Statistical releases provide a summary of the most recent values and trends for the published statistical indicators series compiled by the Croatian National Bank.

Statistics

- Release calendar

- Statistical releases

- Indicators of banking system operations

- Main macroeconomic indicators

-

Statistical data

-

Financial sector

- Republic of Croatia contribution to euro area monetary aggregates

- Consolidated balance sheet of MFIs

- Central bank (CNB)

- Other monetary financial institutions

- Other financial corporations

- General government sector

- External sector

- Financial accounts

- Securities

- Selected non-financial statistics

- Payment systems

- Payment services

- Currency

- Turnover of authorised exchange offices

- Archive

-

Financial sector

- SDDS

- Regulations

- Information for reporting entities

- Information for users of statistical data

- Use of confidential statistical data of the CNB for scientific purposes

- Statistical surveys

- Experimental statistics

Statistical releases

General government debt statistics for June 2022

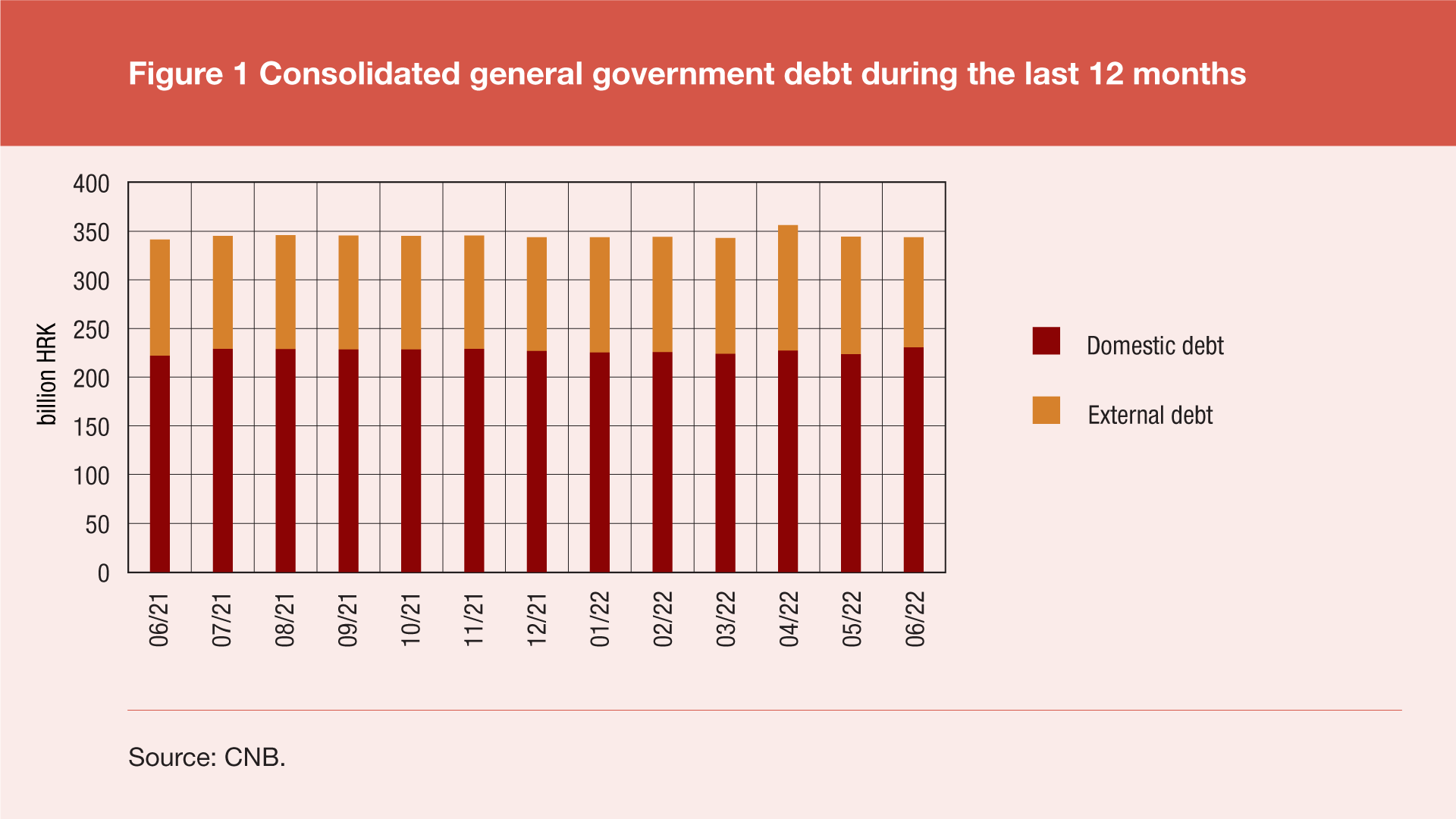

According to the final data of government finance statistics for the second quarter of 2022, the total consolidated debt of all general government sub-sectors[1] reached HRK 343.7bn at the end of June 2022, up by HRK 1.0bn (or 0.3%) from the end of March 2022 and up by HRK 2.2bn (or 0.6%) from the end of June 2021. The annual debt growth was due to an increase in the domestic debt of HRK 8.5bn (or 3.8%) and a decrease in the external debt of HRK 6.3bn (or 5.3%). Domestic debt rose by a little less than HRK 6.5bn (or 2.9%), and external debt fell by a little more than HRK 5.4bn (or 4.6%) compared to the end of the previous quarter.

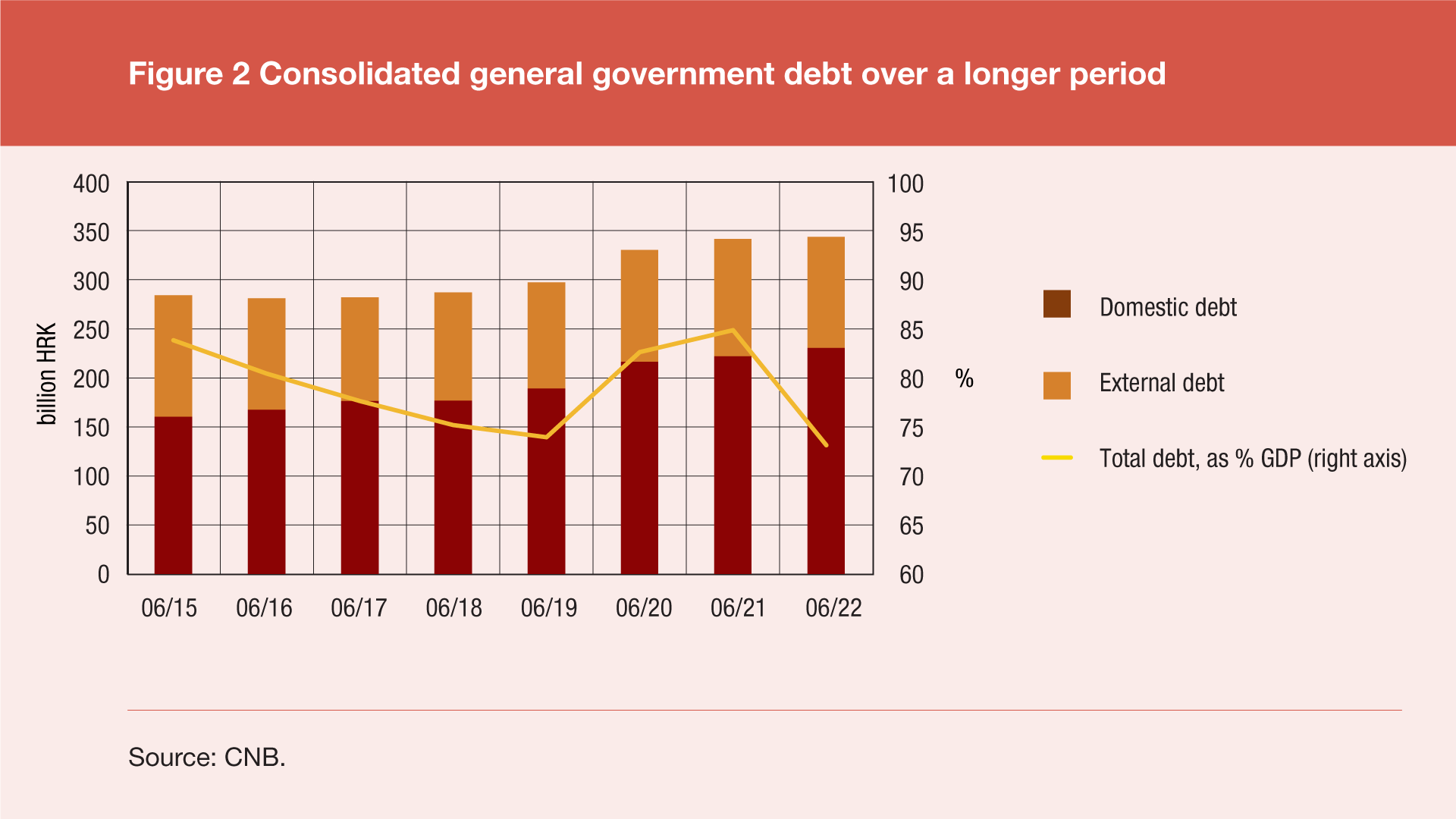

Measured against the annual GDP[1], the share of debt in GDP continues to fall for the fifth consecutive quarter and is approaching its value at the end of the first quarter of 2020, i.e. at the moment just before the negative effects of the COVID-19 pandemic began adversely affecting this measure. The total debt at the end of June 2022 amounted to 73.1% of GDP, a decrease of 11.8 percentage points on an annual basis from 84.9% of GDP at the end of June 2021 and a decrease of 2.9 percentage points from the end of the previous quarter, when this share stood at 76.0%.

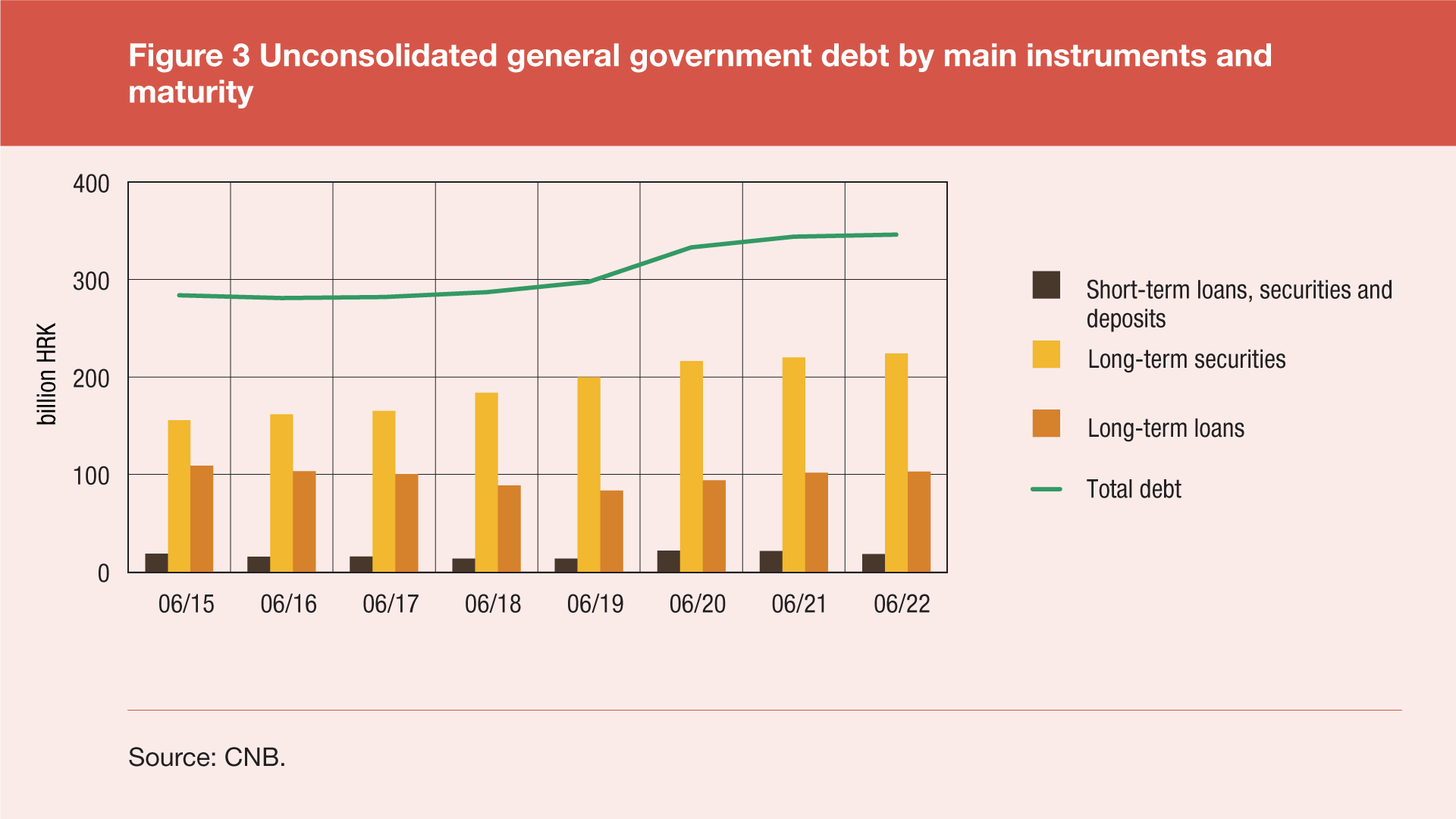

The general government debt structure by main debt instruments and maturity is available only on an unconsolidated basis[2]. Long-term debt instruments dominate the maturity structure of unconsolidated debt: at the end of June 2022 most of this debt was made up of bonds (64.8%), the second by importance were long-term loans (29.7%), and last were short-term loans, securities and deposits (jointly 5.5%). The short-term debt components decreased by HRK 3.1bn (or 14.3%) on an annual basis from the end of June 2021 to the end of June 2022, while the long-term debt components increased by HRK 5.5bn (or 1.7%) during the same period.

Statistical time series: Table I3 General government debt (ESA 2010)