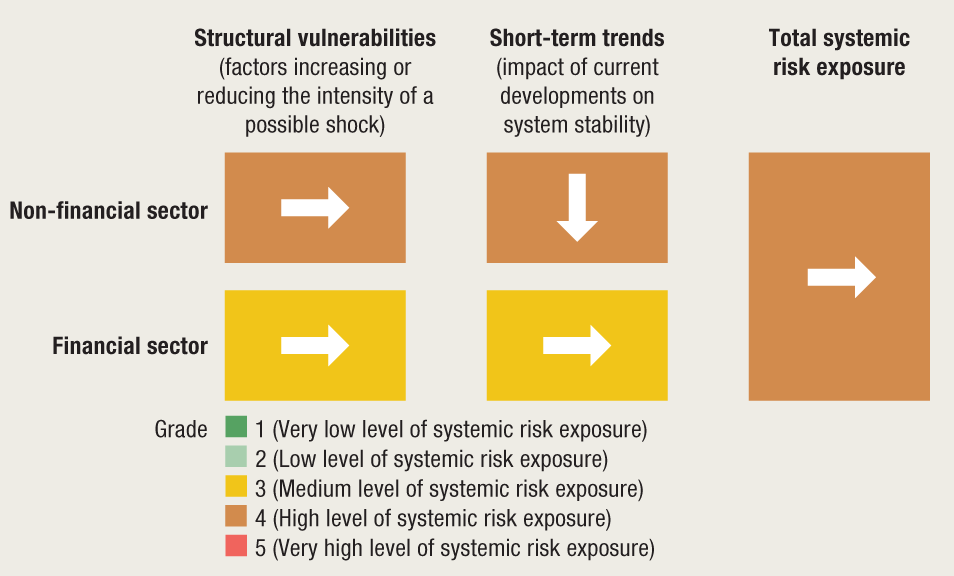

Total exposure to systemic risks in the second quarter of 2021 remained high. Compared to the estimate provided in the last Risk map (Financial Stability No. 22), along with improving macroeconomic outlook, short-term risks in the non-financial sector decreased (Figure 1) while structural vulnerabilities remained elevated. Following a brief worsening of the epidemiological situation during the third wave of the pandemic in early 2021, the acceleration in the process of vaccination against COVID-19 in the EU, Croatia included, ignited optimism that the pandemic would soon be halted and economic recovery pick up. Further progress in vaccination of the population, coupled with the relaxation and ultimately the lifting of epidemiological measures, should further boost economic recovery in 2021. However, the overall assessment of risk exposure has remained high due to a still high uncertainty regarding the threat of the emergence of new strains of the virus and potential vaccine ineffectiveness or slower population vaccination rollout, which may lead to new waves of the pandemic and the tightening of epidemiological measures. As a result, the risks in the government and financial sectors remain elevated.

Figure 1 Risk map, second quarter of 2021

Note: The arrows indicate changes from the Risk map in the first quarter of 2021, published in Financial Stability No. 22 (May 2021).

Source: CNB.

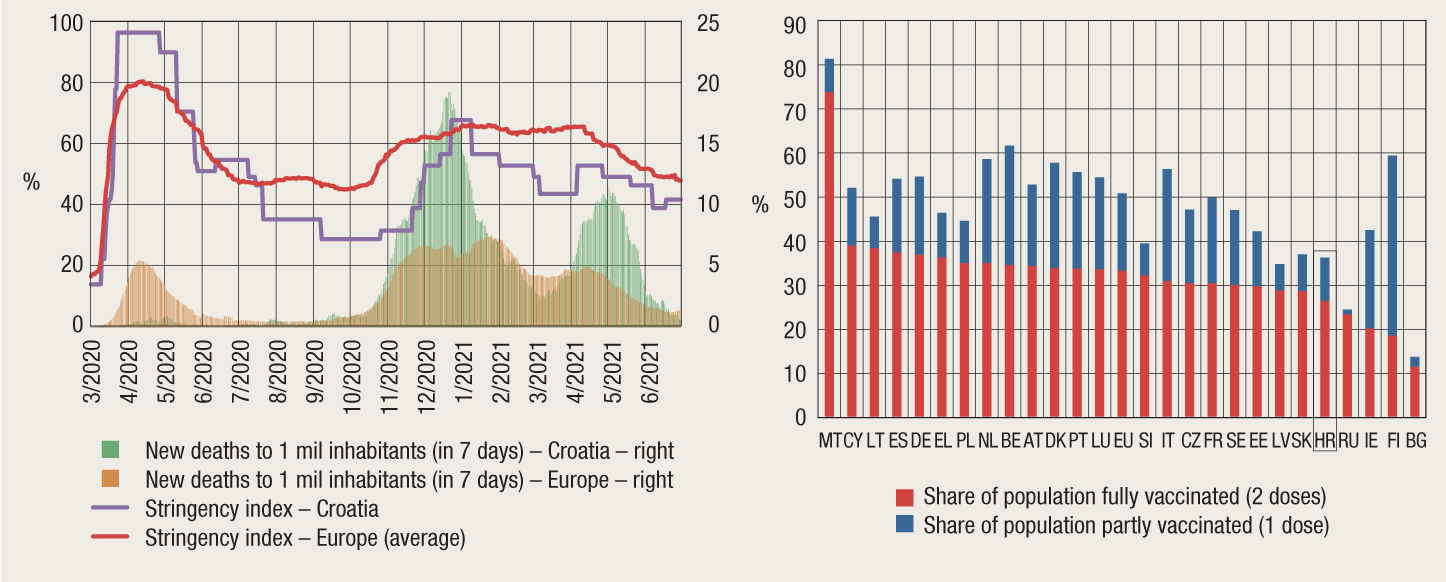

Despite favourable macroeconomic developments, the intensity of the recovery in 2021 remains uncertain. According to the revised CNB projection from July 2021, based on further normalisation of the epidemiological situation, i.e. recovery in domestic demand and the assumption of a relatively successful tourist season (revenues expected to reach approximately 70% of those generated in 2019), economic growth is expected to stand at 6.8%. Although still lower than prior to the pandemic, consumer and business confidence (in construction, manufacturing, trade and services) was higher in the second quarter of 2021 than at the beginning of the year. The recovery in foreign economic activity is also suggested by EU-wide economic sentiment indicators and employment expectations, which peaked in June 2021 compared to the pre-crisis level. Nevertheless, despite growing vaccine availability on the EU level, the pace and scope of the vaccination of the population (with the first and/or the second dose) remain unevenly distributed not only among countries but within individual countries as well. Thus, the relatively slow vaccine rollout in many countries resulting from the only limited interest of citizens seems to suggest that the goal of collective immunity is not very likely to be achieved at this point, which exacerbates the uncertainty regarding recovery in the domestic and international environment (Figure 2).

Croatia entered the tourist season with somewhat more relaxed epidemiological measures than other EU countries, which should, in addition to the COVID-19 digital passports agreed on a EU level, have a favourable impact on developments in tourism. Croatia was one of the first seven EU countries to introduce COVID-19 passports in early June[1], and their introduction in other member states at the beginning of July is expected to make travel during the summer months easier, provided the relatively favourable epidemiological situation persists. However, further intensity in foreign demand and revenues from tourism recovery will depend on the duration and speed of economic recovery, developments in the epidemiological situation in Croatia’s main trading partner countries, such as Germany and Italy, and the ability to tune to the preferences in tourist consumption.

Figure 2 COVID-19 in Croatia and Europe: stringency index, deaths and population vaccination

Source: https://ourworldindata.org/coronavirus (data until 30 June 2021, processed by CNB).

Global financing conditions remain very favourable despite strong economic recovery and growing inflation, bringing closer the expected time of change in the direction of monetary policies of the central banks of major economies, such as the FED. The rise in yields on US bonds in the last few months also points to a small recovery in investor confidence regarding future economic developments. Although some countries have already started tightening their monetary policies, the monetary policy in the euro area and Croatia remains expansionary. Free reserves of domestic credit institutions continue to rise, reaching their highest levels ever, which helped maintain favourable financing conditions as mirrored in the low financial stress index for Croatia. Moreover, in May 2021, Fitch confirmed Croatia’s investment grade rating of BBB- with stable outlook, highlighting the better outlook for economic growth over a medium term owing to the use of EU funds.

Fiscal developments in 2021 will largely depend on the intensity of economic recovery and the costs of measures aimed at alleviating the impacts of the pandemic. Despite rising budget revenues in early 2021, the slow discontinuation of the system of aid to the economy has led to continued high government needs for financing and a wide fiscal deficit. The stability of public finances, particularly developments in the high public debt to GDP ratio will benefit from the use of EU support under the new financial perspective (2021-2027), the support under the Next Generation EU instrument and EU Solidarity Fund provided for areas affected by the earthquakes.

The risks in the non-financial private sectors remain elevated and vulnerabilities largely depend on the dynamics of economic recovery and efficacy and duration/expiry of the measures aimed at alleviating the impacts of the pandemic. The liquidity and solvency risks in the acute phase of the COVID-19 crisis were mitigated by the ample public sector support package and adjustment of the supervisory rules for the treatment of credit institutions’ exposures to clients affected by the crisis. Despite better business results in spring 2021, the recovery and necessary restructuring of non-financial corporations in activities particularly hard hit by the pandemic remain uncertain. In such conditions the risk of zombification that may adversely affect the business of credit institutions and economic growth over a long term (see Financial Stability No. 22, Box 4 The survival of zombie firms and risks to financial stability) is elevated. Credit losses associated with the non-financial corporations sector will remain low as long as support measures are in place. However, risks may rise after their expiration and especially if account is taken of the estimated[2][1] capital reduction resulting from the poor 2020 business results of those corporations hit hardest by the pandemic.

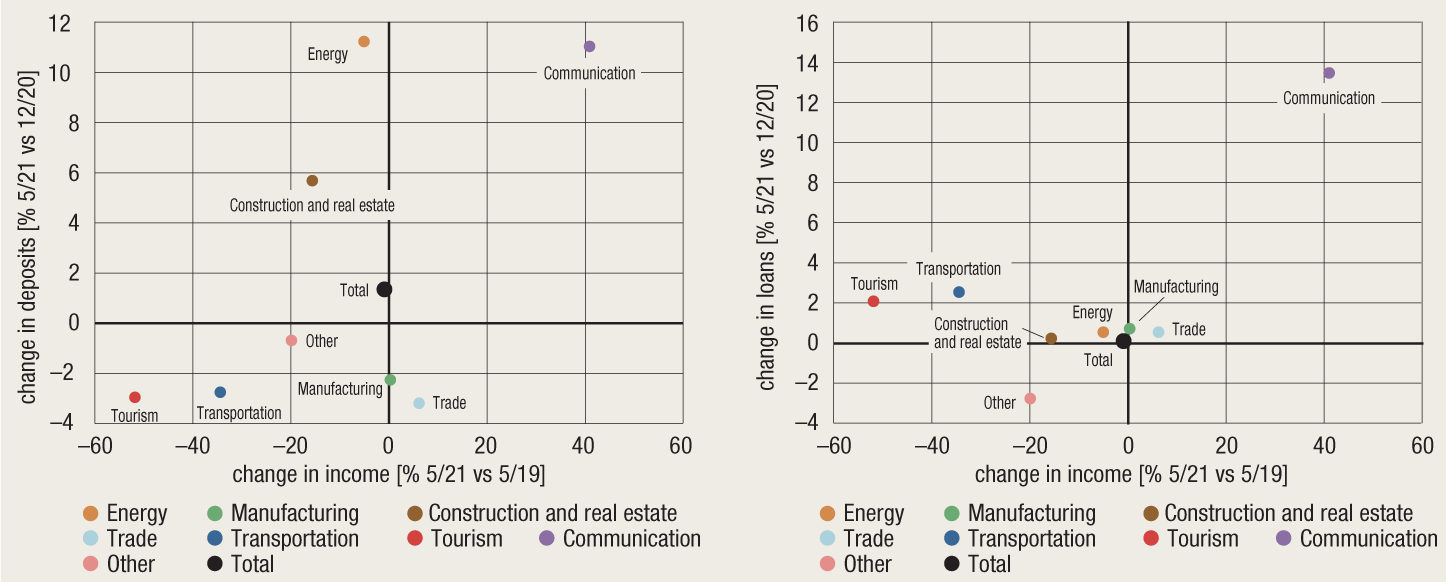

Even though data on fiscalisation suggest recovery in the income of non-financial corporations, thus far it has not reached the level achieved in pre-pandemic 2019. The total amount of fiscalised receipts from March to May 2021 rose 30% from the same period of the previous year; however, if compared with the pre-pandemic year of 2019, the cumulative amount of income in the first five months of this year is somewhat lower (Figure 3). However, good aggregate results notwithstanding, companies in the activities hardest hit by the pandemic (tourism, transport and manufacturing) continue to rely on their own accumulated liquidity, which is reflected in a fall in their deposits in early 2021. Companies in the activities hit by the pandemic also relied on additional borrowing to bridge some of their liquidity gaps (Figure 3).

Figure 3 Changes in deposits, loans and fiscalised receipts

Note: Shows changes in the stock of deposits and loans on 31 May 2021 from 31 December 2020 and changes in cumulative fiscalised receipts in the first five months of 2021 from the same period of 2019 (before the pandemic).

Source: CNB.

The resurgence of economic activity and recovery in consumer optimism led to a gradual acceleration in household lending. As recovery in consumer optimism led to a small recovery in general-purpose cash loans, and as disbursement of subsidised housing loans under government housing loans subsidy programme continued, the annual growth of consumer loans accelerated slightly to 3.5% in May, mostly reflecting the increase in housing loans. Increasing loan maturity, coupled with downward trending interest rates keep household sector liquidity risk at moderate levels. However, the risk of inertia continued to grow, suggesting a possible increase in debt burden in the case of reversal in the dynamics of economic recovery and potential further stagnation or fall in income, particularly in households generating income in the activities hit by the crisis.

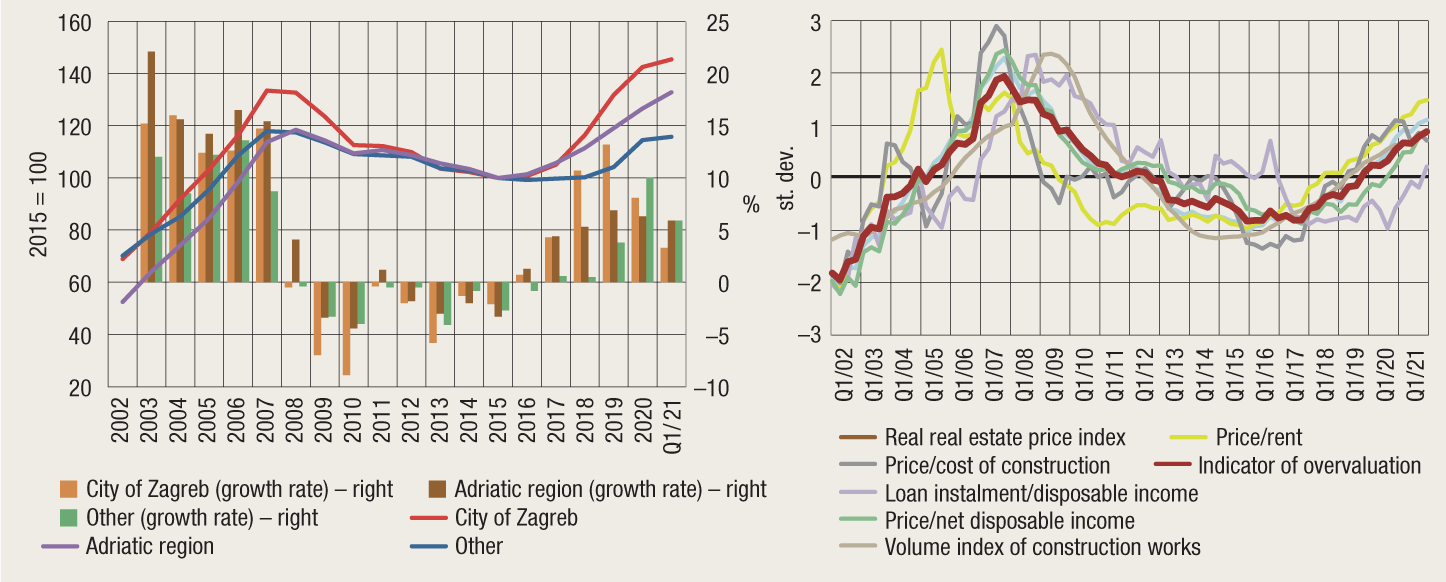

Elevated risks in the real estate market are associated with price increase and their further divergence from the fundamentals. Despite a fall in the number of transactions in 2020 and the uncertainty associated with the effects of the pandemic, the real estate market proved to be resilient to the crisis. The increase in the average prices of residential real estate continues to be strongly influenced by the government’s programme of subsidising APN loans and favourable financing conditions and suggests further price divergence from the level determined by the fundamentals (Figure 4). In addition, the growth in credit institutions’ exposures in the form of loans secured by real estate augments the vulnerabilities of credit institutions’ balance sheets associated with a possible slowdown in the activities in that market and a fall in real estate prices.

Figure 4 Real estate prices continue to rise and diverge from the level determined by the fundamentals

Notes: The Adriatic region consists of 139 coastal municipalities/towns (for details, see Kunovac, Kotarac (2019): Residential Property Prices in Croatia). The composite index of divergence is obtained as the first main component of six indicators (standardised cycle, right). The volume of construction works refers to housing construction.

Sources: CBS and CNB calculations.

Credit institutions’ liquidity and capitalisation continue to be high. Owing to the CNB’s expansionary monetary policy and temporary restriction of distributions (see Macroprudential Diagnostics No. 13, Box 1 What is behind the macroprudendial measure on a temporary restriction of distributions?), the liquidity and capitalisation indicators strengthened further last year. As a result, system liquidity measured by the liquidity coverage ratio (LCR) rose by 13.6 percentage points from the end of 2019 and stood at 187% at the end of the first quarter of 2021, with all the institutions meeting the prescribed minimum requirements of 100%. At the same time, the total capital ratio rose to 25.1%, from 22.8% at the end of September 2019.

Profitability of credit institutions improved slightly in early 2021. In the first quarter of 2021, credit institutions generated a profit of HRK 1.1bn, almost equalling the profit generated in the same period before the pandemic. As a result, the return on average assets (ROAA) rose from 0.6% at the end of 2020 to 0.9% and return on capital (ROAE) rose from 4.4% to 6.8%.

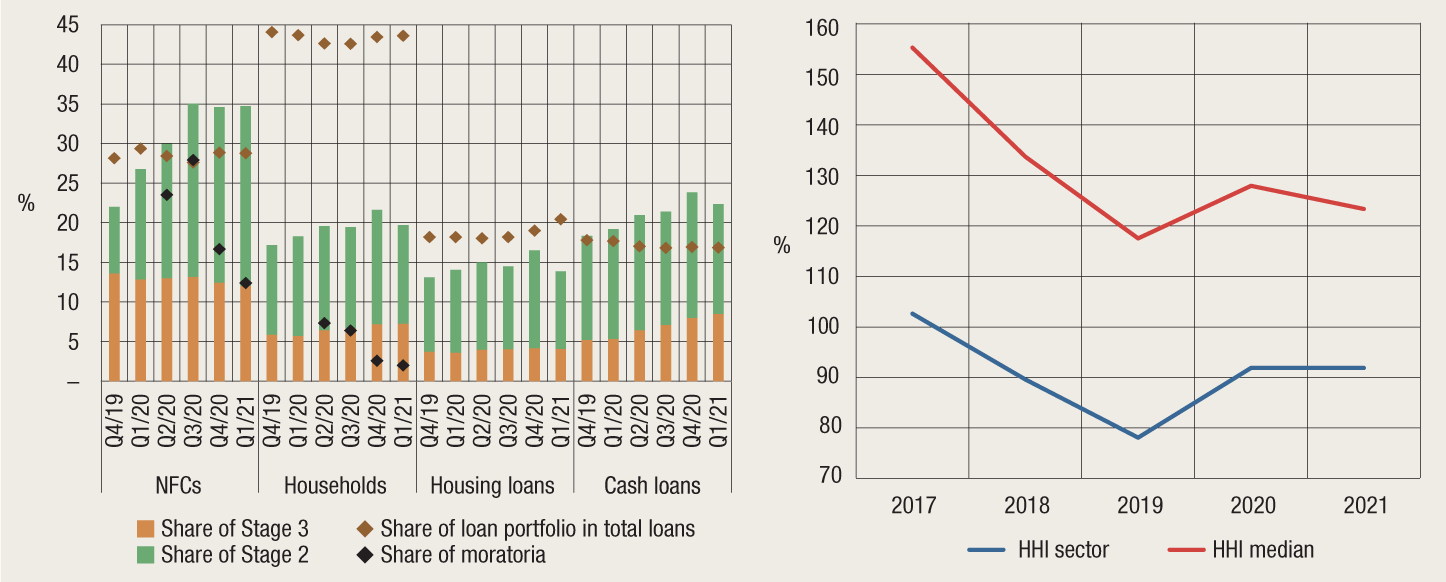

Temporary regulatory changes in the banking sector introduced with the aim of ensuring lending and business continuity during the pandemic mitigated credit risk materialisation. The introduction of a more flexible approach to supervisory rules on the reclassification of existing and new exposures according to the degree of their recoverability and risk and the introduction of the possibility of moratoria on existing loans[3] led to a stagnation in the share of non-performing loans (in Stage 3) in total loans (in the first quarter of 2021 this share even fell slightly to 5.3%), despite the worsening of macroeconomic developments (see Analytical annex: Impact of the support measures on changes in the credit risk cycle). Unlike households, which witnessed a small increase in the share of non-performing loans, particularly in the portfolio of general-purpose cash loans, the non-financial corporations sector witnessed a fall in the share of non-performing loans. At the same time, corporate loan exposures in Stage 2, which are estimated to have witnessed an increase in credit risk since initial recognition of the instrument, rose to 22.7% at the end of March 2021, with 6.8% of loans (at the end of the first quarter of 2021) still being under moratoria (Figure 5, left). However, the share of loans under moratoria declined, standing at 5.5% of total loans at the end of May 2021. With their gradual expiry and a possible slower recovery of the economy, this segment might see credit risk materialisation, which would put additional pressure on credit institutions’ business activities.

In 2020, there was an increase in the concentration risk in the portfolio of loans to non-financial corporations. Owing to a slower establishment of new companies and increased liquidity needs of the existing clients, the Herfindahl-Hirschmann index, calculated at the credit institution level using data on exposure to individual clients in the non-financial corporations sector, suggests that the trend of fall in concentration risk came to a halt in 2020. Influenced by developments in large credit institutions, the concentration of this portfolio at the overall sector level held steady at an elevated level in 2021, suggesting the importance of further monitoring and assessment of this risk (Figure 5, right).

Figure 5 Although the current credit portfolio quality suggests a gradual fall in loans under moratoria, the corporate portfolio concentration of credit institutions is rising

Notes: Loans in Stage 2 relate to performing loans witnessing a considerable increase in credit risk and loans in Stage 3 relate to non-performing loans witnessing a loss. Data on moratoria not available for housing and cash loans. The HHI index is calculated by squaring the share of companies in a credit institution’s corporate portfolio and then summing the resulting numbers.

Sources: CNB.

Credit institutions continue to be faced with structural challenges posing risks to financial stability. The period of low interest rates present for many years has had an adverse impact on credit institutions’ margins and limits potential earnings, which diminishes the attractiveness of doing business in the banking sector and increases the risk of market exit. Changes in the balance sheet structure towards an increase in the share of lower yield positions (such as liquid assets and loans to the government and those secured by real estate) increase the risks stemming from the concentration of exposure towards the government and the real estate sectors.

Analytical annex: Impact of the support measures on changes in the credit risk cycle

A large volume of support measures in the form of moratoria, guarantees and direct aid led to a halt of a thus far standardly negative link between a fall in economic activity and a rise in the share of non-performing loans, breaking the usual credit risk cycle development. The form that the credit risk cycle will take in the forthcoming period will depend on the characteristics of economic recovery.

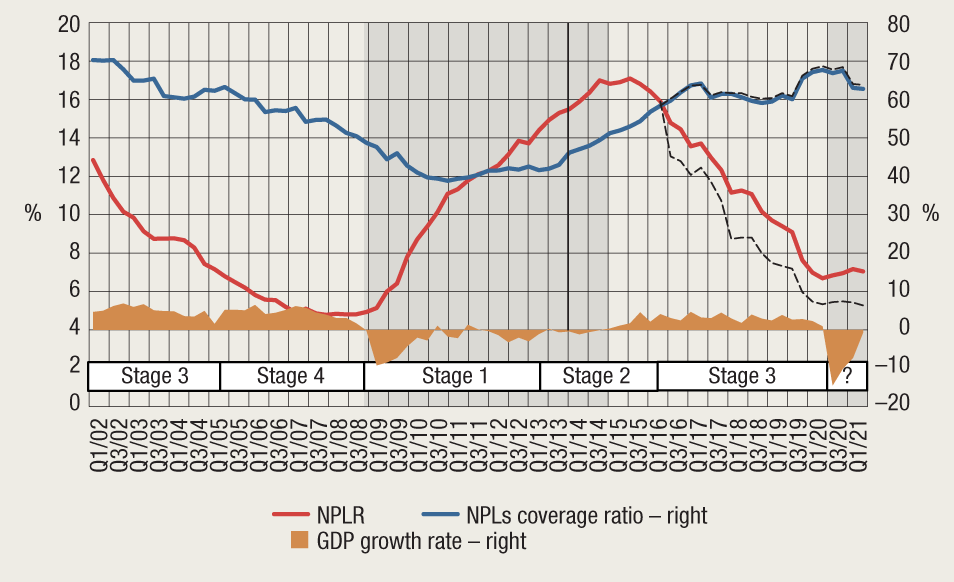

Changes in the non-performing loans ratio (NPLR) and the non-performing loans (NPLs) coverage ratio describe the non-performing loans cycle, which consists of four stages (see Macroprudential Diagnostics No. 3, Box 1 Cyclical movement of loan quality in Croatia). In Stage 1, the share of non-performing loans is high and coverage low. With time, the coverage rises and the share of non-performing loans holds steady at high levels until the last stage which, owing to a gradual write-off of non-performing loans, is characterised by a low share of non-performing loans with low coverage.

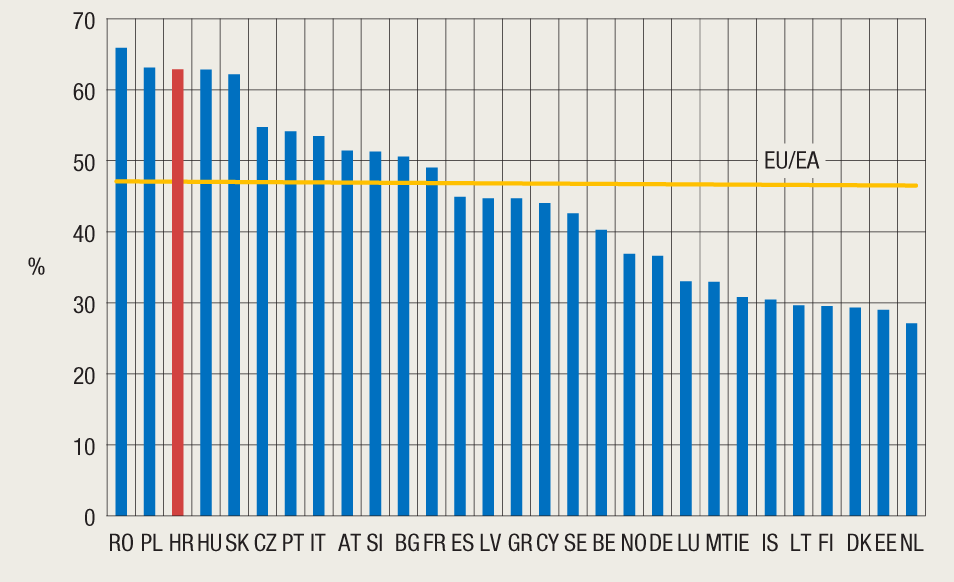

Between 2000 and 2017, Croatia went through all the four stages of this cycle[4]. In the period of the global financial crisis credit portfolio quality started deteriorating – with the outbreak of the crisis, the cycle went from Stage 4 (low NPLR and relatively low coverage) to Stage 1 (high NPLR and low coverage). Portfolio quality worsening peaked towards the end of 2014, when the non-performing loans ratio reached the highest level ever (17%) while the level of coverage reached a relatively high level of approximately 60%, which falls into Stage 2 of the cycle (high NPLR and elevated coverage). Subsequently, the process of balance sheet clean-up was initiated which, owing to the gradual development of the market in non-performing placements, i.e. the emergence of companies specialising in claims collection and management, increased the sale of NPLs. The system thus gradually entered Stage 3 of the cycle (decreased NPLR with still high coverage), which persisted into the period following the outbreak of the coronavirus (Figure 1). Namely, the share of non-performing loans in total loans gradually decreased while the coverage remained high, ranking among the highest in the EU, and stood at 63.8% at the end of the first quarter of 2021 (Figure 2).

Unlike the global financial crisis, this time the fall in economic activity did not lead to a significant increase in credit risk materialisation, mostly owing to the comprehensive aid package provided to the economy (Figure 1). The cancellation of the support measures that involves a transition to selective measures, coupled with a possibly uneven economic recovery across different activities, will probably result in a worsening of a part of the credit portfolio of credit institutions. The transition of the credit risk cycle into Stage 1 could bring about a further deterioration in macroeconomic developments.

Figure 1 Credit risk cycle in Croatia

Notes: The series shown includes a methodological break present since March 2010. Starting with June 2016 data, the CNB publishes on the official website the series compliant with the EBA methodology (based on FINREP templates), which are shown in broken lines and in relation to data available for previous periods (shown in full line), in addition to loans, they also include deposits and advances. The vertical line indicates the entry into force of the Decision on the classification of placements and off-balance sheet liabilities of credit institutions (OG 41A/2014) obligating credit institutions to adjust values of placements depending on the delinquency status in placement write-offs. The grey shaded area denotes the period of fall in economic activity in Croatia.

Sources: CNB, CNB (FINREP) and CBS.

Figure 2 Coverage of NPLs in an international setting

Note: Data as at end-December 2020.

Source: European Banking Authority (EBA).

2. Potential risk materialisation triggers

Great uncertainty and the unpredictability of the course of the pandemic will pose risks in the forthcoming period, despite the growing number of the vaccinated. The threat of the new wave of the pandemic after summer, coupled with a relatively slow and uneven vaccination of population are an important source of risk to a further economic activity recovery. Any new worsening of the epidemiological situation and tightening of epidemiological measures, including localised measures, would adversely impact the speed of economic recovery and the sustainability of public finances.

Further growth of prices in the real estate market increases the risks to the financial system and the magnitude of their materialisation in the event of a fall. The divergence of the real estate prices from the fundamentals, combined with other exposures, increases negative risks for credit institutions and economic growth should there be a sudden reversal in the developments in real estate prices. Any considerable slowdown in market activities would increase the risks associated with low market liquidity and collateral marketability, which would put pressure on credit institutions’ balance sheets and those of their clients. Therefore, the CNB will continue to monitor developments in the real estate market and the related credit activity, including indicators of the loan burden of individual debtors based on granular data on consumer lending standards (see Financial Stability No. 22, Box 1 A new source of data on consumer lending standards).

Developments in loan quality will depend on the intensity and duration of the crisis. Despite a persistently low non-performing loans ratio, credit risk could be a further source of uncertainty for credit institutions given the relatively high shares of loans in Stage 2 in some activities. Any postponement of economic recovery and premature withdrawal of measures might lead to deterioration in debt servicing capacity of a part of the private sector, particularly in the activities with high debt levels, while measures of support contribute considerably to maintaining a relatively stable income (non-financial corporations and households), while keeping them for too long increases the risks of zombification and risks to fiscal sustainability.

3. Recent macroprudential activities

In the second quarter of 2021, there was no need to adjust the macroprudential policy measures of the Croatian National Bank. The countercyclical capital buffer continues to be maintained at the level of 0%, while as regards third countries determined as material for the banking sector of the Republic of Croatia no cyclical risks have been identified that would require a response from the Croatian National Bank. Due to the termination of application in Estonia and Finland, two decisions on the reciprocity of measures adopted by macroprudential authorities of these countries were withdrawn.

3.1 Continued application of the countercyclical capital buffer rate of zero for the Republic of Croatia in the third quarter of 2022

In June 2021, the Croatian National Bank carried out a regular quarterly assessment of the required level of the countercyclical capital buffer. Owing to the need to maintain continuity of bank lending to the non-financial private sector, the countercyclical capital buffer that will be applied in the third quarter of 2022 will remain 0%. As competent macroprudential authority, the CNB will continue to monitor regularly the economic and financial developments and will adjust its activities with monetary policy and supervisory measures to support economic recovery after the crisis caused by the coronavirus pandemic.

3.2 Annual analysis of third-country materiality for the banking system of the Republic of Croatia

In the second quarter of 2021, the Croatian National Bank carried out a regular annual analysis of third-country materiality for the banking system of the Republic of Croatia, identifying Bosnia and Herzegovina and Montenegro as material third countries. The analysis was made in accordance with Article 3 of the Decision of the European Systemic Risk Board (ESRB) on the assessment of materiality of third countries for the Union’s banking system in relation to the recognition and setting of countercyclical buffer rates (ESRB/2015/3). Further to the determination of material third countries, an analysis was made of the developments in systemic risks of a cyclical nature in Bosnia and Herzegovina and Montenegro, and it has determined that there is currently no risk of excessive credit growth that would require regulatory response in relation to Croatian banks exposed to these markets.

3.3 The repealing of decisions on the reciprocity of macroprudential policy measures adopted by the relevant authorities of Estonia and Finland

In March 2021, the CNB repealed two decisions on the reciprocity of macroprudential measures of other member states, following the termination of these measures in the relevant member states. These two decisions are the Decision repealing the Decision on the reciprocity of the macroprudential policy measure adopted by the relevant authority of Estonia (OG 28/2021) repealing the reciprocity in the application of a one percent systemic risk buffer rate to exposures in Estonia and the Decision repealing the Decision on the reciprocity of the macroprudential policy measure adopted by the relevant authority of Finland (OG 28/2021), repealing the application of a 15% floor for the average risk weight for exposures in Finland of credit institutions using the internal ratings-based approach for mortgage loans to the Finnish household sector secured by residential real property located in Finland. As the original decisions are no longer in force in their home countries, they have been removed from the list of decisions recommended for reciprocity by the ESRB. While these measures were reciprocally recognised in the Republic of Croatia, none of the credit institutions in the Republic of Croatia exceeded the materiality threshold which would make them eligible for actual obligatory implementation.

3.4 Implementation of macroprudential policy in other European Economic Area countries

Following the period of active response by the member states to the crisis caused by the coronavirus pandemic, the first half of 2021 mostly saw the extension of the existing measures, even though this period also saw the first signs of a change in direction. Macroprudential authorities also focussed on alignment with the new European financial regulatory package that entered into force at the end of 2020, which also prompted tightening of the measures in some countries. Most of the member states decided to keep the zero countercyclical buffer rate in the second quarter of 2021, which will be applied over the next one year period. Only five countries kept a rate other than zero throughout the entire period of the pandemic: Bulgaria, the Czech Republic, Luxembourg, Norway and Slovakia with the Czech Republic being the first country to adopt a decision in May 2021 to raise this buffer rate again, from 0.5% to 1%, to be applied in the third quarter of 2022.

The regulatory package CRR II/CRD V has been applied since 29 December 2020 and the countries that have already transposed it into their respective national legislation have introduced additivity of the systemic risk buffer and the buffer for systemically important institutions, which prompted some countries to adjust these buffer rates. The Netherlands and the United Kingdom have thus completely cancelled the application of the systemic risk buffer earlier applied only to certain systemically important credit institutions and have replaced it with a buffer for other systemically important institutions. Norway replaced its two systemic risk buffer rates, i.e. that of 5% for all exposures of systemically important credit institutions and of 3% for all exposures of other credit institutions with a single rate of 4.5% applicable to domestic exposures to be maintained by all credit institutions cumulatively with determined buffer rates for systemically important institutions.

Other new measures relate mostly to the risks associated with the real estate market. Sweden has prolonged for another year the application of the measure based on Article 458 of the Regulation on prudential requirements for credit institutions and investment firms (CRR), which consists of the risk weight floor of the weighted average risk weight of 25% applied to the portfolio of housing loans to debtors with a head office in Sweden, secured by real estate. Norway has also introduced two measures, also in accordance with Article 458 of the CRR, introducing a floor for average risk weights applied to exposures secured by commercial (35%) and residential (20%) real estate in Norway. Also, after expiry of the application of the measures aimed at users of housing and cash loans, this country also introduced a set of measures towards the end of 2020 prescribing the highest permissible loan to value ratio (85% with the exception of buyers of second homes in Oslo where this ratio is capped at 60%), the cap on debt income requirement (5), housing and cash loans amortisation requirement, flexibility quotas and the application of stress testing or a testing of sensitivity to an increase in interest rates of 5 percentage points in the assessment of loan users’ creditworthiness. Luxembourg, France and Cyprus also introduced measures aimed at users of housing loans. Luxembourg put a cap on the loan to value ratio for newly granted housing loans secured by residential real estate in Luxembourg, differentiating between first-time buyers (100%), and buyers buying property for their primary residence (90%) and all other buyers (80%). France issued amendments to the 2019 recommendations relating to the highest permissible ratio of debt service to income, raising the ratio to 35% from the previous 33% and loan maturity (25 years as previously but with the added option of further two years in specific cases of postponed loan amortisation), which apply to newly-granted housing loans with a flexibility margin of up to 20% of the amount of newly-granted housing loans in a quarter. France plans to turn the recommendation into a legally binding measure by end June 2021. Cyprus tightened the maximum loan to value ratio applied to luxury real estate construction investments to 50%.

In the context of measures aimed at alleviating the impacts of the COVID-19 pandemic, Poland reduced the risk weight from 100% to 50% for exposures secured by commercial real estate used by lessees to conduct their business activity without generating profit from their sale or income from rent. For other commercial real estate, the risk weight of 100% remains to be applied.

Table 1 Overview of macroprudential measures applied by EU member states, Iceland and Norway

Notes: The listed measures are in line with Regulation (EU) No 575/2013 on prudential requirements for credit institutions and investment firms (CRR) and Directive 2013/36/EU on access to the activity of credit institutions and the prudential supervision of credit institutions and investment firms (CRD IV). The definitions of abbreviations are provided in the List of abbreviations at the end of the publication. Green indicates measures that have been added since the last version of the table. Light red indicates measures that countries have released in response to the crisis triggered by the coronavirus pandemic.

Disclaimer: of which the CNB is aware.

Sources: ESRB, CNB and notifications from central banks and websites of central banks as at 10 June 2021.

For details, see: https://www.esrb.europa.eu/national_policy/html/index.en.html i https://www.esrb.europa.eu/home/coronavirus/html/index.en.html.

Table 2 Implementation of macroprudential policy and overview of macroprudential measures in Croatia

Note: The definitions of abbreviations are provided in the List of abbreviations at the end of the publication.

Source: CNB.

-

Croatia, Bulgaria, the Czech Republic, Poland, Denmark, Germany and Greece. ↑

-

[1] As yet, the CNB has no data available from the Financial Agency on entrepreneurs’ business results in 2020. ↑

-

CNB’s March and earthquake circular letters and the application of EBA Guidelines on legislative and non-legislative moratoria on loan repayments applied in the light of the COVID-19 crisis (EBA/GL/2020/15) . ↑

-

According to EU Council Report: https://data.consilium.europa.eu/doc/document/ST-9854-2017-INIT/en/pdf. ↑