Statistical releases provide a summary of the most recent values and trends for the published statistical indicators series compiled by the Croatian National Bank.

Statistics

- Release calendar

- Statistical releases

- Indicators of banking system operations

- Main macroeconomic indicators

-

Statistical data

-

Financial sector

- Republic of Croatia contribution to euro area monetary aggregates

- Consolidated balance sheet of MFIs

- Central bank (CNB)

- Other monetary financial institutions

- Other financial corporations

- General government sector

- External sector

- Financial accounts

- Securities

- Selected non-financial statistics

- Payment systems

- Payment services

- Currency

- Turnover of authorised exchange offices

- Archive

-

Financial sector

- SDDS

- Regulations

- Information for reporting entities

- Information for users of statistical data

- Use of confidential statistical data of the CNB for scientific purposes

- Statistical surveys

- Experimental statistics

Statistical releases

Financial accounts statistics for the third quarter of 2022

Within the scope of financial accounts statistics[1], the Croatian National Bank currently releases only data on stocks of financial assets and liabilities of the entire economy and individual institutional sectors – non-financial corporations, households, general government and financial sector, in a certain period. Financial net worth of the economy or any part thereof is calculated as the difference between the stocks of its financial assets (e.g. loans and deposits granted, investments in securities and holdings) and the stocks of its financial liabilities (e.g. loans and deposits received, inflows from the issued securities), with the total financial liabilities including debt liabilities, as well as the estimated financial worth of capital.

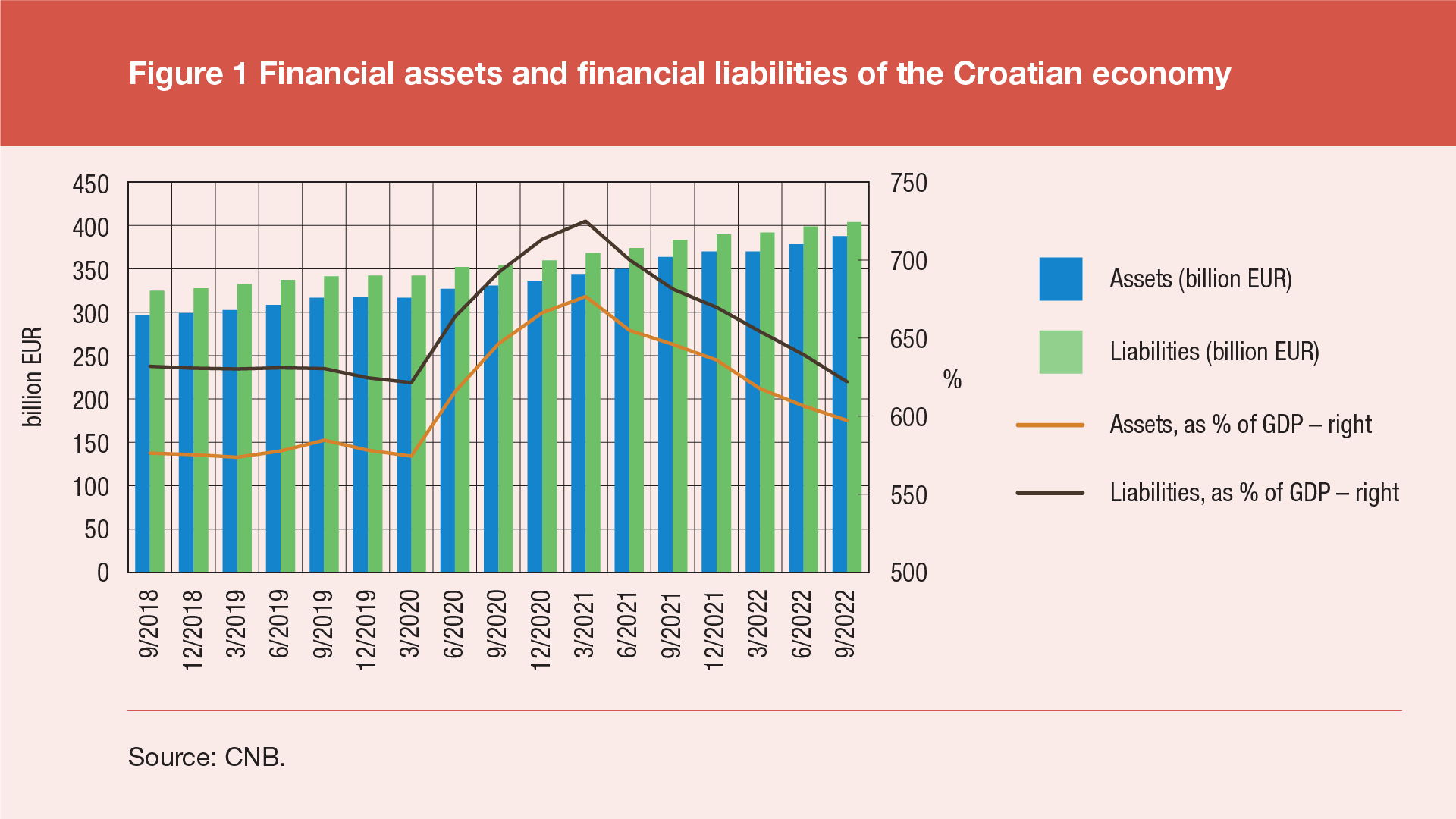

The financial assets of the Croatian economy stood at EUR 388bn at the end of the third quarter of 2022 (Figure 1), up by EUR 9.4bn in the quarter concerned and up by EUR 24.2bn in the period of one year. The financial liabilities of the Croatian economy reached EUR 404bn, up by EUR 5.1bn in the quarter concerned and by EUR 20.4bn in the period of one year. In terms of GDP, the financial assets of the Croatian economy amounted to 597% of the annual GDP at the end of the third quarter of 2022, down by 9.4 percentage points in the quarter concerned and down by 48.7 percentage points in the period of one year. The financial liabilities of the Croatian economy decreased by 17.3 percentage points in the quarter concerned and by 59.3 percentage points in the period of one year, accounting for 622% of the annual GDP at the end of the third quarter of 2022. These quarterly developments continue the trend of decrease of both assets and liabilities of the Croatian economy in terms of GDP, which started in the second quarter of 2021 due to a slower increase in their value compared to the growth of quarterly GDP.

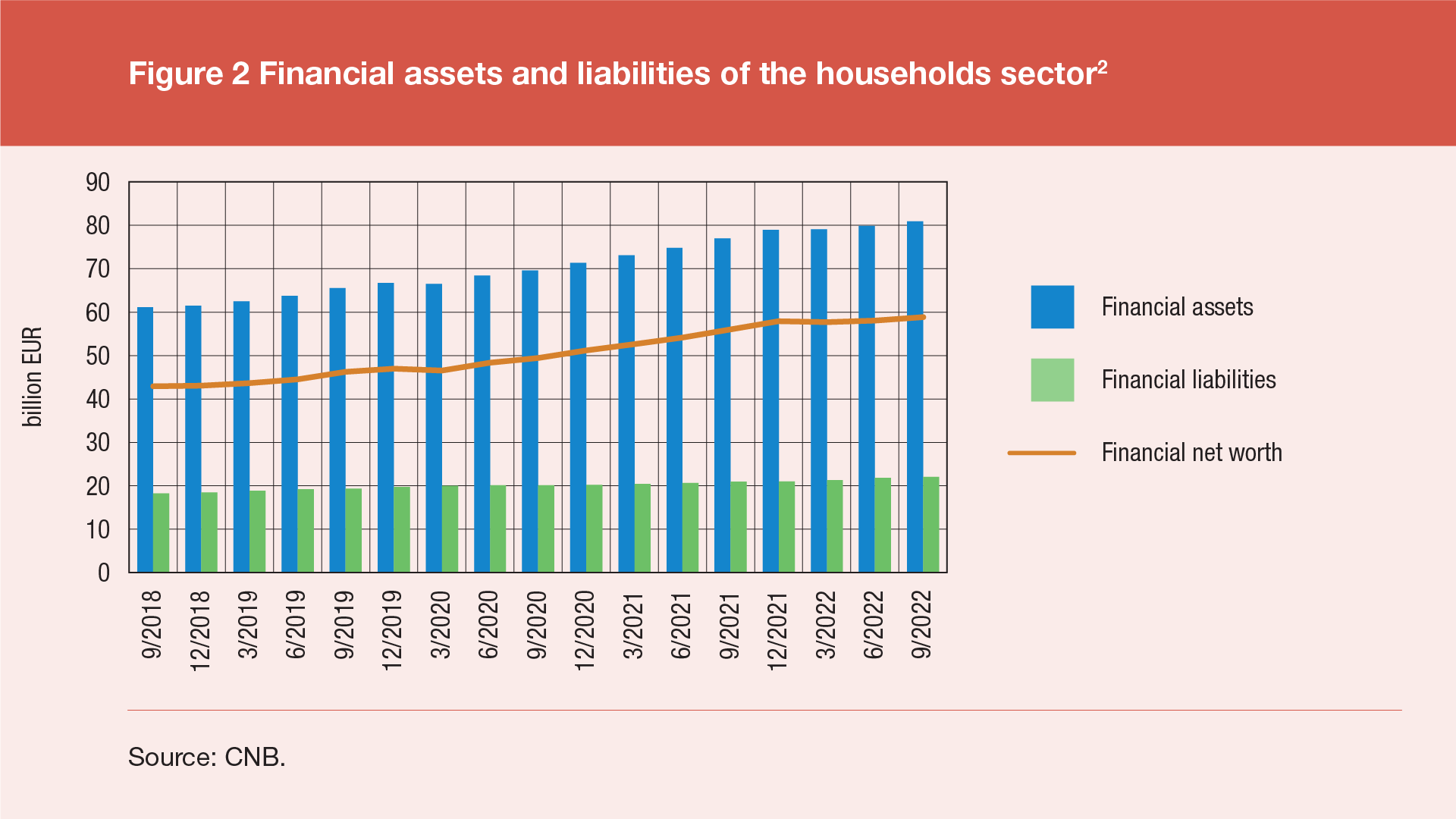

The total financial assets and financial liabilities of households stood at EUR 81bn and EUR 22bn respectively at the end of the third quarter of 2022 (Figure 2), which is an increase of 1.3% and 0.9% respectively from the end of the previous quarter, while in the period of one year, the financial assets of households increased by EUR 3.9bn. As a result, the financial net worth of the household sector amounted to EUR 59bn or 1.4% more than at the end of the previous quarter (i.e. EUR 2.8bn or 5.0% more than at the end of the same quarter of the previous year), and thus the net worth of this sector, showing a trend of accelerated growth since the second quarter of 2020, has increased again following its one-time decrease in the first quarter of 2022.

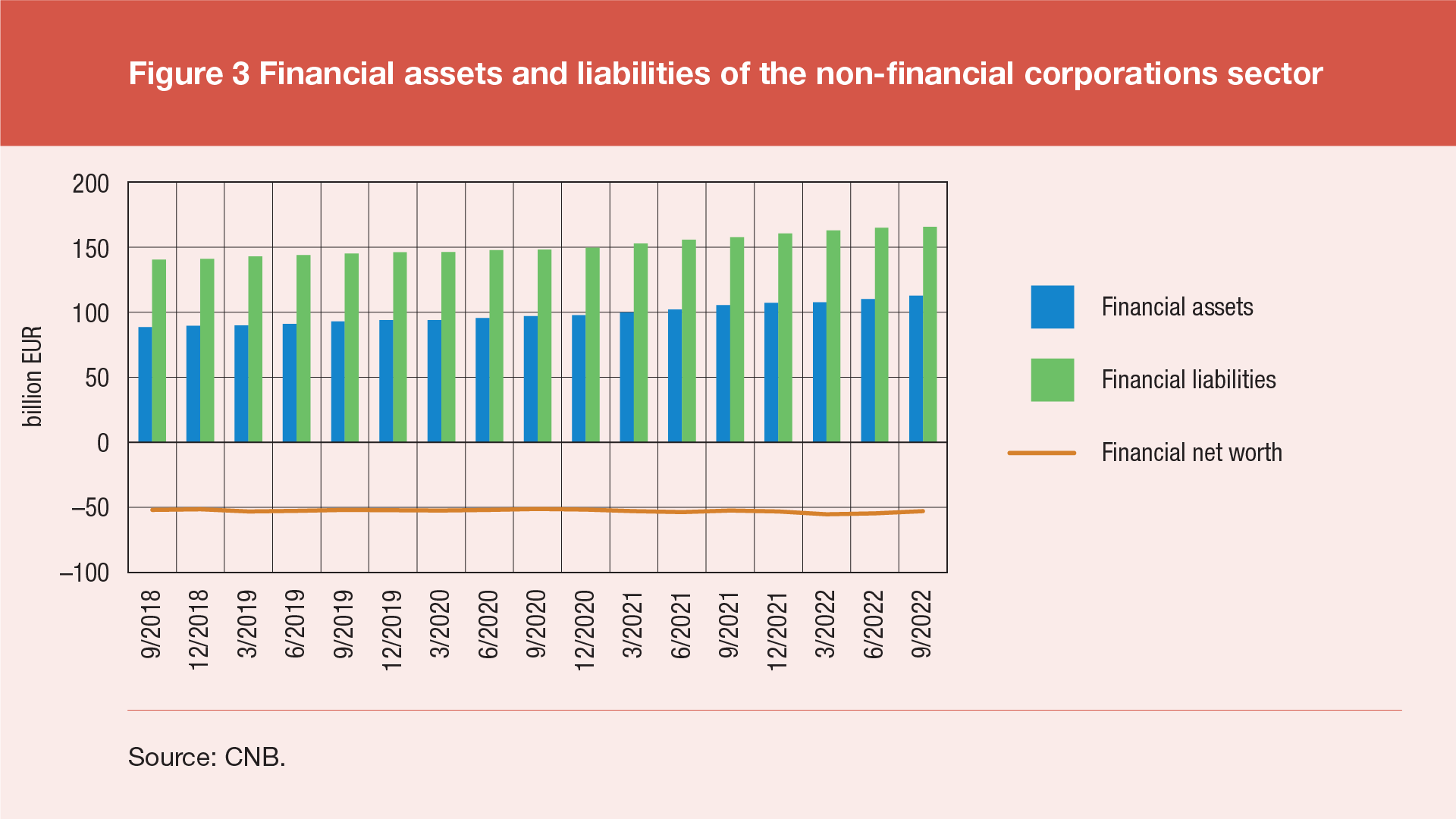

The total financial assets of non-financial corporations stood at EUR 113bn at the end of the third quarter of 2022 (Figure 3), growing by 2.2% from the end of the previous quarter. The financial liabilities of non-financial corporations amounted to EUR 166bn or 0.5% more than at the end of the previous quarter. In line with such developments, the financial net worth of the non-financial corporations sector increased to –EUR 53bn, up by 3.1% from the end of the previous quarter.

Statistical time series:

-

Financial accounts statistics shows the indicators of stocks, transactions, valuation adjustments and other changes in financial assets and liabilities in the economy, classified by sectors and by financial instruments, on the basis of the currently available data sources. These include the CNB's monetary statistics and external statistics, statistical reports of the Croatian Financial Services Supervisory Agency, annual reports of non-financial corporations collected by the Financial Agency, reports on general government equity holdings in corporations by the Ministry of Finance of the Republic of Croatia, Ministry of Physical Planning, Construction and State Assets and Restructuring and Sale Centre, data on general government debt by the Ministry of Finance and the CNB, as well as the Zagreb Stock Exchange trading reports. ↑

-

Apart from households, the households sector also includes non-profit institutions serving households sector (associations of citizens, etc.). ↑