From August 2023 the comments on statistics, a short description of selected, recently issued statistical data in the area of monetary statistics and the non-residents sector statistics, are no longer published. They are replaced by Statistical releases.

Comments on monetary developments for January 2018

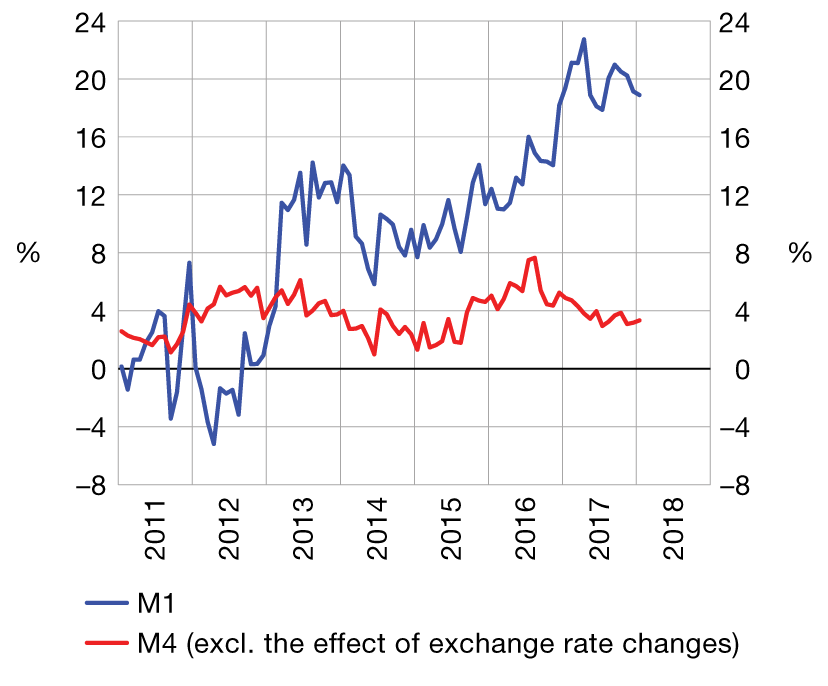

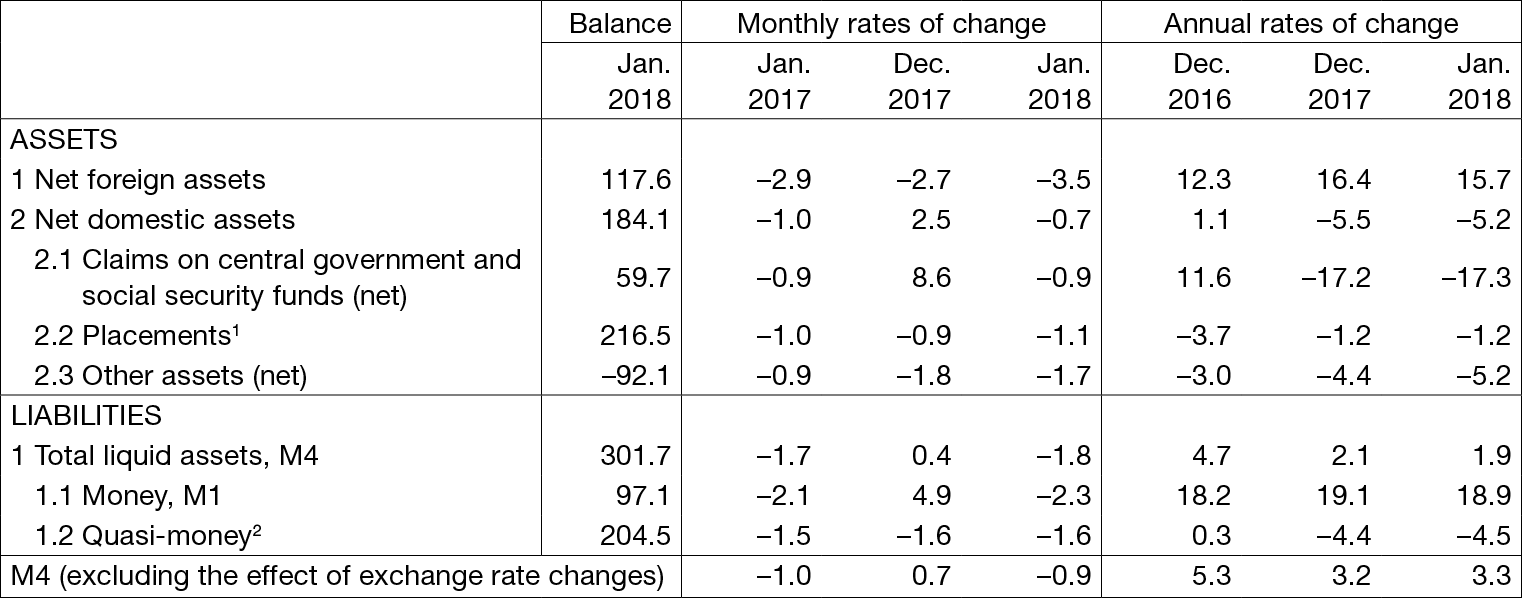

Total liquid assets (M4) declined by HRK 5.6bn (–1.8%) in January 2018, standing at HRK 301.7bn at the end of the month (Table 1). Excluding the effect of the kuna appreciation, M4 decreased by HRK 2.8bn (–0.9%) in January. The monthly decrease in the broadest monetary aggregate was driven by the decline in net foreign assets (NFA) on account of the deterioration in the CNB's net foreign position which was largely the result of the decline in bank assets in TARGET2, but also of the strengthening of the kuna. On the other side, credit institutions increased their net foreign assets. Net domestic assets (NDA) decreased due to a fall in net claims on the central government and placements to other domestic sectors. Total liquid assets increased at an annual rate of 3.3% in January 2018, a rate similar to that in the previous month (exchange rate changes excluded) (Figure 1). The annual growth rate of the narrow monetary aggregate, money (M1), having edged down in January from the previous month, totalled 18.9%, while the annual fall of quasi-money deepened to –4.5%.

| Figure 1 Monetary aggregates annual rates of change |

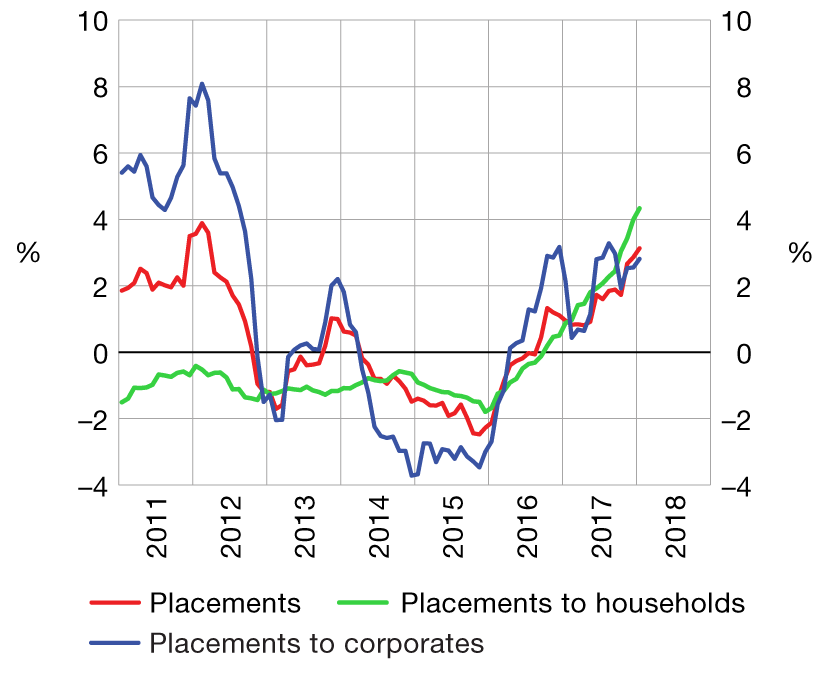

Figure 2 Placements annual rates of change based on transactions |

|

|

| Source: CNB. |

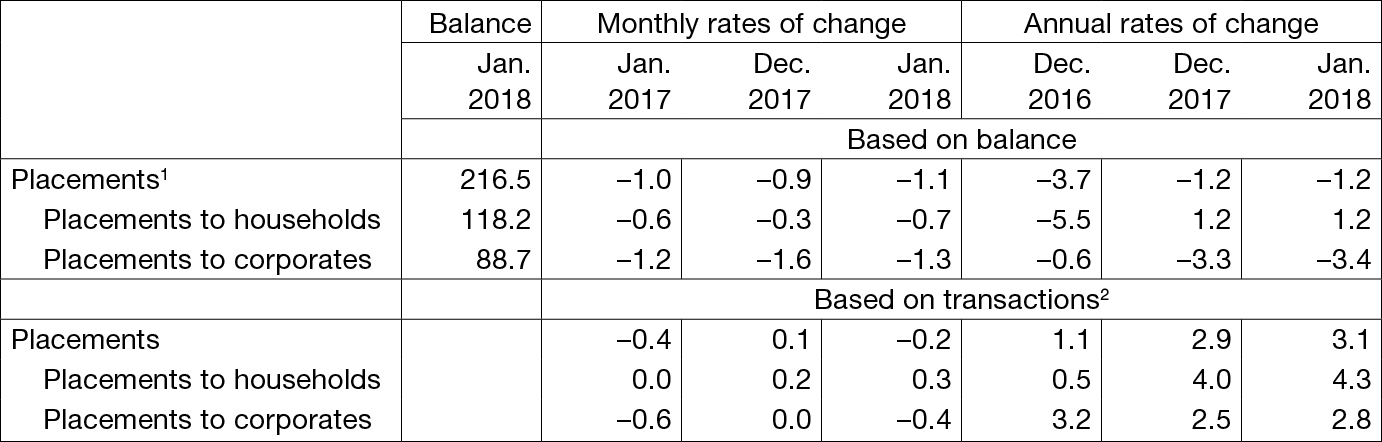

Total placements of monetary institutions to domestic sectors (excluding the government) decreased in January (transaction-based), amounting to HRK 216.5bn at the end of the month, with their annual growth rate accelerating slightly to 3.1% (transaction-based, Figure 2). The annual growth of placements to households continued to accelerate, reaching 4.3%, while placements to non-financial corporations grew at a rate of 2.8% (Table 2). The nominal stock of placements was 1.2% lower at-end January 2018 than at end-January 2017, which was largely due to the sale of non-performing placements.

Table 1 Summary consolidated balance sheet of monetary institutions

in billion HRK and %

1 The sum total of asset items 2.2 to 2.8 of Bulletin Table B1: Consolidated balance sheet of monetary financial institutions.

2 The sum total of liability items 2 to 5 of Bulletin Table B1: Consolidated balance sheet of monetary financial institutions.

Source: CNB.

Table 2 Placements (except the central government) and main components

in billion HRK and %

1 In addition to placements to households and corporates, they also include placements to the local government and other financial institutions.

2 The transactions show changes that exclude the effects of exchange rate changes, securities price adjustments, reclassification and write-off of placements, including the sale of placements in the amount of their value adjustment.

Source: CNB.

For detailed information on monetary statistics as at January 2018, see: