The publication of general government debt data of 30 March 2018 on the stock of that debt as at 31 December 2017 includes a revised historical data series on general government debt stock which reflects two improvements in statistical calculation:

- statistical alignment with ESA 2010 and the Manual on Government

Deficit and Debt relating to consolidation of the debt securities component of general government debt, which included a revision of data series on general government debt as from January 2002; - sectoral reclassification into subsectors of the central and local government, which included a revision of data series as from January 2015.

For the purposes of calculation in the process of consolidation of the debt securities component of general government debt, in June 2017, the CNB launched a survey which has shown long-term and short-term debt securities issued by central government subsectors and owned by other central government subsectors, as exclusive consolidation elements up to now. Thus far, this survey has not revealed other possible securities investments between various subsectors within the general government sector. Unlike the securities position, the loan position of the general government debt was consolidated regularly and was therefore not the subject of this calculation improvement.

By its structure, the process of consolidation results in the Maastricht (EDP) debt of the general government sector which is lower or equal to its unconsolidated stock on each instrument and total level, with the financial assets of the general government sector being reduced by the same amount. This procedure enabled further adjustment of the calculation of EDP debt of the general government sector with the provisions of Regulation (EC) No 479/09.

The second improvement concerns a reclassification of two units from the subsector of public non-financial corporations into the subsector of central or local government, in line with the last official version of the classification of statistical units into the general government sector, determined and published by the CBS. These two reclassifications resulted in a growth in the loan instrument component of the general government debt.

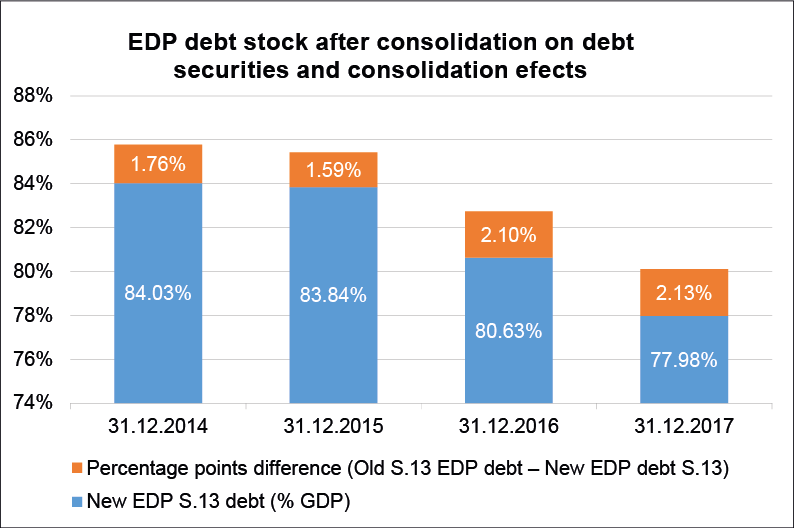

The combined result of these two improvements in statistical calculation is a reduction in the general government debt as from 2002.

Figure 1