Macroprudential Diagnostics No. 10

Introductory remarks

The macroprudential diagnostic process consists of assessing any macroeconomic and financial relations and developments that might result in the disruption of financial stability. In the process, individual signals indicating an increased level of risk are detected based on calibrations using statistical methods, regulatory standards or expert estimates. They are then synthesised in a risk map indicating the level and dynamics of vulnerability, thus facilitating the identification of systemic risk, which includes the definition of its nature (structural or cyclical), location (segment of the system in which it is developing) and source (for instance, identifying whether the risk reflects disruptions on the demand or on the supply side). With regard to such diagnostics, instruments are optimised and the intensity of measures is calibrated in order to address the risks as efficiently as possible, reduce regulatory risk, including that of inaction bias, and minimise potential negative spillovers to other sectors as well as unexpected cross-border effects. What is more, market participants are thus informed of identified vulnerabilities and risks that might materialise and jeopardise financial stability.

1 Identification of systemic risks

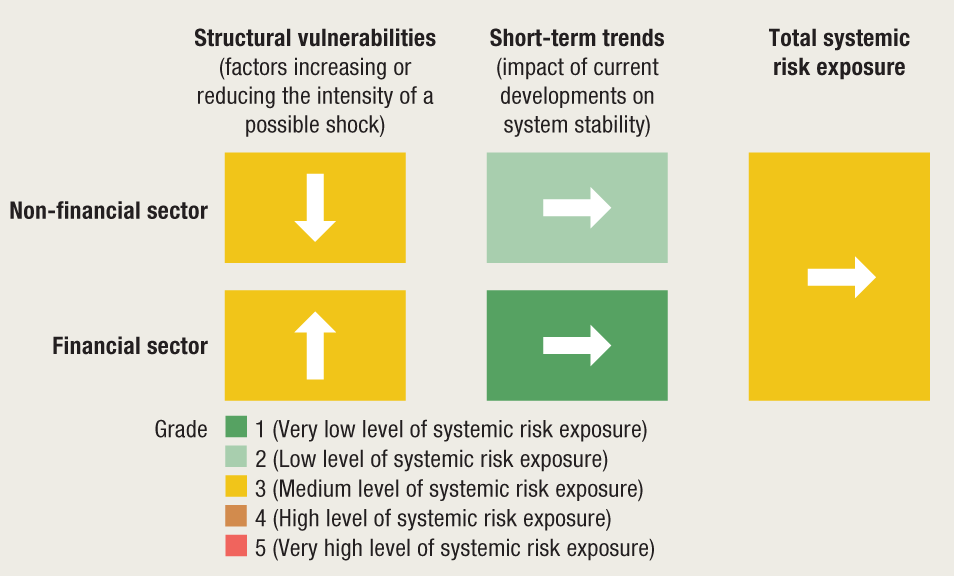

Total systemic risk exposure at the end of the fourth quarter of 2019 remained moderately high (Figure 1). In the period of favourable short-term trends in the financial sector, reflected in an improvement in banks' asset quality and under the conditions of high solvency and liquidity, structural weaknesses of the sector increased due to the growing concentration of revenue and uncertainty regarding future litigation costs. For this reason, the overall risk assessment remained unchanged from the previous assessment (Macroprudential Diagnostics No. 9), despite the favourable macroeconomic developments that reduce structural weaknesses of the non-financial sector.

Figure 1 Risk map, fourth quarter of 2019

Notes: The arrows indicate changes from the risk map in the third quarter of 2019 published in Macroprudential Diagnostics No. 9 (September 2019).

Source: CNB.

Favourable economic developments and a continued decrease in the exposure of the non-financial sector to currency and interest rate risks have alleviated the structural vulnerabilities of the domestic economy. In 2020, economic activity is expected to continue growing at a slightly lower intensity than in the previous year, but will still be based on the growth of domestic demand and capital investments, with the expected continuation of a decrease in macroeconomic imbalances. Favourable developments in the labour market and wage increases support a record level of consumer optimism, which, together with the increase in household lending, is boosting domestic demand. In addition to growth in personal consumption and imports, which support budget revenues, favourable developments in the financial markets also have a positive effect on the stability of public finance. These trends enable government borrowing under the most historically favourable conditions, which will contribute to the decrease in interest expenditure in the coming period. However, the still high level of public debt is a significant structural risk, even more so as it includes high shares of external debt and foreign-currency indexed debt.

Exposure to financial risks, in addition to the public sector is also reduced in the private non-financial sector, but its structural vulnerabilities still pose a threat to financial stability. Corporate and household debt are still relatively high in a CEE perspective, which impedes the absorption of potential macroeconomic shocks. Although the share of loans with a variable interest rate and loans indexed to foreign currency is still noticeable both in households and in corporations, the decline of this share leads to the reduction of their structural vulnerability.

The continued growth of credit portfolio quality has a favourable effect on the profitability of banks. The quality of the credit portfolio of banks is constantly improving in the process of the sale of non-performing placements and is also due to the simultaneous inflow of newly-granted loans. In addition, the high coverage of non-performing placements and the traditionally high capitalisation indicate banks’ resilience. However, despite these positive trends, Croatia still has the EU highest NPL ratio. The continuation of the several-year growth in the share of loans in the domestic currency and with a fixed interest rate in total loans is tending to reduce the potential credit risk of banks, while on the other hand, it makes their management of direct financial risks more complex. With regard to the structure of financing, the trend of growth in domestic sources of financing reduces structural vulnerabilities related to dependency on external financing. Also, high short-term liquidity measured by the liquidity coverage ratio (LCR) increased additionally under the effect of the rise in investments in central government bonds (accompanied by the simultaneous decrease in the bank loans granted to the central government). At the same time, growth in deposits of domestic sectors, spurred by the inflow of funds during the tourist season, had an impact on the increase in the net stable funding ratio (NSFR).

The growing reliance of banks on revenues from general-purpose cash loans and uncertainty regarding future litigation costs have an impact on the growth of structural risks in the financial system. In the environment of historically low interest rates, general-purpose cash loans are the only bank product recording a growth in interest revenue. However, the risk of an increasing reliance of banks on these products, most of which are unsecured, is also pronounced because of the currently non-functional Croatian Registry of Credit Obligations (HROK). At the same time, the revenue from government sector financing, while it was very important in the acute phase of the financial crisis, continues to decrease in the present conditions of declining yields and smaller government needs for financing. Finally, despite the lower expenses of value adjustments for credit risk, provisions for litigation costs based on contracting loans with a currency clause in the Swiss franc or with a variable interest rate have increased noticeably. The total volume of these costs is uncertain because it depends on the final court decisions, as well as on the number and the dynamics of the initiation of individual litigations.

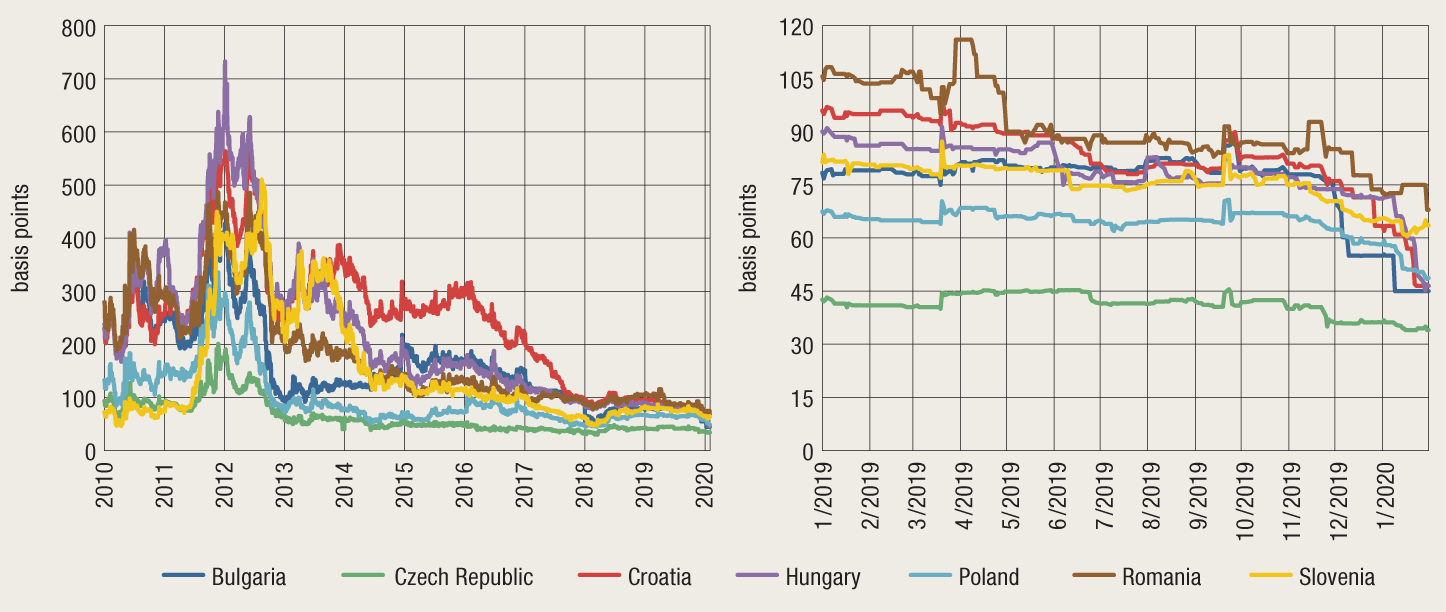

Favourable developments in financial markets are reflected in the low volatility of the financial stress index and the lower risk premium. The financial stress index, showing current developments in the Croatian financial market, remains low, without major volatilities. The CDS for Croatia has continued to decrease (Figure 2), currently standing at all-time lows, which should enable the continuation of the rollover of debt under favourable conditions in the coming period.

Figure 2 Credit default swap (CDS) on five-year bonds for selected CEE countries and Croatia

Note: Data until 31 January 2020.

Source: S&P Capital IQ.

Low interest rates and growth in net financial assets alleviate the repayment burden and strengthen household debt repayment capacity. Despite the expected tightening of lending conditions for cash loans, as a result of the alignment with the Recommendation on actions in granting non-housing consumer loans, these loans are still the main generator of growth in household debt. Household debt is also growing based on housing loans, the acceleration of which at the end of 2019 was also under the impact of the government’s subsidy programme in the competence of the Agency for Transactions and Mediation in Immovable Properties (APN). The implementation of the programme in 2020 was announced for March and September. Notwithstanding the growth in debt, favourable financing conditions, accompanied by positive trends in the labour market and growth in liquid financial assets facilitate this sector’s debt servicing.

Under the effect of increasing real estate prices risks related to this market are also increasing. One of the reasons for the surge in prices is the government’s loans subsidy programme, which in addition to positive developments in the labour market and favourable financing conditions supports the rise in real estate prices. However, real estate prices in Zagreb and on the Adriatic Coast are also rising under the impact of developments in tourism, as well as the attractiveness of the Croatian coast to foreign citizens, who are increasingly investing in the purchase of real estate. Nevertheless, although under the present conditions of low interest rates investment in real estate ensures a certain yield, it also gives rise to the accumulation of risks. Changes in real estate prices may have an impact on the level of risk in financial institutions through both housing loans granted to households and lending to corporate construction projects. By the intensified lending to the real estate sector, banks are exposed to the risk of a potential decrease in prices, which may have a negative impact on their stability through the decline in the value of collateral, in particular if it is compounded by the high indebtedness of loan users.

Positive short-term developments are present in non-financial corporations, whose debt indicators are decreasing. The recorded growth of capital and gross operating surplus has a favourable effect on the solvency and liquidity of the corporate sector. However, there are still uncertainties associated with the operational restructuring of the Fortenova Group (former Agrokor), as well as the implementation of the settlement itself. In addition to the lack of an adequate labour force, insufficient investment in new technologies and limited access to capital are also limiting factors that might have an impact on developments in the non-financial corporate sector in the forthcoming period.

2 Potential risk materialisation triggers

The main potential triggers for risk materialisation in Croatia still lie to the largest extent in external developments. Although in the past months progress was made in trade negotiations between China and the USA, trade tensions between the USA and the EU, as well as uncertainty regarding future growth in Germany are still pronounced. The short period for reaching an agreement on future trade relations between the UK and the EU, as well as a potential relatively strong slowdown in economic growth in China and geopolitical tensions in the Middle East might have an additional negative impact on global growth. Against the background of slower economic growth and weak inflationary pressures, the ECB has announced that it will continue pursuing its expansionary monetary policy.

Potential triggers for risk materialisation stemming from the domestic environment are currently not considered significant. In 2020, the economy is expected to grow further, although at a slower pace than in 2019, accompanied by the still present risks linked to the labour market, productivity and the structure of the economy itself. In addition to the emigration of the working age population, the labour market is characterised by the low participation of the labour force and structural unemployment. The continued accumulation of arrears in the health sector and a sharp increase in expenditures on wages and various transfers in the election year could have a negative impact on the currently favourable developments in public finances. Additional risk still lies in uncertainties regarding the results of legal actions and international arbitrations in which the Republic of Croatia is currently involved. Finally, even though financial problems at the Fortenova Group and with shipyards have been greatly reduced, risks with regard to the implementation of the settlement or the preparation of the programme of restructuring of individual large enterprises facing problems are still present.

As regards the financial sector, the main challenges for safeguarding stability stem from the uncertainty regarding court decisions in the processes initiated by consumers against banks. This is primarily related to the issue of the nullity of the provisions of loan contracts with a variable interest rate and a currency clause in the Swiss franc and consequently also to the agreement on conversion. Specifically, the Supreme Court is expected to take a decision by mid-March 2020 in the pilot-judgement procedure regarding the issue of the nullity of the agreement on conversion initiated according to the amendments to the Civil Procedure Act. Once this decision is adopted, all courts will be bound by this legal interpretation in future procedures. The number of actions and the amount of potential expenses for banks will depend on this decision. Furthermore, even though the burdening of capital by the loan portfolio quality has been reduced significantly since the outbreak of the crisis, account should be taken of the fact that the loan portfolio quality can deteriorate very quickly in stressed conditions, in particular because we are now in the mature phase of the cycle of non-performing loans (Macroprudential Diagnostics No.3, Box 1).

3 Recent macroprudential activities

3.1 Continued application of the countercyclical capital buffer rate for the Republic of Croatia in the first quarter of 2021

On the basis of a new quarterly analytical assessment of the development of cyclical systemic risks, the CNB has announced that the countercyclical capital buffer rate of 0% will continue to be applied in the first quarter of 2021. This is because the acceleration of real economic growth in the third quarter of 2019 was accompanied by a slightly slower growth in the placements of monetary financial institutions to the private sector. The downward trend in the standardised indicator of relative indebtedness continued (i.e. the ratio of total placements to nominal annual GDP), with the credit gap calculated on the basis of that indicator also remaining negative and below its long-term trend. The specific indicator of relative indebtedness, i.e. the ratio of loans of domestic credit institutions to the non-financial sector to quarterly, seasonally adjusted GDP, also declined, with the credit gap calculated on the basis of that indicator also remaining negative. Since no other important indicators point to an increase in cyclical systemic risk linked to the periods of excessive credit growth, corrective action by the CNB is still not required.

3.2 Review of the identification of other systemically important credit institutions in the Republic of Croatia

In accordance with the Guidelines of the European Banking Authority (EBA/GL/2014/10) and the Credit Institutions Act (Official Gazette 159/2013, 19/2015, 102/2015, 15/2018 and 70/2019), in the fourth quarter of 2019, the CNB, as the designated authority for identifying other systemically important credit institutions (O-SIIs), carried out a regular annual identification of O-SIIs in the Republic of Croatia and calibration of the capital buffer for O-SIIs. The review was conducted using the internal methodology, and, as in the previous iteration, a total of seven O-SIIs were identified. Capital buffer rates for O-SIIs were calibrated using the method of equal expected impact, where as a result, depending on the estimated systemic importance of a credit institution, within the legally permitted range, buffer rates were determined within the range of 0.5% to 2% of the total risk exposure amount. The results of the annual review were published in December 2019.

Pursuant to the Decision on the application of the structural systemic risk buffer (Official Gazette 78/2017), O-SIIs are also obligated to maintain a structural systemic risk buffer applied to all exposures. In accordance with the Credit Institutions Act, credit institutions are required to maintain either the structural systemic risk buffer rate or the O-SII buffer rate, whichever is the higher Since in the latest O-SIIs review the structural systemic risk buffer rate (see Table 2) was the higher of the two capital buffers for all identified O-SIIs, O-SIIs are only subject to the application of the structural systemic risk buffer rate.

3.3 Preparations to enter the European Exchange Rate Mechanism II and the Banking Union

3.3.1 Amendments to the Credit Institutions Act and the Act on the Croatian National Bank in the part related to macroprudential policy measures

In the letter of intent to enter the European Exchange Rate Mechanism II (ERM II) and the Banking Union, the Republic of Croatia has undertaken to adopt certain amendments to the Credit Institutions Act and the Act on the Croatian National Bank, which were submitted to the parliamentary procedure in January 2020. The important adjustments of the Credit Institutions Act include those in the area of macroprudential policy, which will allow the ECB to intervene if it assesses that a Croatian macroprudential measure, which is based on harmonised European rules and aimed at credit institutions (capital buffer for O-SIIs, for structural systemic risks, countercyclical capital buffer, stricter national measures due to changes in the intensity of risk in the financial system), is not strict enough.[1] The adjustment of the competent legal framework for the purpose of enabling the establishing of close cooperation with the ECB and the entry in the Single Resolution Mechanism also includes the appropriate provisions of the Act on the Croatian National Bank.

Furthermore, in the letter of intent to enter the ERM II and the Banking Union, the Republic of Croatia has undertaken to integrate borrower-based macroprudential measures (see Box 1) into the national legal framework. Currently, this type of measure is not part of harmonised European macroprudential regulations, but it is within the domain of national legislations. Accordingly, the CNB's powers to participate in the adoption and the implementation of macroprudential measures and instruments with the objective of preserving the stability of the financial system as a whole are elaborated in the amendments to the Credit Institutions Act.

3.3.2 Collecting data on standards on lending to consumers

In order to collect data necessary for the analysis and the regular monitoring of systemic risk, credit risk, the calibration and the implementation of borrower-based macroprudential measures (see 3.3.1), the CNB introduces a new reporting requirement for credit institutions. In November 2019, the Draft Decision on collecting data on standards on lending to consumers was submitted for public consultation. The draft envisages the monthly collection of individual data on all newly-granted consumer loans at the individual loan level and the annual collection of data on all individual consumer loan balances. The CNB has covered all types of loans to consumers under this reporting requirement in order to enable the monitoring of systemic risk development in all segments of lending to consumers and in this way facilitate the fulfilment of the task prescribed in the Act on the Croatian National Bank of contributing to the stability of the financial system as a whole.

Box 1 Borrower-based macroprudential measures

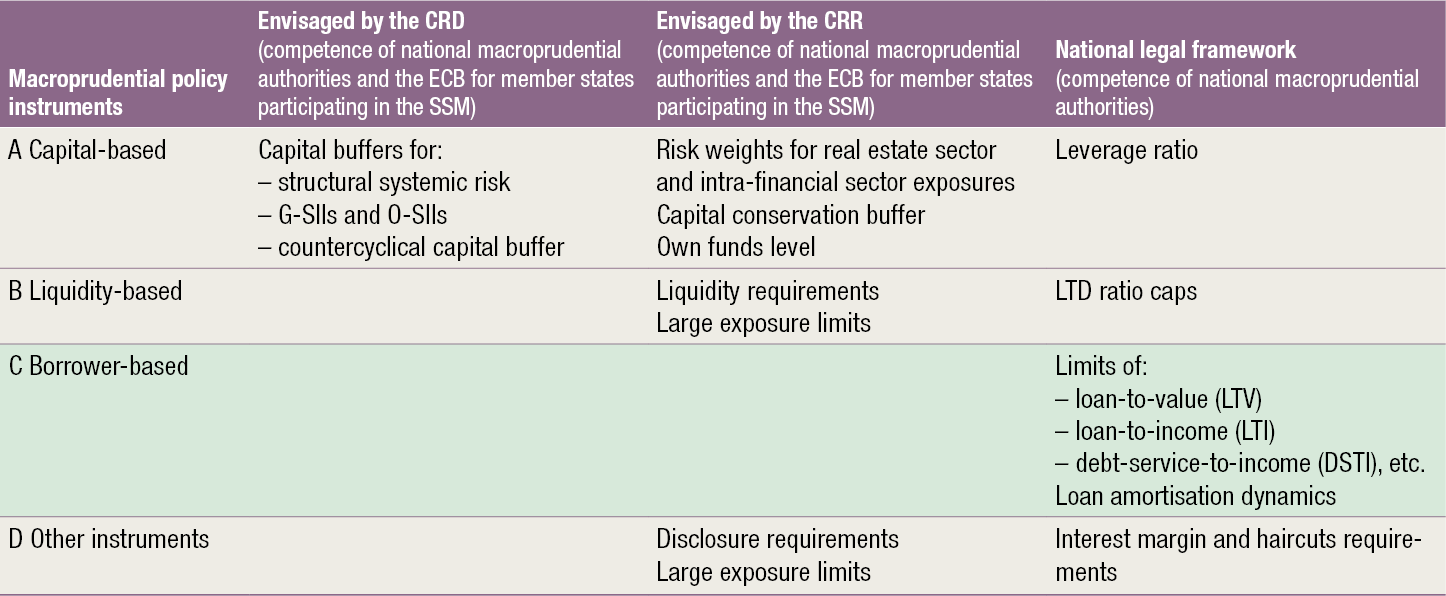

The end objective of the implementation of macroprudential policy – safeguarding financial stability – implies preventing excessive accumulation of systemic risks and imbalances in the system and increasing financial system resilience in the case of risk materialisation. The instruments available to the competent authorities in implementing macroprudential policy can be grouped into three basic categories: capital-based instruments, liquidity-based instruments and borrower-based instruments (Table 1). The direct aim of borrower-based measures is to limit (excessive) credit activity and reduce the accumulation of risks in the system by increasing borrowers' resilience in the event of unfavourable economic and/or financial developments. The examples of such measures include limits on the loan amount in relation to collateral value (loan-to-value ratio, LTV), limits on the loan amount and/or instalments of loan repayment or the total debt in relation to borrowers' income (loan-to-income (LTI), loan service-to-income (LSTI), debt-to-income (DTI), debt-service-to-income (DSTI)), prescribing the maximum loan maturity, loan amortisation schedules and other similar limits. Their impact on credit activity arises from constraining new lending, while they have no impact on previously granted loans. The setting up of such limits on newly-granted loans enhances the resilience of borrowers because by limiting their indebtedness, their debt servicing capacity increases, which then reduces potential losses for credit institutions related to the risk of borrowers defaulting on their loans. In contrast, capital-based and liquidity-based instruments are aimed at credit institutions and primarily increase their resilience in the case of systemic risk materialisation, although some of them can also contribute to the reduction of financial cycle amplitudes.

At the EU level, capital-based macroprudential instruments and some of the liquidity-based instruments are part of the EU’s harmonised legal framework and stipulated by the provisions of Regulation (EU) No 575/2013 on prudential requirements for credit institutions and investment firms (CRR) and Directive 2013/36/EU on access to the activity of credit institutions and prudential supervision of credit institutions and investment firms (CRD). By contrast, borrower-based macroprudential measures (marked green in Table 1) are completely under the authority of national legislations, which allows national authorities to have greater flexibility in formulating, calibrating and implementing the measures.

Table 1 Classification of macroprudential instruments for the banking sector

Source: V. Constancio et al. (2019): Macroprudential policy at the ECB: Institutional framework, strategy, analytical tools and policies, ECB Occasional Paper Series, No. 227.

The integration of the legal basis for these measures in the legal frameworks of euro area member states was recommended by the Governing Council of the ECB in 2016, and the European Systemic Risk Board report from December 2018 on macroprudential approaches to non-performing loans additionally emphasises the important role these measures can play in mitigating risks associated with the occurrence of non-performing loans in the early stage of the credit cycle. These measures today constitute the common part of the instruments of macroprudential authorities of the majority of EU member states that use them primarily to mitigate systemic risks arising from household lending and exposure to the real estate market.

Accordingly, in the letter of intent to enter the European Exchange Rate Mechanism II (ERM II) and the Banking Union, the Republic of Croatia and the CNB have undertaken to strengthen the legal framework for the implementation of macroprudential policy by explicitly empowering the central bank to implement borrower-based measures. Thus the proposal of amendments to the Credit Institutions Act elaborates in detail the powers of the CNB as the authority competent for the implementation of macroprudential policy in fulfilling its task of contributing to the stability of the financial system as a whole. These powers explicitly include the adoption of borrower-based measures that may include prescribing the highest permitted ratio of the value of collateral to the approved loan amount, the highest permitted ratio of the loan amount (and/or loan instalment) to the income of the loan user, the longest permitted duration of the loan, the requirements related to the loan repayment calculation method and other measures and requirements aimed at mitigating and preventing systemic risks.

The design and supervision of the implementation of such measures require individual data on lending standards, which so far have not been systematically collected at the CNB. In order to expand the analytical framework required for the implementation of the above measures, the CNB is introducing a new reporting system for credit institutions on consumer lending standards, which includes reporting on a granular basis (at the level of the individual loan) on all newly-granted consumer loans. Data that will be collected starting from the end of the third quarter of 2020 will serve as the database with which to create a group of indicators and their distributions, necessary for the regular monitoring and analysis of systemic risk, the monitoring of credit risk, the calibration of macroprudential measures and monitoring credit institutions in the implementation of the adopted measures. At the same time, the data will also serve for meeting the requirements from the recommendations of the European Systemic Risk Board on closing real estate data gaps (Recommendation on closing real estate data gaps (ESRB/2016/14) and Recommendation amending Recommendation on closing real estate data gaps (ESRB/2019/3)), which harmonise data at the EU level required for the assessment and monitoring of financial stability risks associated with real estate markets (for more information, see Macroprudential Diagnostics No. 9).

3. 4 Recommendations of the European Systemic Risk Board

3.4.1 Recommendation of the European Systemic Risk Board on exchange and collection of information for macroprudential purposes on branches of credit institutions having their head office in another Member State or in a third country (ESRB/2019/18)

In September 2019, the ESRB published the Recommendation on exchange and collection of information for macroprudential purposes on branches of credit institutions having their head office in another Member State or in a third country, with the aim of information exchange and improvement of cooperation between relevant authorities of host member states and home member states, for where branches of credit institutions having their head office in another member state or in a third country are considered relevant for financial stability in the country in which they operate there is a need to intensify the collaboration between the relevant authorities of the host and home member states. In such cases, the exchange of selected information is necessary to assess the potential impact on financial stability that such branches might have during periods of excessive credit growth or a crisis and to ensure the effectiveness of macroprudential policy in the host member state.

The provision of cross-border financial services via branches of credit institutions having their head office in another member state or a third country is currently an important part of the financial system in a number of member states, while the importance of branches might increase further in the future as financial integration within the EU continues. In response, the ESRB adopted a recommendation that consists of three parts: Recommendation A calls for cooperation between macroprudential authorities of host and home member states and the exchange of information as regards branches of credit institutions would be based on bilaterally concluded memoranda of understanding. Recommendation B proposes that the European Commission remove any regulatory impediments to the exchange of information on the operation of branches of credit institutions, while Recommendation C requires the European Banking Authority to prepare a list of information on branches that competent authorities of home member states should, on request, submit to the macroprudential authorities of the host member states.

3. 5 Macroprudential policy implementation in other European Economic Area countries

The countercyclical capital buffer continues to be among the most actively applied measures of macroprudential policy in the European Economic Area (EEA) countries in which credit activity growth has been intensified for some time, often accompanied by an increase in real estate prices. The non-zero countercyclical capital buffer rate (ranging from 0.25% in France to 2.5% in Sweden and Norway) was in January 2020 applied by twelve EEA countries. In the first half of the current year they are being joined by two other countries, Belgium (0.5%) and Germany (0.25%), and an additional rise in the existing countercyclical capital buffer rate has already been announced in Bulgaria, Czech Republic, Denmark, France, Island and Slovakia.

With regard to real estate market developments, in the summer of 2019, the ESRB published a set of EEA country-specific recommendations and warnings on medium-term vulnerabilities in the residential real estate sector and identified these vulnerabilities as a potential source of systemic risk to financial stability, which the ESRB assessed to be only partially and not completely covered by macroprudential policy measures. These are Belgium (ESRB/2019/4), Denmark (ESRB/2019/5), Luxembourg (ESRB/2019/6), the Netherlands (ESRB/2019/7), Finland (ESRB/2019/8), Sweden (ESRB/2019/9), the Czech Republic (ESRB/2019/10), Germany (ESRB/2019/11), France (ESRB/2019/12), Iceland (ESRB/2019/13) and Norway (ESRB/2019/14).

In November 2019, the binding application of borrower-based macroprudential measures entered into force in Slovenia. In response to the accelerated growth rates of household loans, the central bank of Slovenia issued a macroprudential recommendation for household lending in 2016, aimed at limiting excessive growth in housing loans and household debt by setting a cap on the ratio of the annual debt servicing costs to the consumer's annual income (debt-service-to-income, DSTI) and the ratio of the amount of a granted loan to the value of collateral (loan-to-value LTV). In October 2018, the Recommendation was extended by the recommendation of a cap on DSTI for all consumer loans, not only housing loans, while at the same time a cap on the maximum maturity of consumer loans to 120 months was recommended. Since the main objective of the Recommendation, limiting excessive growth in household lending and leverage, in particular consumer non-housing loans, was not completely achieved, the central bank of Slovenia introduced at the end of 2019 the binding application of borrower-based macroprudential measures including a binding cap on the ratio of the annual debt servicing costs to the consumer’s net income (DSTI) for all household loans and a binding limit on the maturity of consumer loans that are not secured. The cap on the ratio of the amount of the granted loan to the value of the instrument of collateral (LTV) still remained non-binding, in the form of a recommendation.

After the implemented recalibration and review of the application of the structural systemic risk buffer, the Hungarian central bank extended the scope of this buffer. In addition to the level of problem exposures collateralised by commercial real estate[2], the application of this buffer from January 2020 also depends on non-problem exposures secured by commercial real estate denominated in foreign currency[3]. The extension of the scope of the structural systemic risk buffer is a response to the recorded increase in lending to the commercial real estate sector denominated in foreign currency, with the objective of preventing the excessive accumulation of risks, in particular foreign currency risk.

Table 1 Overview of macroprudential measures applied by EU member states, Iceland and Norway

Notes: The measures listed are in line with Regulation (EU) No 575/2013 on prudential requirements for credit institutions and investment firms (CRR) and Directive 2013/36/EU on access to the activity of credit institutions and the prudential supervision of credit institutions and investment firms (CRD IV). The definitions of abbreviations are provided in the List of Abbreviations at the end of the publication. Green indicates measures that have been added since the last version of the table. For CCB, green marks the rates applied or announced after 1 October 2019.

Disclaimer: of which the CNB is aware.

Sources: Sources: ESRB, CNB and notifications from central banks and websites of central banks as at 15 January 2020.

For more detailed data, see: https://www.esrb.europa.eu/national_policy/html/index.en.html.

Table 2 Implementation of macroprudential policy and overview of macroprudential measures in Croatia

Note: The definitions of abbreviations are provided in the List of abbreviations at the end of the publication.

ource: CNB.

Glossary

Financial stability is characterised by the smooth and efficient functioning of the entire financial system with regard to the financial resource allocation process, risk assessment and management, payments execution, resilience of the financial system to sudden shocks and its contribution to sustainable long-term economic growth.

Systemic risk is defined as the risk of an event that might, through various channels, disrupt the provision of financial services or result in a surge in their prices, as well as jeopardise the smooth functioning of a larger part of the financial system, thus negatively affecting real economic activity.

Vulnerability, in the context of financial stability, refers to structural characteristics or weaknesses of the domestic economy that may either make it less resilient to possible shocks or intensify the negative consequences of such shocks. This publication analyses risks related to events or developments that, if materialised, may result in the disruption of financial stability. For instance, due to the high ratios of public and external debt to GDP and the consequentially high demand for debt (re)financing, Croatia is very vulnerable to possible changes in financial conditions and is exposed to interest rate and exchange rate change risks.

Macroprudential policy measures imply the use of economic policy instruments that, depending on the specific features of risk and the characteristics of its materialisation, may be standard macroprudential policy measures. In addition, monetary, microprudential, fiscal and other policy measures may also be used for macroprudential purposes, if necessary. Because the evolution of systemic risk and the consequences of such risk, despite certain regularities, may be difficult to predict in all of their manifestations, the successful safeguarding of financial stability requires not only cross-institutional cooperation within the field of their coordination but also the development of additional measures and approaches, when needed.

In such a case, the ECB is authorised to apply higher requirements for capital buffers and stricter macroprudential measures aimed at addressing systemic and macroprudential risks at the level of credit institutions, in coordination with the national authorities of the SSM members. The ECB will carry out the above effectively by issuing instructions to the CNB, which, under the amendments to the Credit Institutions Act, has undertaken to act in accordance with the instructions issued by the ECB with regard to determining the capital buffer rate. ↑

The Hungarian central bank defines the mentioned problem exposures as the sum of non-performing and restructured gross amount of domestic loans secured by commercial real estate and the gross amount of domestic commercial real estate that credit institutions hold on their balance sheet as held for sale. ↑

This group includes all gross domestic loans secured by commercial real estate denominated in foreign currency, but not classified as problem exposures. ↑