Statistical releases provide a summary of the most recent values and trends for the published statistical indicators series compiled by the Croatian National Bank.

Statistics

- Release calendar

- Statistical releases

- Indicators of banking system operations

- Main macroeconomic indicators

-

Statistical data

-

Financial sector

- Republic of Croatia contribution to euro area monetary aggregates

- Consolidated balance sheet of MFIs

- Central bank (CNB)

- Other monetary financial institutions

- Other financial corporations

- General government sector

- External sector

- Financial accounts

- Securities

- Selected non-financial statistics

- Payment systems

- Payment services

- Currency

- Turnover of authorised exchange offices

- Archive

-

Financial sector

- SDDS

- Regulations

- Information for reporting entities

- Information for users of statistical data

- Use of confidential statistical data of the CNB for scientific purposes

- Statistical surveys

- Experimental statistics

Statistical releases

Credit institutions’ interest rate statistics for July 2021

Statistical indicators of interest rates[1] which are used by credit institutions to calculate interest on their main sources of funds continued their years-long downward trend (time deposits) or stagnation (transaction accounts) in July 2021.

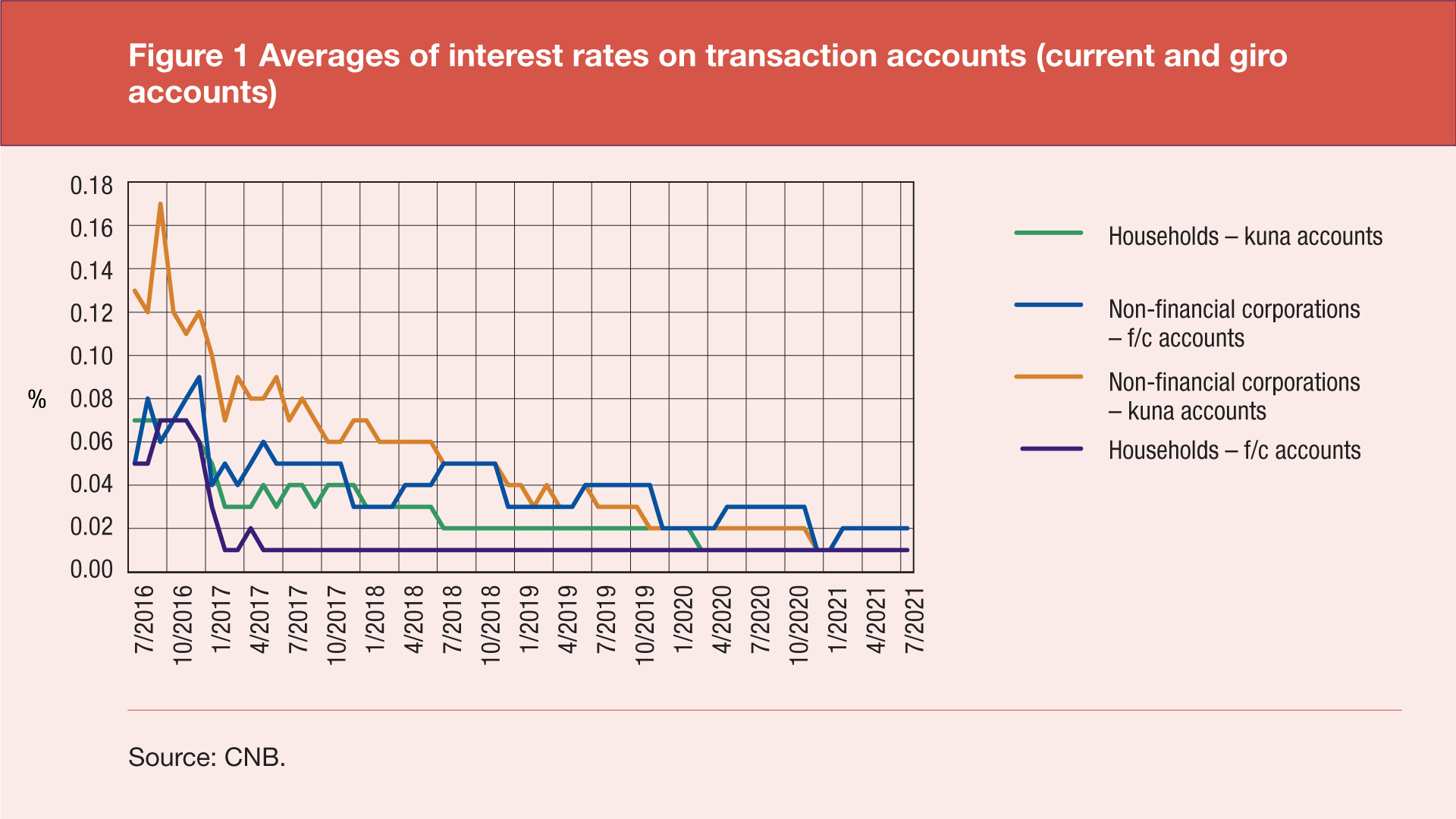

As regards transaction accounts (current and giro), the average of interest rates on kuna and foreign currency accounts of non-financial corporations was 0.01 percentage point lower in July 2021 than in the same month of the previous year, whereas averages of interest rates on kuna and foreign currency accounts of households remained unchanged from July 2020. The average of interest rates on foreign currency transaction accounts of non-financial corporations was 0.02%, while the remaining three averages stood at 0.01% in July 2021.

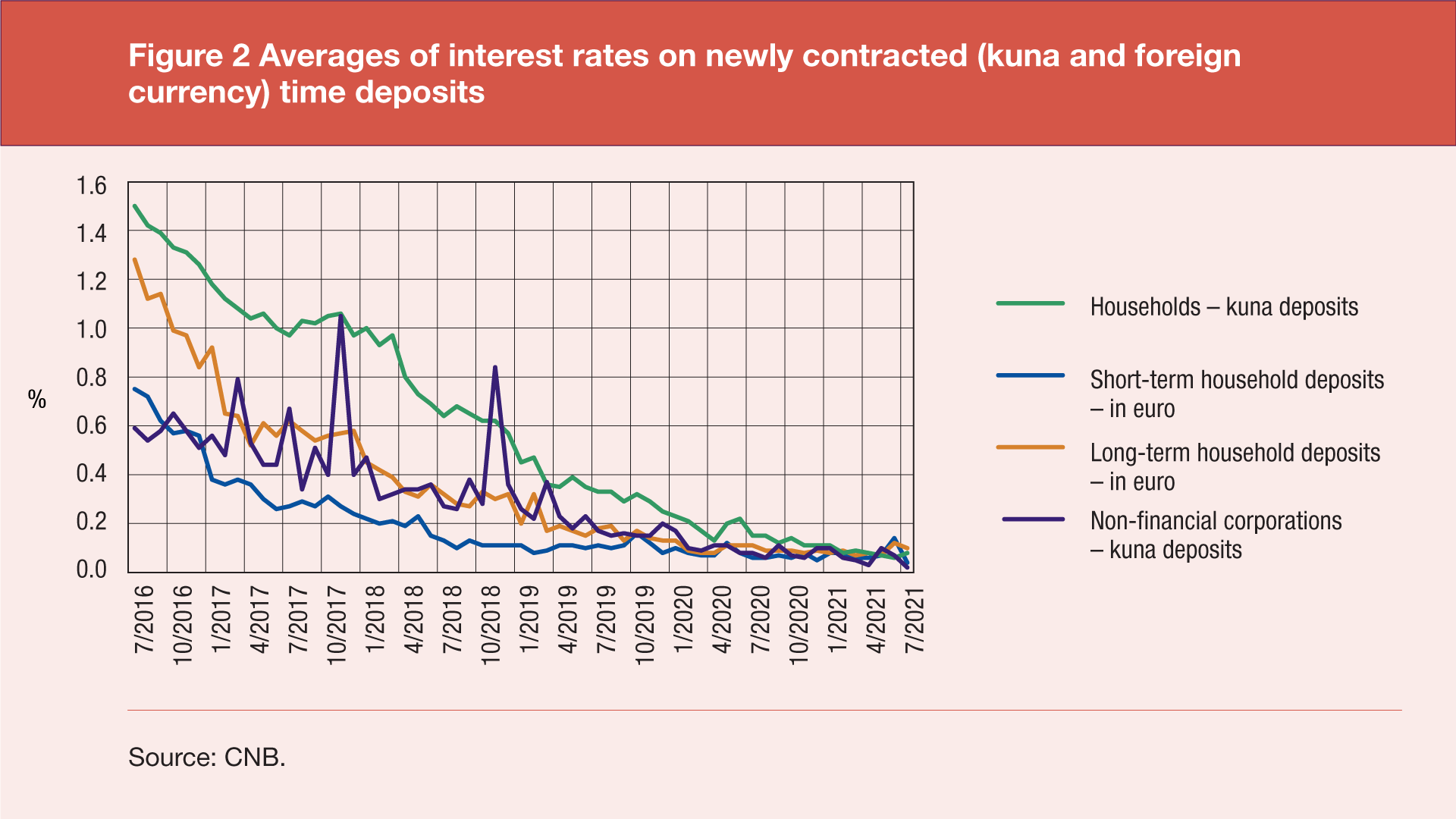

With regard to time (kuna and foreign currency) deposits, averages of interest rates on kuna deposits were significantly lower in July 2021 than in the same month of the preceding year (by 0.07 percentage points on household deposits and by 0.06 percentage points on deposits of non-financial corporations), while averages for foreign currency deposits in euro were marginally lower than in July 2020 (0.02 percentage points lower for short-term and 0.01 percentage point lower for long-term deposits). The average of interest rates on household time deposits in kuna stood at 0.08% in July 2021, while on long-term household time deposits in euro it stood at 0.10%. The lowest was the average of interest rates on kuna time deposits of non-financial corporations (0.02%).

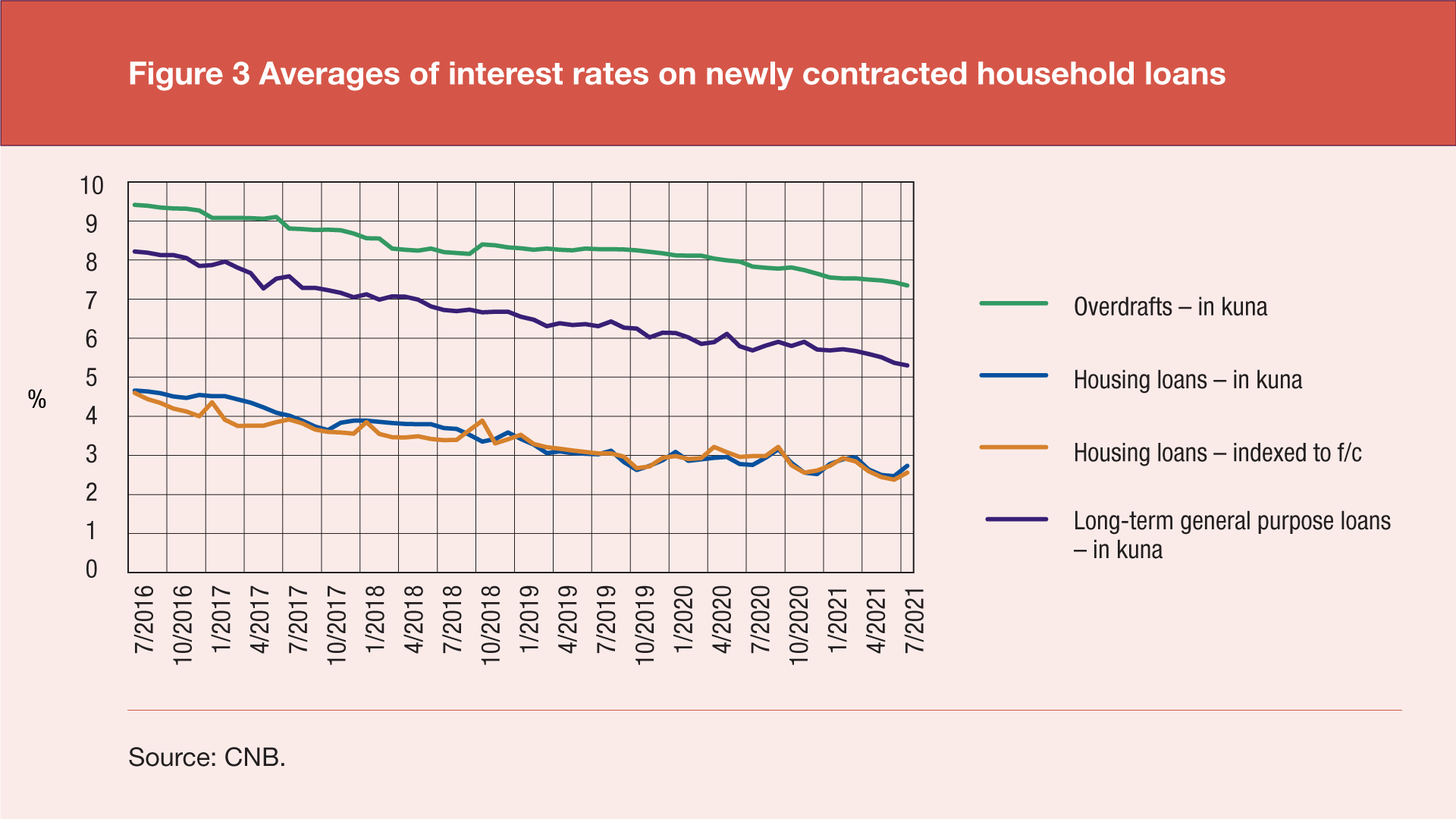

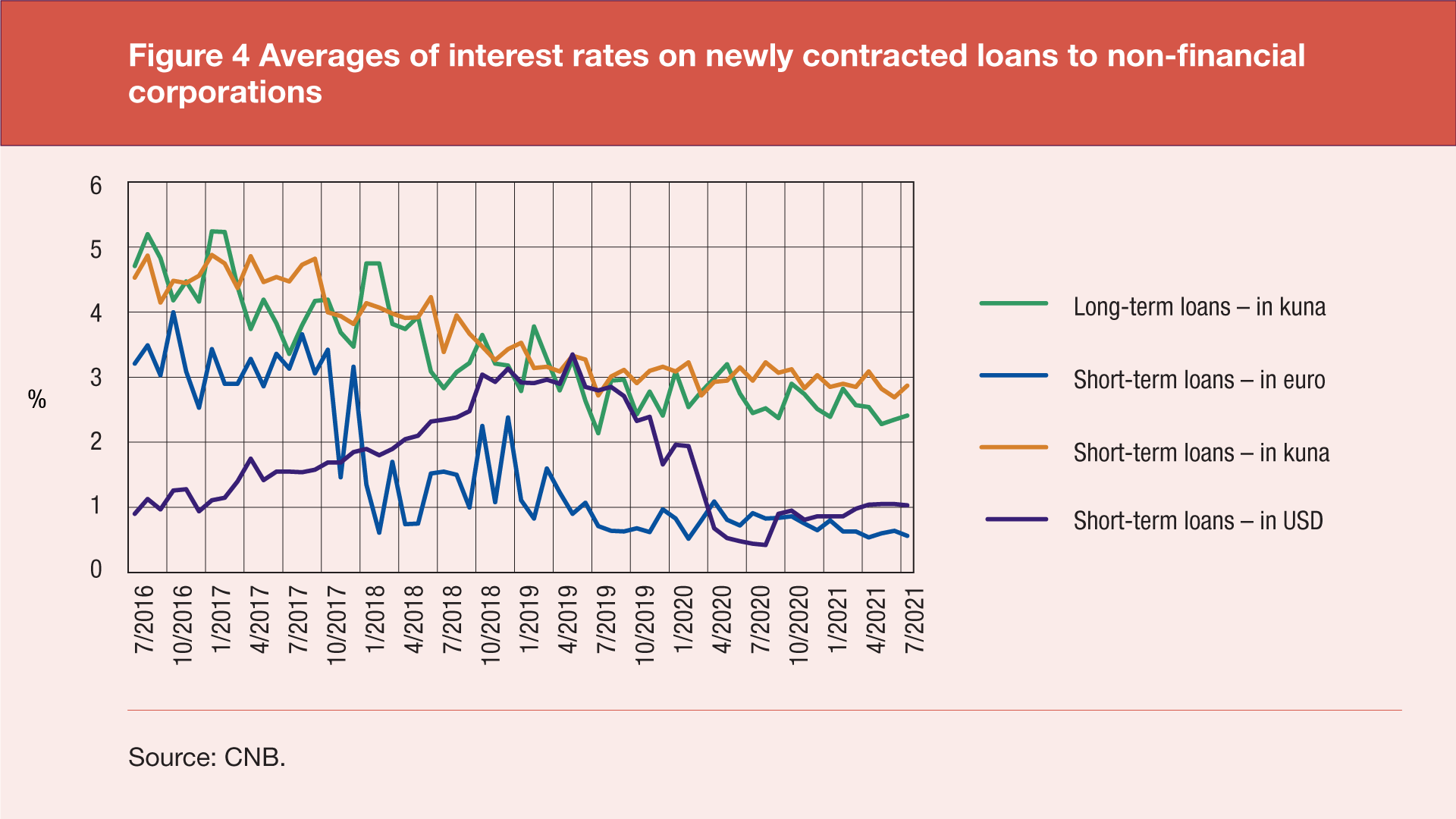

Statistical indicators of interest rates which are used by credit institutions to calculate interest on the most important types of loans granted to households and non-financial corporations also mostly continued their years-long decline in July 2021, whereas an increase relative to July 2020 was seen only in interest rates on short-term loans to non-financial corporations denominated in US dollars.

As for the main categories of household loans, the highest average of interest rates in July 2021 was recorded for kuna loans in the form of transaction account overdrafts (7.35%, down 0.48 percentage points from July 2020) and the lowest average was seen in housing loans indexed to foreign currency (2.56%, down 0.42 percentage points from July 2020), where both loan categories have a slight downward trend on quarterly and annual basis.

As regards the main categories of loans to non-financial corporations, the highest average of interest rates in July 2021 was seen in short-term kuna loans (2.87%, down 0.08 percentage points from July 2020) and the lowest average was recorded in short-term euro loans (0.56%, down 0.35 percentage points from July 2020).

Statistical time series: Credit institutions’ interest rates

-

Statistical indicators of interest rates are calculated as weighted monthly averages of agreed (nominal) interest rates on new deposit and loan contracts between credit institutions and their clients from the household sector (citizens and non-profit organisations) and the non-financial corporate sector (corporations outside the financial sector and the government sector) in a given month. The weights used in the calculation are newly contracted deposit and loan amounts, with the exception of transaction accounts and demand deposits as well as transaction account overdrafts and credit card loans, which are assumed to be contractually renewed each month, but in indefinite amounts; for this reason, the weights used are their corresponding book balances at the end of a month. Indicators that are being calculated differ according to the instrument, currency, maturity and sector to which deposits and loans relate. ↑