For the first time after Croatia’s accession to the euro area, the Eurostat and the CBS released their flash estimate of inflation in Croatia on 1 February. The earlier availability of official data on price developments facilitates the monitoring and timely estimate of price developments.

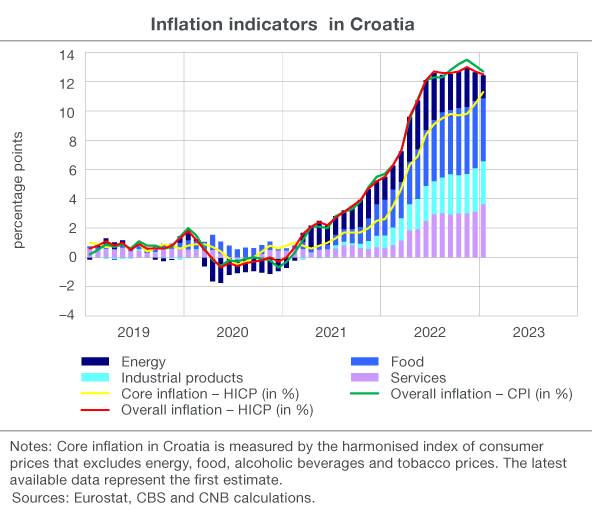

The annual inflation rate, measured by the harmonised index of consumer prices, dropped from 12.7% in December 2022 to 12.5% in January 2023 as a result of a slower increase in the prices of energy (from 14.7% to 12.1%) and food products (from 16% to 14.8%). The annual increase in industrial product prices slowed down only marginally (from 11.2% to 11.1%), whereas the annual growth in the prices of services picked up from 9.9% to 11.5%. The annual overall inflation rate measured by the national consumer price index stood at 12.7% in January, down from 13.1% in December. The slight January slowdown in inflation is in line with CNB expectations, which are based on the lower prices of refined petroleum products and estimates of slower annual growth in food prices derived from developments in retail chain store prices. The slowdown in inflation was also driven by the decrease in the prices of raw materials in the world market seen from mid-2022 onwards as well as the gradual elimination of lingering supply chain bottlenecks. By contrast, there is still no evidence of any significant impact of weakened economic activity. Bearing in mind the signs of the easing of inflationary pressures around the world and the statistical elements such as a favourable base effect, the annual inflation rate is expected to continue to slow down gradually throughout the rest of 2023, though it will remain elevated for some time. However, significant risks that inflation could be higher than anticipated should not be overlooked.

January developments suggest that the introduction of the euro in Croatia might have a relatively mild effect on overall inflation, which is in line with the experience of other countries. Also following the experience of other countries, the price increase after the introduction of the euro is probably most apparent in the service industry. For a final assessment of the price increase after the euro introduction, it is necessary to wait for detailed data for January and the following few months. Elevated inflation, seen even before the euro area accession, might make it difficult to isolate the impact of individual factors of inflationary pressures.

The latest survey data suggest that the inflation slowdown in January 2023 was accompanied by a noticeable decrease in perceived and expected inflation, which was broad-based across all consumer groups divided by gender, age, education and income, and which was probably associated with the fall in the prices of refined petroleum products. Official inflation data measure the average increase in the prices of all household goods and services, while the consumer habits of individual households may vary significantly, which adds to the still highly dispersed perception among households.