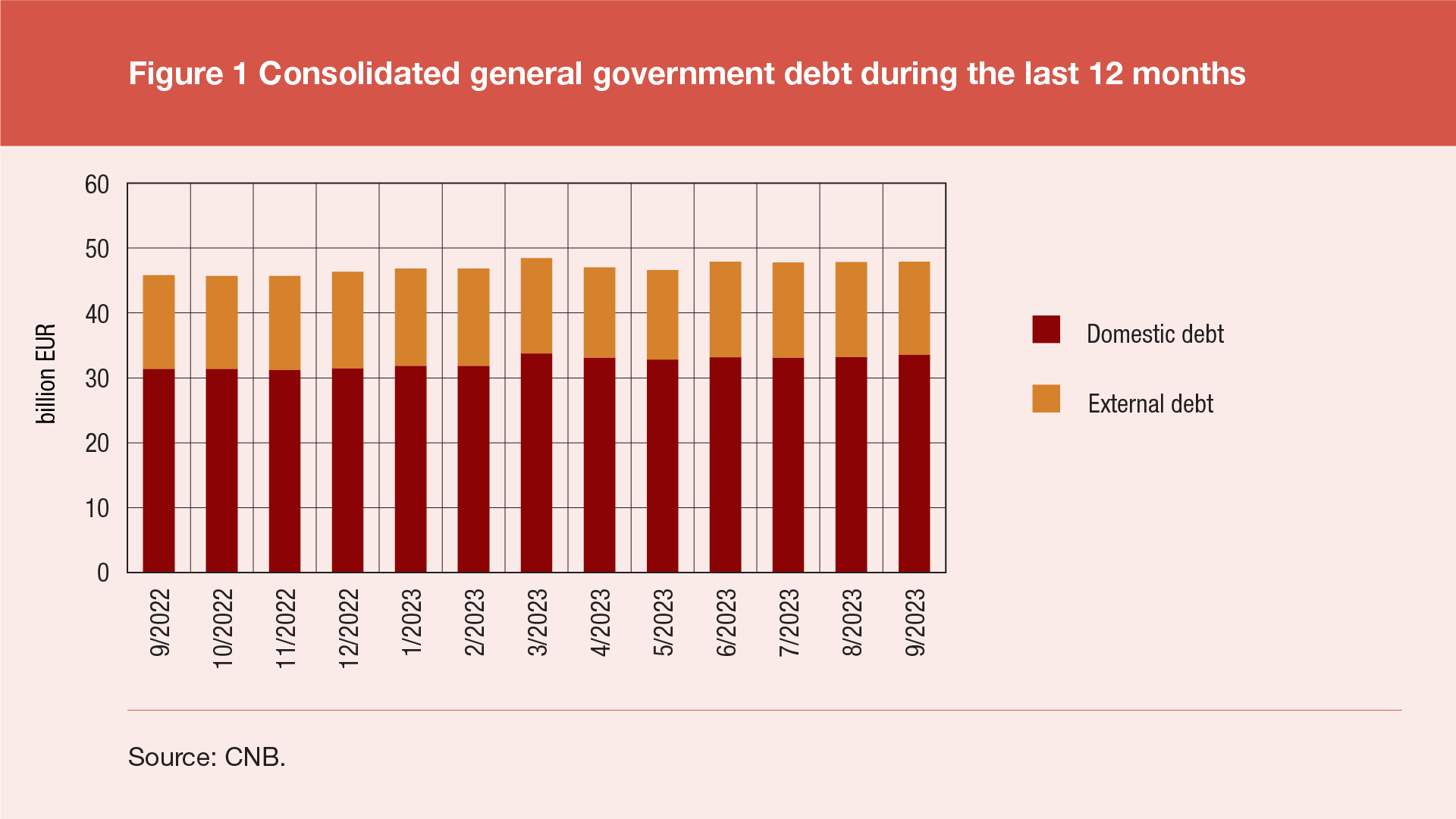

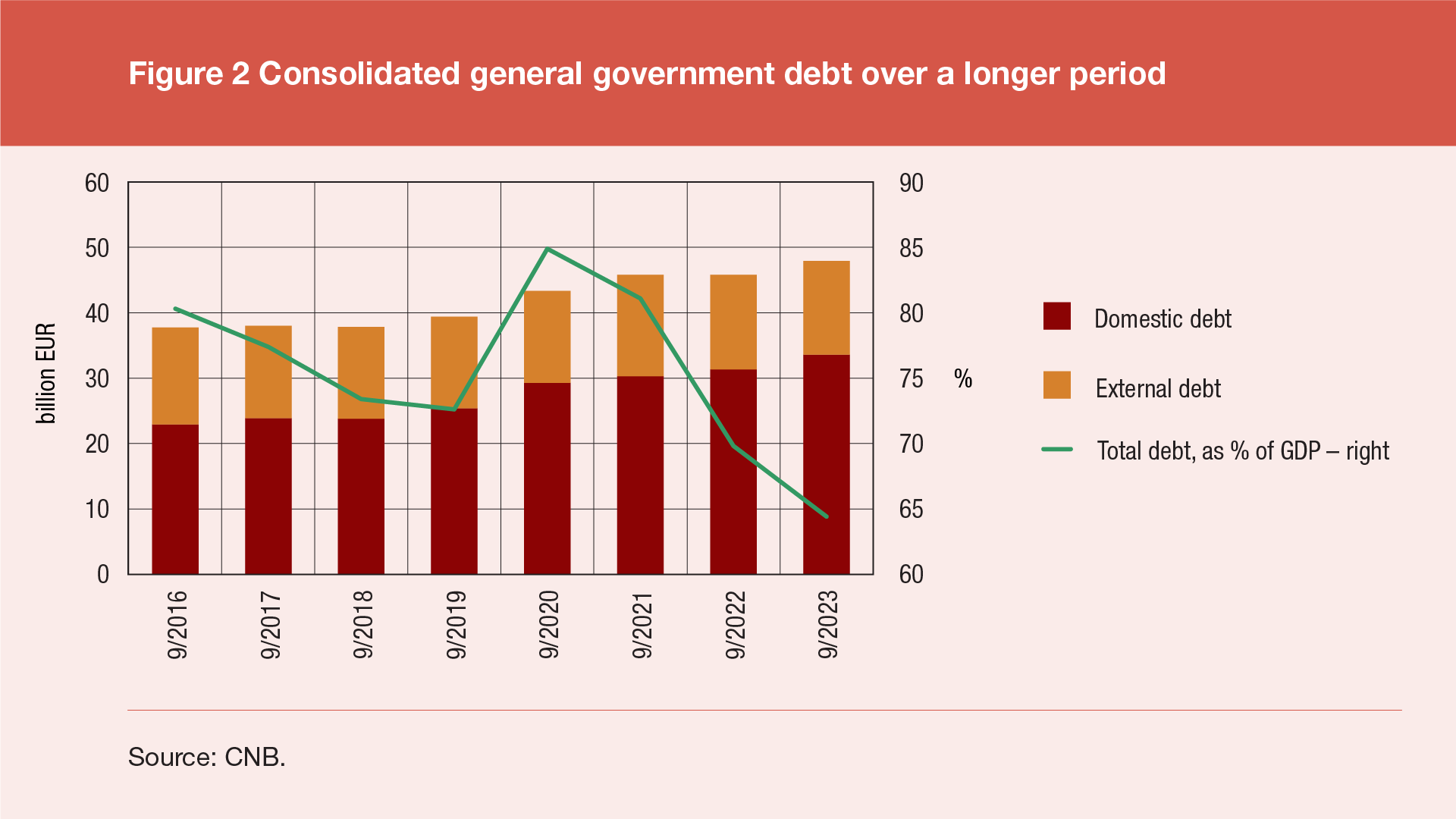

According to the final data of government finance statistics for the third quarter of 2023, the total consolidated debt of all general government sub-sectors[1] reached EUR 47.9bn at the end of September 2023, thus remaining at approximately the same level as at the end of June 2023 (a decrease of only EUR 0.8mill occurred) and up by EUR 2.1bn (or 4.6%) from the end of September 2022. The annual increase in debt was due to a combination of a decrease in the external debt of EUR 0.1bn (or 0.8%) and an increase in the domestic debt of EUR 2.2bn (or 7.1%). Domestic debt rose by EUR 0.4bn (or 1.2%), and external debt fell by EUR 0.4bn (or 2.8%) compared to the end of the previous quarter.

Measured against the annual GDP[2], the total debt at the end of September 2023 amounted to 64.4% of GDP, which is a decrease of 5.4 percentage points on an annual basis from 69.8% of GDP at the end of September 2022 and a decrease of 2.1 percentage points from the end of the previous quarter, when this share stood at 66.5%.

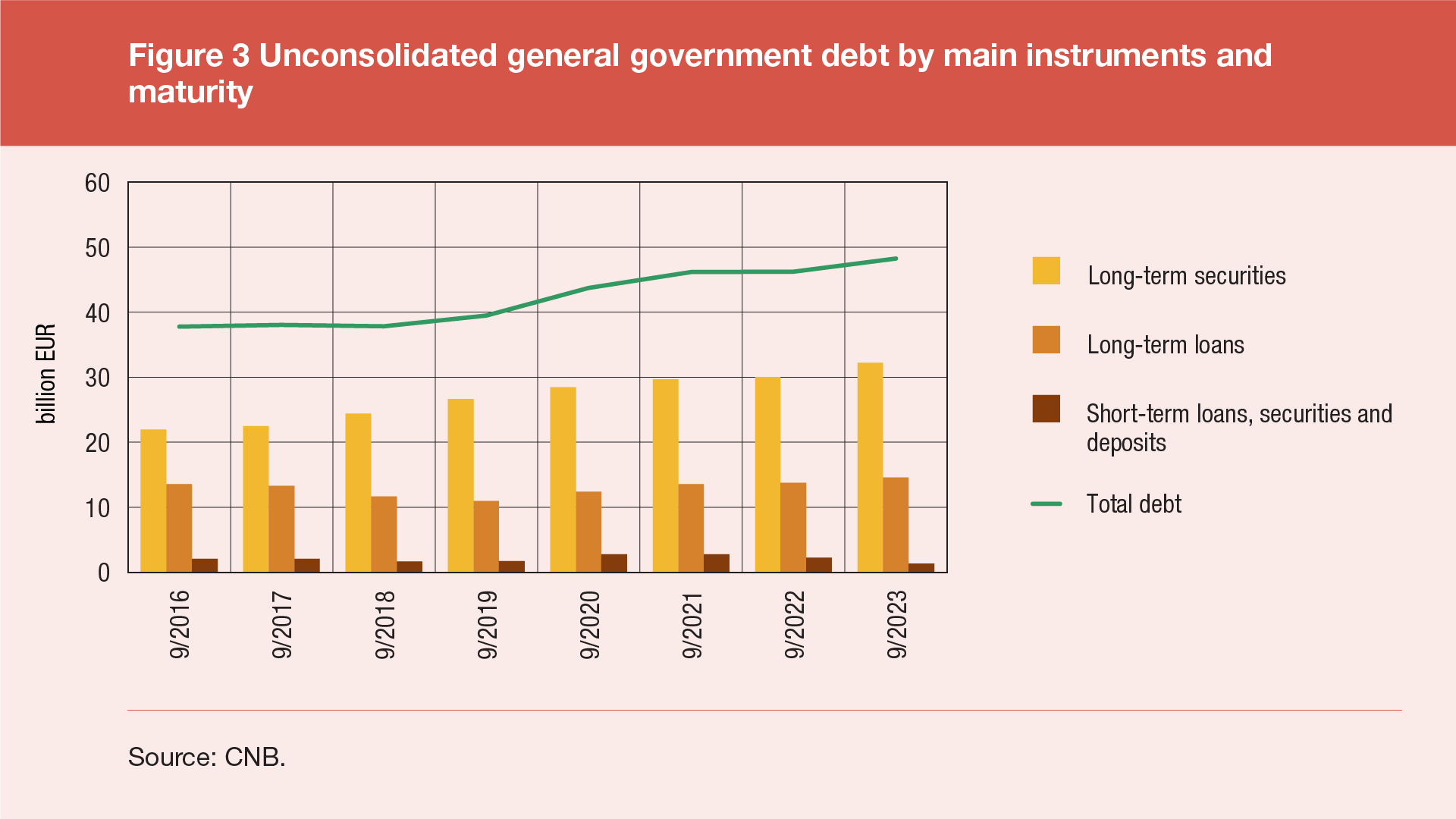

The general government debt structure by main debt instruments and maturity is available only on an unconsolidated basis[3]. Long-term debt instruments dominate the maturity structure of unconsolidated debt: at the end of September 2023 most of this debt was made up of bonds (66.8%), the second by importance were long-term loans (30.3%), and last were short-term loans, securities and deposits (jointly 2.9%). The short-term debt components decrease by EUR 0.9bn (or 39.7%) on an annual basis from the end of September 2022 to the end of September 2023, while the long-term debt components increase by EUR 2.9bn (or 6.7%) during the same period.

Statistical time series: Table I3 General government debt (ESA 2010)

-

This debt excludes the cross claims of institutions within the same sub-sector and between sectors, the so-called Maastricht debt. ↑

-

Calculated as the sum of the preceding four quarterly GDP figures. ↑

-

The unconsolidated debt represents the Maastricht debt increased by cross claims of different units within the general government sector. ↑