1 Introduction

Climate change is one of the greatest challenges that we face today. Raising awareness about its potential catastrophic consequences already today, and certainly in the near future and beyond, encourages all segments of society, including the financial sector, to act. The Croatian National Bank (CNB), like the other central banks of the Eurosystem, recognises and accepts its role in facing this global problem.

We adopt the Climate Strategy in order to define and present the long-term vision, which is perceived as the very foundation of our action for climate change adaptation and mitigation. The Strategy defines our objectives and priorities with regard to climate change and presents the activities planned in the three-year period, from 2024 to 2026.

CNB’s mission in the context of climate and environment

The CNB is a central bank that supports climate-related and environmental objectives, without compromising price and financial stability. The CNB integrates climate-related and environmental considerations into all areas of its activity and identifies and manages climate change-related risks to price and financial stability, while simultaneously supporting the transition to a low-carbon economy. In addition, the CNB undertakes and coordinates internal activities associated with climate change and achieving its own climate neutrality.

CNB’s vision in the context of climate and environment

The CNB is a central bank that recognises and manages its own climate-related risks and the risks to the financial system, promotes sustainability and supports the transition to a low-carbon economy. The CNB is a recognisable partner in the area of climate action at the European and international level.

Climate change presents a risk for economic and financial stability and thus impacts the achievement of our primary objective and other tasks within our competence. Therefore, our Climate Strategy focuses on the identification and management of climate-related risks that may impact price stability and the financial system, as well as on support to the process of transition to a low-carbon economy and greening the financial system.

This document provides a detailed presentation of climate change-related plans and measures that the CNB intends to undertake. The Strategy will enable us to appropriately respond to the challenges of the climate crisis for maintaining price and financial stability. It will contribute to the comprehensive effort of the country and the wider community in facing the challenge of climate change.

2 CNB’s climate mandate and previous activities

As the central bank of the Republic of Croatia and part of the Eurosystem, the CNB plays an important role in meeting the climate-related objectives of the Republic of Croatia and the European Union. In accordance with the objectives and tasks defined in the Treaty on the Functioning of the European Union and the Paris Agreement, the CNB is obliged to incorporate climate-related considerations into its operations. Within its mandate, the CNB contributes to the achievement of climate-related objectives of the European Union by implementing the adaptation of its activities, without compromising price stability. In addition to the commitment to sustainable development[1] as one of its strategic objectives for the forthcoming three-year period, the CNB can contribute to the achievement of the climate-related objectives of the European Union, in particular if it joins its efforts with the European Central Bank and other euro area national central banks.

For a few years already the CNB has been proactive with regard to climate change and environmental protection. The Croatian central bank has been involved more intensively in European and international activities since it joined the Network for Greening the Financial System (NGFS) in 2021. Joint supervision of systemically important credit institutions began with the participation in the Single Supervisory Mechanism (SSM), which also included the consideration of climate-related risks. By adhering to the principles of proportionality, the CNB also tries to apply an equal approach in the supervision of less significant domestic credit institutions. The CNB also participates in the joint activities of the working group on climate change of the Vienna Initiative. In 2021, the CNB adopted its Climate Pledge in which it committed to further incorporate climate change-related considerations into its operations. With the decision on Croatia’s joining the euro area in July 2022, the CNB intensified its climate-related activities by deepening the membership in committees and groups in the Eurosystem that implement a comprehensive climate agenda of the European Central Bank (ECB). In the same year, the CNB began cooperation in the area of climate change with stakeholders in the Republic of Croatia – the European Investment Bank, the Croatian Banking Association, the Ministry of Finance, the Croatian Chamber of Economy and others. The CNB also started to evaluate the exposure of its portfolio to climate risks and assess the level of emissions it finances through its investments. The CNB also established a working group for reducing its own carbon footprint.

By defining the “commitment to sustainable development” as one of the CNB’s strategic objectives and by adopting the Climate Strategy, the consideration of climate change has been integrated in all areas of CNB’s activity. Intensified coordination of climate-related activities and a further strengthening of cooperation with stakeholders at the national, European and global levels will contribute to the reinforcement and the necessary interconnectedness of the planned activities at the CNB.

3 Climate strategy goals and priorities

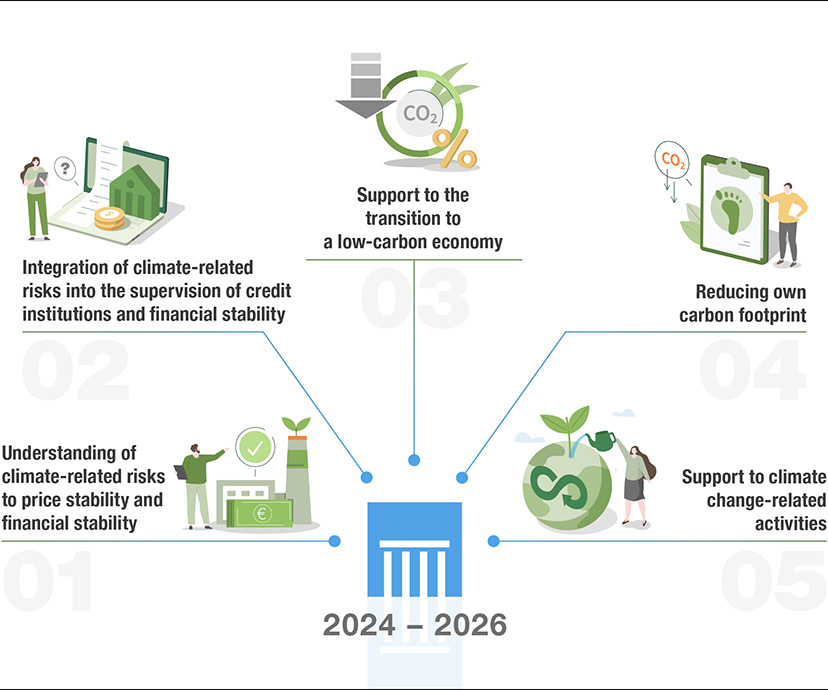

The CNB’s Climate Strategy sets the following goals and priorities for the forthcoming three-year period:

1 Understanding of climate-related risks for price stability and financial stability

The CNB will develop and regularly analyse and assess the impact of climate-related risks on price stability, economic developments and the stability of the financial system. The aim is to increase the understanding of possible consequences of climate change for the economy and the financial sector and develop appropriate strategies to manage, prevent and mitigate such risks. The aim of the disclosure of the analyses and educational materials on the impact of climate change on the Croatian economy and the financial system is to raise awareness of the professional and wider public about the importance of the topic. For these activities it is necessary to collect relevant data and indicators in a systematic way, which in addition to cooperation within the CNB also requires cooperation with other relevant institutions.

Indirect/operational objectives:

- Collection of climate-related data and indicators

- Research on the impact of climate change on the Croatian economy as well as price and financial stability and publication of the results

- Compilation of educational materials on the impact of climate change on the Croatian economy and the financial system

2 Integration of climate-related risks into the supervision of credit institutions and financial stability

The CNB will strengthen its supervisory activities in the area of climate-related risks, including the assessment and monitoring of climate exposure of credit institutions in line with SSM activities and the regular conduct of climate stress tests. Through its action, the CNB will ensure that credit institutions understand their climate-related risks and that their operation is as resilient to risks caused by climate change as possible.

Indirect/operational objectives:

2.1 Incorporating climate-related and environmental risks into supervisory methodologies and processes

2.2 Conducting stress testing of credit institutions for climate-related risks

3 Support to the transition to a low-carbon economy

The CNB will strengthen its cooperation with external stakeholders and the financial sector and support the transition to a low-carbon economy in the area of financing the adaptation to and the fight against climate change and environmental protection. The Bank will disclose information on the impact of its own financial assets on climate and consider the possibilities of investing in environmentally sustainable initiatives and projects. The use of monetary policy instruments to foster sustainable development will also be considered within the Eurosystem fora.

Indirect/operational objectives:

3.1 Preparing the climate strategy and setting up a climate risk management system, preparing a comprehensive climate report on the investment of CNB financial assets and the continuation of reporting on the ESG investment of financial assets

3.2 Promoting investments in activities related to the adaptation to climate change and low-carbon technology through cooperation with stakeholders and public speaking engagements

4 Reducing own carbon footprint

The CNB is taking steps to reduce its own carbon footprint and increase energy efficiency of its operations. The Bank will promote the application of sustainable practices in the management of assets and resources and work on achieving climate-related objectives through activities, such as reducing greenhouse gas emissions, increasing energy efficiency and promoting sustainable transport options.

Indirect/operational objectives:

4.1 Setting up of the process of systematic monitoring of own carbon footprint

4.2 Strengthening the existing and undertaking new measures to reduce own carbon footprint

5 Providing support to climate change-related activities

In order to achieve these objectives and ensure a good quality and efficient implementation of climate change-related activities, the CNB will intensify employee education in the area of climate change. The CNB will also carry out a set of other activities that will provide support to climate change-related processes, in particular in the segments of coordination and monitoring of such activities at the level of the CNB, communication with the public, the review of such processes or the development and monitoring of the execution of the objectives of this climate strategy. In addition, the CNB will actively cooperate with the ECB and other central banks, supervisory authorities and international organisations with the aim of exchanging experiences, best practices and knowledge and participating in the development of international standards and guidelines.

In order to achieve these objectives, the CNB has adopted action plans for specific areas and functional units, as well as plans concerning the support to climate change-related processes, which are presented in the Annex to this Strategy.

4 Implementation of the Climate Strategy

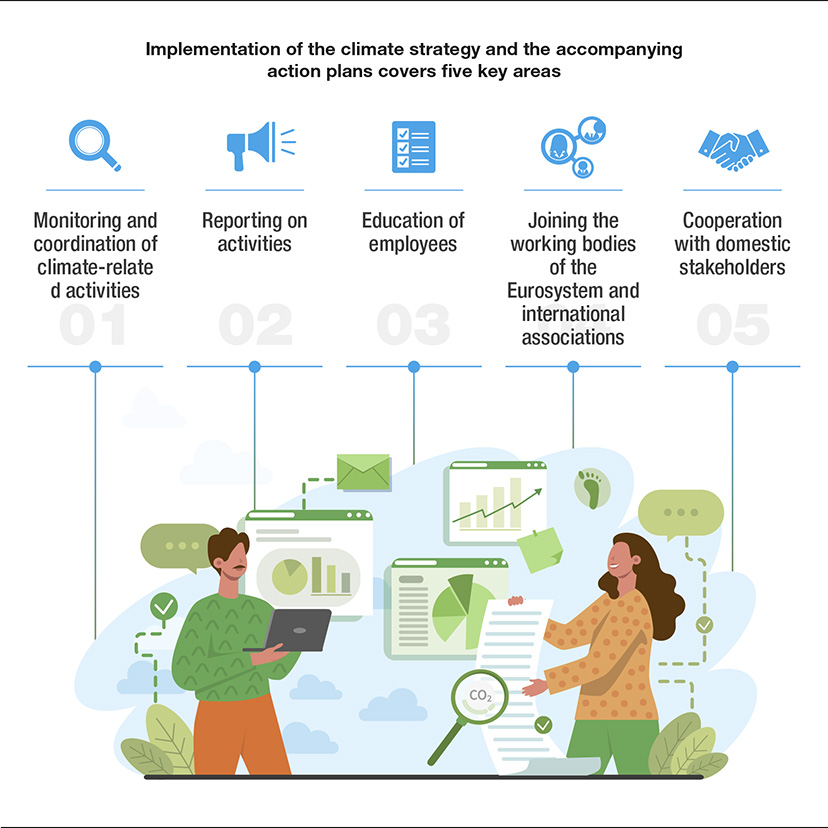

The implementation of the Climate Strategy and the accompanying action plans includes five key areas:

- establishment of mechanisms for the monitoring and coordination of climate-related activities;

- reporting on conducted activities;

- increasing the capacity and education of employees;

- joining the work of the Eurosystem and the European Systemic Risk Board (ESRB) working groups and other relevant international associations;

- cooperation with other government institutions, the financial sector, the economy and civil society.

The setting up of the mechanisms for monitoring and coordination of climate-related activities within the Bank itself is key for monitoring the progress of a systematic and coordinated implementation of activities undertaken by the CNB.

The Bank will also establish mechanisms for reporting on the progress made in the implementation of the Climate Strategy.

Employee capacity building and education is one of the priorities in the forthcoming period, since the existing level of knowledge in that area is inadequate. These programmes will aim at increasing the general understanding of climate-related risks and developing specific skills necessary for the efficient management of individual risks.

Participation in the work of the Eurosystem and ESRB groups and other relevant international associations provides the CNB with an opportunity to liaise with other central banks and institutions, which is crucial for the exchange of information, learning and adopting best practices and coordination of activities at the European level. Through the participation in these groups, the CNB can transfer information to the technical level and contribute to the development of European guidelines and standards for climate-related activities.

The CNB also cooperates with other government institutions, the financial sector and the economy to coordinate climate-related activities. It includes working with other regulatory authorities in order to ensure that policies and regulations are harmonised and to encourage the private sector to switch to more sustainable business models. This cooperation may include educational programmes, the exchange of experiences and fostering innovations in the area of sustainable finance and investment. The CNB also intends to establish cooperation with civil society organisations dedicated to the climate change consideration.

The CNB is systematically integrating sustainability considerations into its activities, and the implementation of the Climate Strategy is a step forward in this direction.

5 Conclusion

The CNB’s Climate Strategy clearly reflects our commitment to face the challenges of climate change and provides guidelines for future action. Through the identification and management of climate-related risks, the strengthening of supervisory activities, support to the transition to a low-carbon economy and reducing own carbon footprint, the CNB will actively contribute to the sustainability and resilience of the financial system. In the forthcoming three-year period, the emphasis of the strategy is on climate-related activities, while activities related to environmental objectives will be gradually integrated into CNB’s action. In addition to cooperation with other institutions and an active participation at the national, European and global levels, in accordance with its mandate, the CNB will be a recognisable partner in facing the climate crisis.

-

Within the CNB’s strategic objectives, commitment to sustainable development means working on reducing the financial system’s adverse impacts on the environment, fostering socially responsible operations and promoting the economy with a low carbon share. ↑