At the end of 2022, the European Commission presented a proposal for amendments to the Stability and Growth Pact, which puts a strong emphasis on the need to achieve a sustainable path of public debt. High public debt weakens the resilience of the national economy to various shocks, reducing the capacity to run counter-cyclical fiscal policy. In addition, it is considered that high public debt can have a negative impact on economic growth through two main channels. The first is related to the crowding out of the private sector from the capital market due to substantial government borrowing needs and a potential negative impact through interest rate growth. The second channel is related to the possible impact on the expectations of households and enterprises that additional borrowing will have to be financed by increased taxes, which could reduce consumption and investments. Attention to debt sustainability risks is particularly important in the current macroeconomic environment characterised by a high level of uncertainty and rising borrowing costs.

Two fundamental approaches to the analysis of public debt sustainability, deterministic and stochastic[1], have advantages and disadvantages and are usually used to complement each other. While under the stochastic approach the risks to public debt sustainability are empirically assessed on the basis of historical volatility of individual factors and an assessment of their interdependence, under the deterministic approach the analysis is usually based on shock scenarios (e.g. interest rate shock, exchange rate shock, etc.), which do not necessarily depend on historical developments. Stochastic analysis is increasingly used to assess fiscal sustainability risks, as it allows the use of a large number of shocks, risk quantification and an assessment of the reasonableness of projections. Assessments of public debt sustainability using the stochastic approach for Croatia suggest that risks are not pronounced. The central estimate shows a declining path of public debt over the projection period, towards the threshold of 60% of GDP, and is in line with the projections of the Ministry of Finance of the Republic of Croatia. In addition, the probability that public debt will grow steadily is relatively small, with even the worst scenario suggesting that public debt would remain below the 2020 level, when it reached historical highs.

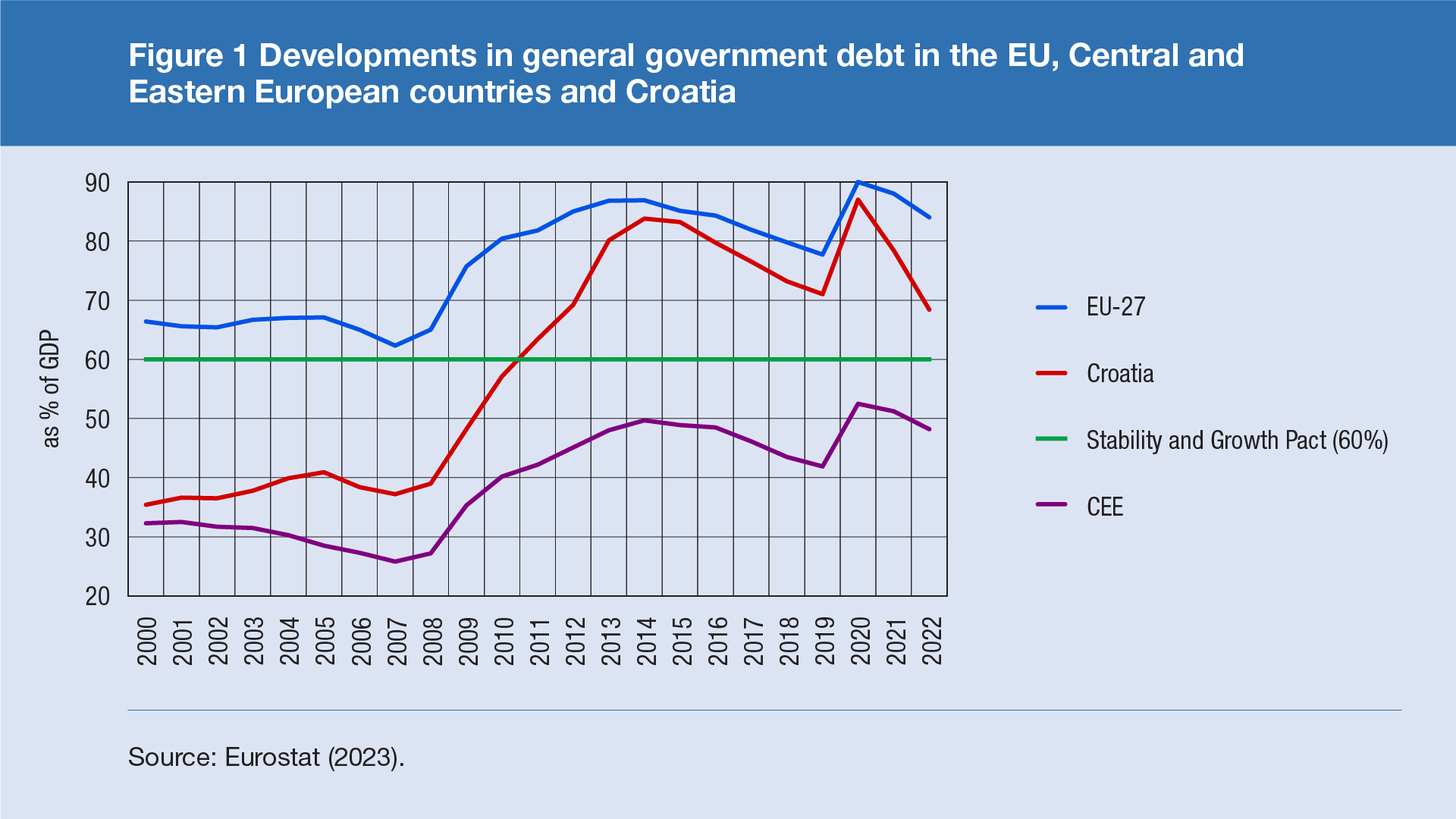

After reaching almost 90% of GDP in 2020Croatia’s public debt,[2] started to decline again as economic activity recovered, but it still remained elevated. The strong debt growth in 2020 offset the consolidation efforts that resulted in a continuous decrease in public debt in the period from 2014 to 2019. This jump was caused by the substantial weakening of economic activity due to the COVID-19 pandemic and the rise in the general government deficit, which exceeded 7% of GDP, as a result of the operation of automatic stabilisers and fiscal measures aimed at alleviating the economic crisis[3]. This crisis was short-lived and real activity started recovering as early as the second half of 2020, which, among other things, enabled the phasing-out of pandemic-related fiscal stimulus. Despite such developments, Croatia’s public debt remains above the threshold set by the Maastricht criteria in 2021 and 2022 (Figure 1). However, compared with the average of EU Member States and Central and Eastern European (CEE) countries, Croatia recorded the largest annual decrease in the public debt-to-GDP ratio in 2022, with public debt falling from 78.4% in 2021 to 68.4% last year. This annual decrease in debt was mostly driven by economic recovery, which resulted in a favourable snowball effect (the difference between the implicit interest rate on public debt and the nominal GDP growth rate), as well as favourable trends in the general government primary balance. This effect outweighed the negative fiscal impact of discretionary measures of 1.5% of GDP[4], introduced with the aim of preserving the living standards of citizens and corporate business activity in a period of high inflation. However, Croatia faces new challenges, including an uncertain external environment, the slowdown in economic growth and rising financing costs. In such circumstances, it is important to consider risks to public debt sustainability, which is the subject analysed in this blog.

Most international institutions such as the European Central Bank (Bouabdallah et al., 2017), the European Commission (EC, 2014) and the International Monetary Fund (IMF, 2013) use a public debt sustainability analysis that is based on the following debt accumulation equation:

\(\Delta d_t=\left(\frac{i-g}{1+g}\right)_t * d_{t-1}-p b_t+d d a_t\)

This equation shows that the change in debt in a particular year depends on the level of the primary balance (pbt), the multiple of the public debt level in the previous year (dt– 1) and the difference between the implicit interest rate on public debt (i)[5] and the rate of economic growth (g) in the current year and on other factors (ddat), which, for example, may relate to borrowing in excess of the need to cover the current budget deficit or to the impact of exchange rate changes. The first term on the right-hand side of the equation is also referred to as the snowball effect because it shows that the rise in the public debt-to-GDP ratio will become increasingly larger if the implicit interest rate on public debt is higher than the economic growth rate.

The analysis of public debt sustainability may follow a deterministic and a stochastic approach, each of which has advantages and disadvantages, so that they are usually used to complement each other, providing a more complete picture of fiscal sustainability risks. The main difference between these two approaches is that under the stochastic approach, risks to public debt sustainability are empirically assessed on the basis of the historical volatility of individual factors and an assessment of their interdependence, while the deterministic approach is usually based on scenarios of shocks of individual variables (e.g. interest rate shock, exchange rate shock, etc.), which do not necessarily depend on historical developments. In addition, the deterministic approach is subject to changes in assumptions, especially in uncertain times. The main advantage of the stochastic approach is that it enables the simulation of a large number of shocks and the quantification of risks and that it illustrates the distribution of probability and uncertainty around the projected public debt path. The stochastic approach can also be used to assess the reasonableness of the baseline projections of public debt and deterministic shocks depending on the historical volatility of macroeconomic variables and their interdependencies.

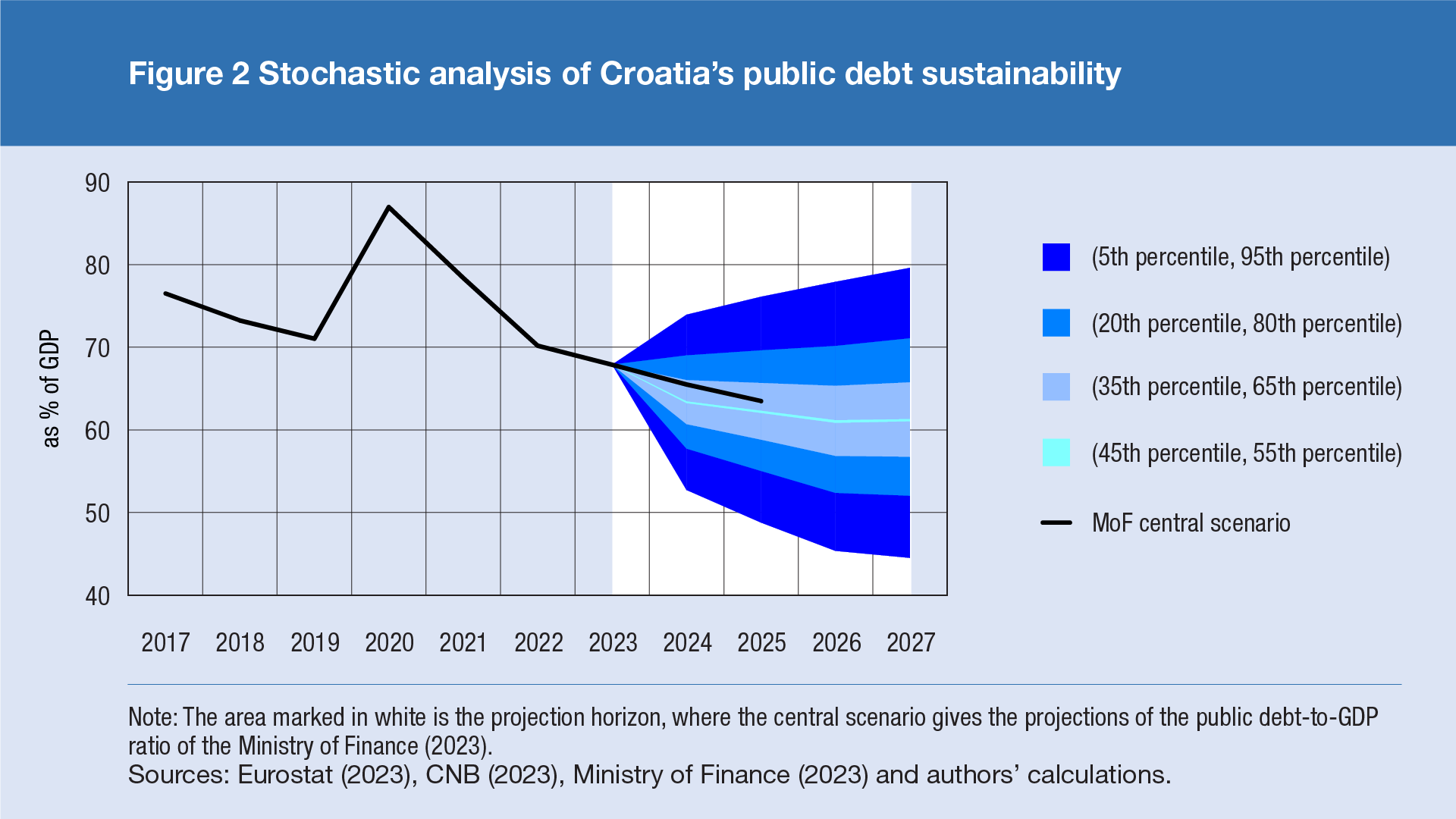

The stochastic analysis of public debt sustainability for Croatia is based on a model estimate of the function of the primary balance, nominal GDP growth and implicit interest rate, as well as the estimated adjustment of the public debt level and the flow of the general government balance[6]. The future developments in public debt are then projected by applying random shocks and estimated coefficients from previous models. The distribution of projected public debt trajectories is shown in Figure 2 in the form of percentiles, which also enables the determination of the probability of their materialisation[7]. In this example, the fan chart covers 90% of probability, meaning that the public debt-to-GDP ratio is 10% likely to be outside the range determined by the stochastic approach.

The results of the stochastic analysis suggest that, according to the central model estimate (between the 45th and the 55th percentiles), public debt should move down over the projection horizon. In doing so, it could fall to almost 60% of GDP in 2027, which is in line with the threshold defined in the Stability and Growth Pact. There is a noticeable relative match of the central model projection (line marked light blue) with projections of the Ministry of Finance (line marked in black), which are based on projected developments in macroeconomic and fiscal assumptions over the projection horizon. On the other hand, the spread of the fan chart is relatively broad, with a stochastic analysis suggesting that the public debt-to-GDP ratio could be between 49% and 76% in 2025 with a 90% probability. The relatively wide spread also suggests that the trend in the projected public debt level is highly uncertain, which increases the risks to public debt sustainability. Furthermore, the spread of the fan chart shows that public debt is unlikely to grow continuously. However, in such a case, the public debt-to-GDP ratio at the end of the projection horizon might be lower than in 2020 (87%). Overall, a stochastic public debt sustainability analysis for Croatia suggests that fiscal sustainability risks are not pronounced.

References

Banić, F., Deskar-Škrbić, M. and Šimović, H. (2022): Fiscal Response to the COVID-19 Shock in Croatia, in: Olgić Draženović, B., Buterin, V. and Suljić Nikolaj, S. (eds) Real and Financial Sectors in Post-Pandemic Central and Eastern Europe, Cham, Springer, pp. 35-49, doi:10.1007/978-3-030-99850-9_3.

Banić, Frane (2020): A Stochastic Analysis of Public Debt: Case of Croatia, Tradicionalni skup Hrvatskog društva ekonomista u Opatiji – published chapters, in: Josip Tica and Katarina Bačić (eds), Ekonomska politika u 2021. godini – Hrvatska poslije pandemije, (Economic Policy in 2021 – Croatia after the Pandemic, available in Croatian only), Volume 28, Chapter 10, Hrvatsko društvo ekonomista (Croatian Society of Economists).

Bouabdallah, Othman and Checherita-Westphal, Cristina D. and Warmedinger, Thomas and De Stefani, Roberta and Drudi, Francesco and Setzer, Ralph and Westphal, Andreas (2017): Debt Sustainability Analysis for Euro Area Sovereigns: A Methodological Framework, ECB Occasional Paper No. 185, Available at SSRN: https://ssrn.com/abstract=2950979 or http://dx.doi.org/10.2139/ssrn.2950979.

Braz, Cláudia and Campos, Maria Manuel (2019): An analytical assessment of the risks to the sustainability of the Portuguese public debt, Economic Bulletin and Financial Stability Report Articles and Banco de Portugal Economic Studies, Banco de Portugal, Economics and Research Department.

European Commission (2014): Assessing Public Debt Sustainability, in EU Member States: A guide, European Economy, Occasional Paper, No. 200, Bruxelles.

Croatian National Bank (2010): Bulletin, No. 165, Box 1 Forecast risks presented in the form of a fan chart, available at https://www.hnb.hr/-/bilten-165.

Croatian National Bank (2020): Macroeconomic Developments and Outlook, No. 8, Box 6 Fiscal policy measures aimed at alleviating the negative consequences of the pandemic, available at https://www.hnb.hr/documents/20182/3398618/hMKP_08.pdf.

International Monetary Fund (2013): Staff Guidance Note for public debt sustainability analysis in market-access countries, May, Washington DC.

Ministry of Finance (2023): Stability Programme of the Republic of Croatia for the period 2024 – 2026, available at https://vlada.gov.hr/UserDocsImages//2016/Sjednice/2023/Travanj/212%20sjednica%20VRH//212%20-%206%20Program.pdf.

-

The concept of "stochastic" (chance/random) refers to a process that cannot be precisely projected and includes random variables the output of which can only be determined with a certain level of probability. In the debt sustainability analysis, the stochastic approach takes into account the uncertainty surrounding the public debt path, which is presented through a probability distribution of risks over the projection horizon. ↑

-

In this text, the term "public debt" refers to "general government debt". ↑

-

For a detailed description of the implemented anti-pandemic discretionary fiscal measures in 2020, see Banić et al. (2022) and Box 1 (CNB, 2020). ↑

-

For details, see Stability Programme (Ministry of Finance, 2023). ↑

-

The implicit interest rate is defined as the ratio of interest expense in period t to general government debt in period t-1. ↑

-

For details, see Banić (2019). ↑

-

The fan chart shows the spreads between the 5th and the 95th percentiles, the 20th and the 80th percentiles, the 35th and the 65th percentiles and the 45th and the 55th percentiles. This also means that there is a 90% probability that over the projection horizon public debt will be between the 5th and the 95th percentiles, a 60% probability of it being between the 20th and the 80th percentiles, a 30% probability of it being between the 35th and the 65th percentiles and a 10% probability of it being between the 45th and the 55th percentiles. ↑