Introduction

Risk, as defined in professional literature, is a threat of loss of assets in a venture or a threat of a complete or partial failure to achieve the desired objective and the expected result due to unforeseen events. When entering into a credit relationship with a bank, consumers are exposed to or assume several types of risks, which can broadly be divided to financial and other risks. Financial risks are primarily interest rate and currency risks.

Interest rate risk is associated with a possible change in the amount of annuity or loan repayment, based on an interest rate change and currency risk is associated with a possible change in the amount of annuity or loan repayment, based on a change in the exchange rate of the currency to which a loan is indexed./p>

One has to take into account the legal risk which is also always present and which implies that the use of a financial product may have unfavourable legal consequences for the user. This risk is activated by, for instance, enforced collection.

Different loans carry different risks, which mainly depend on the currency, maturity and interest rate variability.

It is important to distinguish between a risk that a loan carries and the risk to the consumer. To estimate the risk to the consumer, a much deeper analysis is required which includes the consumer's entire assets, or sources of income and his/her liabilities (this will be discussed in more detail later on in the text). Let us start with a brief explanation of currency and interest rate risks.

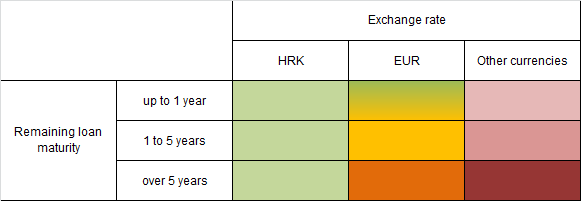

Under the assumption of income in the domestic currency, there is no currency risk for loans in the domestic currency. By contrast, this risk is the biggest in the case of long-term loans indexed to foreign currencies other than euro as, owing to a widespread use of the euro as the reference currency in domestic credit and business relationships, due to the dominant foreign currency savings, the CNB acts in the foreign exchange market to contain any sudden changes in the exchange rate of the kuna against the euro. The CNB stabilises the exchange rate of the kuna against the euro, but cannot stabilise the exchange rate of the kuna against other foreign currencies. Nevertheless, loans indexed to the exchange rate of the euro still carry a currency risk. And lastly, currency risk on longer-term loans in a foreign currency is always greater than the currency risk on shorter-term loans as longer maturity implies higher probability for a significant change in the exchange rate of the domestic currency against a foreign currency.

Figure 1 Currency risks are the highest for other currencies

Note: Green colour denotes low risk, yellow and orange, medium risk, and the shades of red denote higher risks.

Source: CNB.

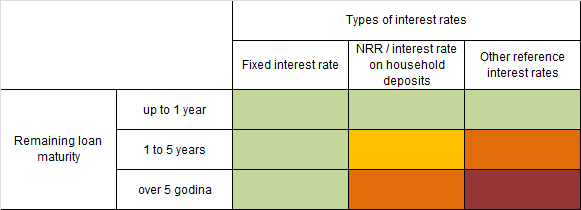

A change in interest rate may have a significant impact on the annuity amount for longer-term loans. In other words, annuity loans with a longer term to maturity are more sensitive to interest rate changes than loans with a shorter term to maturity. By contrast, loans with a fixed interest rate to maturity are by definition not directly affected by interest rate changes.

It should be noted that in the case of a significant fall in interest rates, the consumers with fixed interest rate loans have the option to refinance such loans under more favourable conditions. The same applies to loans with a variable interest rate, in case of improved market conditions (e.g. the banks start to offer loans with a lower fixed component of the interest rate). Naturally, the cost of such operations depends on the fees defined in a loan agreement as well as on the supply available to the consumer on the loan market at the moment of refinancing and the costs of taking out a new loan.

Figure 2 Interest risks are higher for longer-maturity loans

Note: Green colour denotes low risk, yellow and orange, medium risk, and the shades of red denote higher risks.

The NRR is an abbreviation for the national reference rate, discussed in more detail later in the text.

Source: CNB.

Variable interest rate loans may also differ in terms of the variable parameter defined by the Credit Consumer Act. Some parameters respond to market interest rate changes faster and some more slowly which results in somewhat higher risks for those responding faster to market interest rate changes. The national reference rate has in the past generally responded more slowly to market interest rate changes than EURIBOR1 or interest rates on T-bills, and this gives us reason to believe this will continue to be so in the future. Nevertheless, irrespective of the type of reference interest rate, any increase in market interest rates will eventually spill over to the variable interest rate.

The specific moment of the application of the provisions of the Consumer Credit Act, in the conditions of currently historically low level of indices such as EURIBOR, resulted in loans with a relatively large fixed component. Therefore, any faster growth in EURIBOR would soon result in relatively high interest rates on such loans.

The consumer, i.e. the loan user, is best placed to estimate the risk associated with the credit operation he/she is entering into as he/she has the greatest amount of information. The ability for regular loan servicing can be influenced by the absence of regular income or its significant reduction due to events such as job loss, reduction of income due to health issues, etc., more than by interest rate or currency risk. In addition, the consumer may have income in a foreign currency, which reduces currency risk. The examples of this include income from letting apartments in a foreign currency, temporary or regular (seamen) income in foreign currency. The analysis of the risks for consumers can therefore only be made on an individual level, for each consumer separately.

Depending on future developments in interest rates and currency market, at the end of tenure, a loan may be cheaper or more expensive, if shown in kuna. So, for instance, kuna depreciation over a long term makes kuna loans more favourable while any significant appreciation of the kuna makes loans indexed to a foreign exchange rate more favourable since we pay fewer kuna for each unit of a foreign currency in which we borrowed. Nobody knows the final result nor can it be estimated in advance with certainty. It will only be known at the end, as a result of developments in exchange and money markets.

The purpose for which the funds have been borrowed from the bank definitely needs to be included in the assessment of the risk of a consumer's credit operation. A loan invested in an investment which proves unsuccessful or which does not bring subjective of objective benefits or create value to the consumer is better be avoided. In addition, it is possible that changes in market conditions in the future will prompt the banks to offer to the consumers loans under more favourable as well as less favourable conditions, such as higher or lower interest rates, fees, etc.

Credit operations, in the same way as business operations, inevitably carry risks. It is impossible to fully avoid the risks associated with loans and other financial products but it is possible to reduce their impact on personal finances and life of consumers. Therefore, it is up to the consumer to decide on his/her own if such risks are worth taking. Consumer protection therefore implies that consumers obtain detailed information about financial and other risks before entering into a credit operation, taking into account their personal financial conditions and expectations of future income and expenditure. Based on such an analysis and personal preferences, the consumer has to decide on his/her own the level of risk that he/she wishes to assume and to what purpose.

Accordingly, in general, kuna loans with a fixed interest rate carry the lowest risk to the consumer. However, this does not mean that such a loan will be the most favourable.

Currency risk

Foreign exchange (currency) risk is the risk which is associated with cross currency changes and the consumer (debtor) is exposed to it if he/she has assets or income denominated in one currency and liabilities in another. It is almost certain that assets or liabilities assumed by the consumer in an individual currency will have alternatives which would give better or poorer results over the observed period than the portfolio selected by the consumer. The consumer may hedge against this risk by having income, assets and liabilities denominated in the same currency. The consumer thus loses the opportunity to make profit but also prevents losses.

The majority of loans in Croatia are indexed to a foreign currency. A currency clause in credit relationships, or indexation of loans to a kuna exchange rate against some foreign currency is due to the fact that approximately 80% of savings and time deposits in banks are in a foreign currency, mostly euro (Figure 3). Such a high level of deposit euroisation is associated with a negative historical experience of savers during the period of high inflation and hyperinflation and devaluation and strong weakening of the domestic currency against the German mark and overall macroeconomic stability which marked the '70s and '80 of the last century and the period following Croatia's gaining of independence up to the 1993 stabilisation programme, as well as foreign exchange inflows from tourism and remittances from abroad from emigrants, seamen, etc.

Since the banks mainly have foreign exchange deposits in their sources of funds, they hedge against the risks by granting predominantly loans indexed to a foreign currency (Figure 4). In other words, high deposit euroisation leads to a high loan euroisation since the banks have to hedge against currency risk in accordance with the rules of the profession. They are also bound to do so by regulatory rules under Regulation (EU) 575/2013 of the European Parliament and of the Council on prudential requirements for credit institutions and investment firms directly applicable in the Republic of Croatia. Therefore, in the conditions of deposit euroisation, credit euroisation serves for the protection of assets entrusted to banks by the savers, which is crucial for maintaining the confidence in banking system safety and stability. Also, the level of deposit euroisation fluctuates over time, as evidenced by a visible increase in the share of kuna loans during the periods of a reduction in the share of foreign exchange deposits.

Figure 3 Savings in Croatia are predominantly in euro

Source: CNB.

Figure 4 Financial institutions' assets correspond to the currency structure of liabilities

Source: CNB.

In the case of a significant fall in the value of the domestic currency, the loans granted in foreign currencies or indexed to foreign currencies would be exposed to a currency induced credit risk – increased probability of default due to increased loan liability. Clients without income or assets in a foreign currency or clients who are not in any other way hedged against domestic currency depreciation are exposed to a currency risk, and the banks may also be faced with difficulties in collecting the claims resulting from a currency clause.

In such conditions, a stable exchange rate of the kuna against the euro is key to preserving financial stability as a significant fall in the value of the kuna would leave many debtors in a position where they would no longer be able to repay their loans, which might threaten households, corporations or the government and eventually undermine financial stability and result in high fiscal and social costs. The CNB therefore pursues the policy of the so-called managed float exchange rate whereby the exchange rate of the kuna against the euro is set freely on the foreign exchange market, depending on the developments in the supply and demand for foreign exchange with the CNB directly intervening in the foreign exchange market in cases of sudden exchange rate fluctuations. With the aid of such a policy, the CNB attempts to stabilise the weight of loan repayment of debtors with loans with a currency clause in euro which have always accounted for the majority of the debt of all the sectors of the domestic economy, thus contributing to the achievement of financial stability. To ensure stability of the exchange rate of the kuna, it is vital to keep an adequate level of international reserves, which serve to ensure the country's foreign exchange liquidity, payment of imports and maintenance of the stability of the exchange rate of the kuna against the euro in case of shocks.

The value of the kuna against other currencies listed on the CNB's exchange rate list, including the Swiss franc and the American dollar, is calculated based on the relationship between the euro and these currencies on the global foreign exchange markets and is outside CNB influence. Since the introduction of the euro on 1 January 1999 until the end of 2015, the average monthly exchange rate of the kuna against the euro fluctuated between 7.11 and 7.74 kuna to the euro, and the average daily exchange rate during that period stood at HRK 7.46 to one euro (Figure 5).

The risks of borrowing in other foreign currencies are higher. Owing to a widespread use of the euro as the reference currency in domestic credit and business relationships, due to the dominant savings in that currency, the CNB intervenes in the foreign exchange market to contain sudden changes in the exchange rate of the kuna against the euro, which is not possible for other foreign currencies.

Figure 5 Exchange rates of foreign currencies can fluctuate strongly over a long term

Source: CNB.

Interest rate risk

Interest rate risk may be defined as the possible increase or a decrease in consumer liabilities, due to changes in the interest rates applicable to the consumer's liabilities.

In terms of their variability, interest rates may be divided into fixed, variable and combined interest rates which may be fixed and variable, respectively, over specific, pre-defined periods of time. The characteristic of fixed interest rates is that they do not change throughout the entire duration of a credit relationship, with the result that loans granted at a fixed interest rate carry no interest rate risk to the consumer. By contrast, variable interest rates fluctuate during the term of a credit relationship and carry an interest rate risk.

It should be noted that consumers have the option to refinance both fixed interest rate and variable interest rate loans if they think this will benefit them. For example, the interest rate on a fixed interest rate loan is expectedly lower today than it was 5 years ago (which does not mean this trend will continue in the future). The cost of loan refinancing depends on the fees defined in a loan agreement and on the supply available to the consumer on the loan market at the moment of refinancing and the costs of taking out a new loan.

It should be noted that, in accordance with Article 11.a, paragraph (6) of the Consumer Credit Act, if a change in the agreed variable interest rate necessitates an increase in the interest rate, the consumer has the right to an early repayment of the loan, free of any fees.

To understand and analyse the developments in interest rates, one needs to understand the structure of the interest rate that is being applied to a loan. From an economic standpoint, the banks make their offers based on three main interest rate determinants: cost of source, regulatory cost and interest margin. Thus defined, the interest margin contains the required risk premium, a component for covering operating expenses and, naturally, the expected profit of the credit institution.

From a legal standpoint, the Consumer Credit Act defines interest rate for the consumer as the sum total of the variable parameter (of an interest rate) and the fixed component - the margin.

Manner of determining variable interest rates in Croatia

Until the adoption of the amendments to the Consumer Credit Act in 2013, variable interest rates in Croatia were mostly administratively set which meant that banks were able to determine the level of interest rates on new and existing loans in accordance with developments in interest rates on the market or risk perception. It should be noted that during that period, the manner of determining variable interest rates was not explicitly regulated by law. Under the Act on Amendments to the Consumer Credit Act (Official Gazette 143/2013), Article 11.a was amended again and in paragraph (2), the variable interest rate is defined as the sum total of the agreed parameter and the fixed bank margin which may not increase over the loan repayment term and which must be agreed together with the parameter. In accordance with transitional and final provisions of that Act, this provision was also to be applied to all consumer credit agreements irrespective of the date of entering into the respective credit agreement. The Act on Amendments to the Consumer Credit Act explicitly prescribes that EURIBOR, LIBOR, NRR, yield on T-bills of the Ministry of Finance and the average interest rate on household deposits in the respective currency may be defined as the parameters. These Amendments have improved transparency of interest rate setting and consumers may at any point find out what are the components of the interest rate that they are being charged: the fixed component which remains the same throughout the credit relationship and the variable component which fluctuates within the set permitted variable parameters.

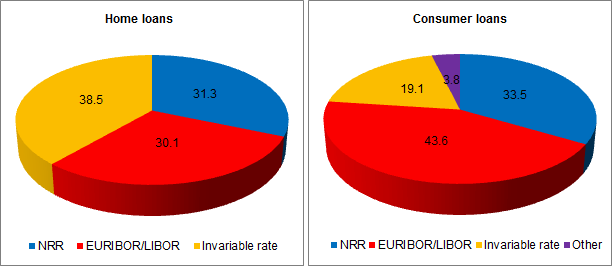

Figure 6 Variable interest rate is the predominant rate on household loans in Croatia

Source: CNB.

As regards variable interest rate home loans, EURIBOR and the national reference rate (NRR) are equally used as reference interest rates, with each component serving as the reference rate for approximately 30% of home loans (Figure 6). EURIBOR/LIBOR account for a somewhat larger share of other consumer loans (approximately 44%) (Figure 7).

Figure 7 Assessment of the structure of household loans of banks by reference rates, February 2015

Note: The assessment of the degree to which an individual reference variable parameter is used is based on information on the variable parameter posted on banks' web pages for individual types of loans and an individual bank's share in the total granted amount of an individual loan type at the end of February 2015. As regards home loans, the invariable interest rate category refers almost entirely to home loans granted in Swiss francs or indexed to the exchange rate of the Swiss franc, where the exchange rate of the agreed foreign currency has appreciated by over 20% from the agreed exchange rate on the first day of the use of the loan (Article 3, paragraph (5) of the Act on Amendments to the Consumer Credit Act, Official Gazette 143/2013).

Source: CHB assessment based on banks' web pages.

The variable parameters determined by the mentioned Act as a starting point for the calculation of variable interest rates in credit operations have been at extremely low levels in the past several years. It follows that any possible increase in reference interest rates is an important source of risk to the consumers. This risk is particularly significant if it occurs simultaneously with domestic currency depreciation and/or slowing down of the domestic economy, which has a negative effect on household income.

In addition, EURIBOR, as a possible variable parameter, has been introduced into banking products by the Act on Amendments to the Consumer Credit Act at the time when it stood around zero, which leaves much more room for its future growth than decrease. Also, the changes in this international reference interest rate would spill over relatively quickly to interest rate growth. The NRR is the rate which is set on the domestic market, primarily influenced by the cost of financing of several largest banks.

Interest rate trends in the international and in the domestic market

The international market

EURIBOR is an interest rate which for the euro is set by the European interbank market and reflects the policy of the European Central Bank. The EURIBOR rate is the average interest rate at which financial institutions within the euro area that have high credit ratings are prepared to lend money to each other.

The EURIBOR rate is set on daily basis as the average of the quotations of a large number of banks actively participating in the euro area money market with considerable amounts.2 As of 1 November 2013, the EURIBOR rate is calculated for eight maturities: 1 and 2 weeks, 1, 2, 3, 6, 9 and 12 months. The EURIBOR level is determined by the supply of and the demand for liquid assets in the interbank market. Its level is significantly affected by the ECB's monetary policy but also numerous other factors, such as expectations regarding future interest rate trends, economic growth and inflation, bank solvency, confidence, etc.

By changing its key interest rate the ECB strives to influence short-term interest rates, that is, the reference interest rates in the money market. Changes in short-term interest rates are then expected to lead to changes in long-term rates. Finally, the change in the key interest rate should affect the real economic activity and, with a certain time lag, prices.

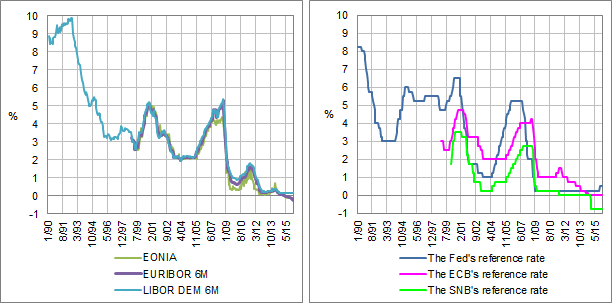

In the past few years after the outbreak of the global financial crisis the reference interest rates of central banks and the leading market interest rates like EURIBOR, which constitute the basis for determining lending interest rates, have declined to their historic lows. Although current market expectations do not suggest that the following one-year period is likely to witness their significant rise, this will depend on the trends in economic and monetary indicators, i.e. on the level of the interest rates of central banks. Accordingly, next to a more lasting recovery of the world's major economies, we may expect higher reference and market interest rates, similar to the pre-crisis period (Figures 8 and 9).

Figures 8 and 9 Movements of euro market interest rates and the interest rate on the German mark (left) and movements of the reference interest rates of the leading central banks (right)

Source: Bloomberg.

Domestic market

Apart from the international market interest rates, the prices of borrowing by domestic sectors are under a considerable influence of risk premiums. In that regard, the most important is a country's risk premium whose movement, as a rule, depends on the general risk aversion and domestic macroeconomic and financial results. In the past, the risk premium for the Republic of Croatia (measured in terms of the EMBI yield spread) moved within a relatively wide band from the almost negligible 0.17% (17 basis points) to more than 6% (625 basis points) (Figure 10). A country's risk premium is not transferred directly to the cost of borrowing for consumers but has a significant impact on the interest rate level.

Figure 10 Croatia's risk premium is volatile

Note: The EMBI yield spread is an indicator which reflects the average relative risk of investing in the portfolio of securities. The figure shows values for Croatia and the European emerging market economies. The VIX index measures the implied volatility of S&P 500 index options and is often used as an indicator of investor risk aversion.

Source: Bloomberg.

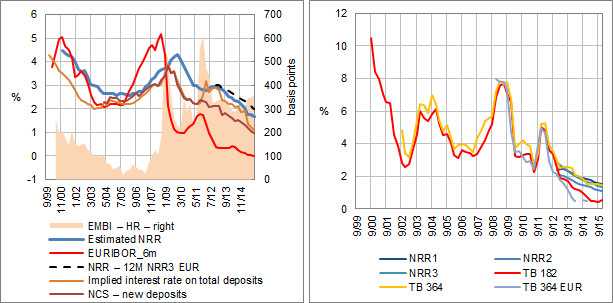

The risk premium for Croatia is currently high; at the end of the first quarter of 2016 it stood at some 346 basis points (approximated by the EMBI yield spread) and it was much higher than in other Central and Eastern European countries. This means that interest rates in Croatia are currently relatively low, primarily thanks to low reference interest rates across the globe and in the country (Figures 11 and 12).

See Figures 11 and 12 The NRR moves similarly as the deposit interest rate

Note: NCS – new deposits denote the interest rate on newly-received total deposits (all sectors, all currency); TB182 and TB364 are interest rates on kuna T-bills of the Ministry of Finance maturing in 182 or 364 days, and TB364 EUR interest rates on euro T-bills maturing in 364 days; in the figure on the right all NRR indicators are one-year indicators.

Source: CNB.

The national reference rate is used as a variable parameter for determining the level of the interest rate published and calculated by the Croatian Banking Association since the end of 2012. It is updated every three months. Accordingly, the time series of these data is relatively short and consists of 13 published values for each of the published indices.

According to its definition, the national reference rate is the average cost of the sources of funds of the Croatian banking sector (banks and savings banks), given the period under review, the type of source (deposits of natural persons, deposits of legal persons from the non-financial sector, other sources of bank funds) and the relevant currency. According to the type of source, the NRR is calculated separately for the sources of funds comprising the deposits of natural persons and they make up the NRR1 indicator. The deposits of natural persons and the non-financial sector make up the NRR2 indicator. The NRR1 and NRR2 are calculated separately for kuna and euro sources of funds. The NRR3 is calculated for all major sources of funds of all natural and legal persons, including those from the financial sector, separately for the kuna, euros, Swiss francs and American dollars.

Each of the mentioned versions of the NRR is calculated for the period of 3, 6 and 12 months. There are altogether 24 versions, with the code for the three-month NRR formed on the basis of the data on the kuna deposits of natural persons – HRK 3M NRR1.

Within its short framework, the one-year NRR, calculated for the kuna sources of funds, has been registering an uninterrupted downward trend ever since the start of its calculation. The decline of the NRR1 and the NRR2 indicators is lower than that of the NRR3 indicator because the funds bank borrow from the financial sector are also included in the calculation of the NRR3 and they have registered a greater decline in price of funds in the observed period than it has been the case with household deposits and the deposits of non-financial enterprises. As a result, all the said rates are currently at their lowest recorded levels, totalling 1.5% for the NRR1, 1.12% for the NRR2 and 1.36% for the NRR3.

As mentioned earlier, the time series of the official NRR data is relatively short, primarily due to unavailable historical data on the costs of the individual sources of bank funds in Croatia. However, in order to gain an insight into more long-term trends, historical NRR movements may be assessed, although only at an aggregate level, for all sources of bank funds and all currencies. A review of the movements of thus estimated aggregate one-year NRR from 1999 to 2015, shows that it reflects the movement of the ECB's reference rate and the risk premium for the Republic of Croatia. In addition, it is noteworthy that the NRR, due to its calculation methodology from historical data, reacts relatively slower to the changes in these indicators, which are, by their nature, somewhat more variable. The average value of the NRR estimated in this way over the priod under review totalled 3.1 percentage point and ranged between 1.7 and 4.5 percentage points.

In addition, since the NRR is calculated from the average cost of bank sources of funds and banks in Croatia are predominantly financed from deposits, which make up over 80% of bank liabilities, the movement of the estimated aggregate NRR is aligned with the movement of the implied nominal deposit rate (Figure 11). This connection is even more evident if the NRR2 and NRR3 versions are reviewed since they are calculated exclusively from the deposits of natural persons and deposits of the non-financial sector.

Interest rates on T-bills of the Ministry of Finance pursuant to the Consumer Credit Act are a one more changeable parameter in the credit relationship between consumers and banks. In the period under review they have been a more variable indicator than the NRR. Due to a poorly developed domestic financial market this interest rate can vary substantially over the long term (Figure 12). Currently, the dynamics of these rates is comparable to the dynamics of the NRR, with their levels being similar as well. Their level depends on a series of factors: the country's credit rating, the state's financing needs, the liquidity of the banking system, global risk aversion, the reference rates of major global central banks, etc. The deficiencies of these rates for consumers are their possible variability, dependence on state finances and lack of hedgeability from the risk of their growth.

Similarly to the NRR, interest rates on T-bills of the Ministry of Finance are currently at their lowest level – of 0.55 percentage points in case of the six-month kuna T-bill and 1.5 percentage points in case of a one-year kuna T-bill, which is approximately 6 percentage points below the value this indicator stood at in the middle of 2009 when the inflow of capital in the international capital markets dried out (Figure 12). The Ministry of Finance issues kuna and euro T-bills. The movement of interest rates on both types of T-bills is concordant, generally speaking, but there are periods when interest rates on these two types of T-bills may differ, depending on the supply of and the demand for kuna and foreign exchange in the money market. (Figure 12).

Figure 13 With the exception of the crisis, interest on consumer loans are in decline

Source: CNB.

Interest rates on newly granted home and consumer loans followed a similar pattern in the period after 2002. Following their uninterrupted decline until the onset of the crises (interest rates on consumer loans went down from approximately 15% to 11%, while interest rates on home loans went down from approximately 9% to 5%) early in 2008, they trended mildly upwards until the beginning of 2010, partly due to the change in the structure of newly granted loans, characterised by fewer home loans with a relatively lower interest rate. After that they trended downward noticeably until to date. However, this decline in interest rates after 2010 is most prominent in relation to consumer loans relative to home loans, especially due to the influences of regulatory changes during the period. These changes limited the price of short-term consumer financing.

International comparison

An international comparison of the current level and the recent movement of interest rates on home and other consumer loans, positioned Croatia around the CEE average. Interest rates on home loans are slightly above average, while interest rates on other consumer loans are below average. The comparison of interest rates from the category of other household loans should be viewed with caution because this category contains inhomogenous products. In contrast, home loans are a more homogenous group of products. Adjusted by the country risk premium, which, among other factors, affects the interest rate level, interest rates on home loans in Croatia are below the CEE average (Figures 14 and 15). However, this comparison is limited even when such a relatively homogenous product group as home loans is in the focus. Namely, in order for interest rates to be fully comparable, it is necessary to adjust them by loan maturity, collateral, currency of withdrawal, etc.

Figures 14 and 15 An international comparison of movements of interest rates on home loans (left) and interest rates on other household loans (right)

Note: Interest rates rates are related to a simple average of monthly interest rates within a year. The code “2015 minus CDS” denotes the interest rate on home loans reduced by the country risk premium, measured by credit default swaps.

Source: ECB.

The differences between the national reference rate (NRR) and EURIBOR

The manner in which the change in interest rates in the region is transferred to a particular loan depends on the reference rate applied to it. Thus, there are significant differences in the dynamics of the two most often used reference interest rates – national reference rates (NRR) and EURIBOR.

The NRR is the implied deposit interest rate, i.e. the average weighted cost of bank financing. Given the manner of its calculation (e.g. its level from May to August is calculated on the basis of data on the cost of bank liabilities, on average two quarters earlier – from January to March) this variable parameter reacts with a lag. In addition, once it starts reacting, in the beginning the intensity of this reaction is lower since movements within one month have a small impact on total implicit costs.

The growth of the EURIBOR rate on the other hand would result in an overall increase in interest rates within a much shorter period of time. Given that its value changes daily, its spillover to interest rates applied to loans would not be instant only due to the time required to change interest rates. Although the Consumer Credit Act does not expressly stipulate the term within which banks may adjust their interest rates to an EURIBOR increase, experience has shown that they usually adjust the interest rates charged to consumers to reference rates within a period of six months.

Due to a somewhat slower spillover of the cost of the sources of bank financing (most notably received deposits and loans) to the NRR in comparison to EURIBOR, interest rates on loans to consumers with variable NRR would grow slower.

However, changes in interest rates need not go in the upward direction so it is necessary to view the position of the debtor in case of a decline in interest rates. In that case, the slow reaction of the NRR would not go in favour of the consumer. Rather, it would slow down the decline in interest rates, that is, the improvement of the conditions for the consumer. Under such a scenario, the position of borrowers that have EURIBOR as variable parameter would be more favourable.

The specifics of the NRR and EURIBOR are not the only elements affecting the dynamics of interest rate changes. Namely, the rules on the maximum allowed level of interest rates pursuant to the Consumer Credit Act may also cause inertia when it comes to interest rate changes. As the Act defines the maximum nominal interest rates on household loans as a function of the average weighted rate on loans of all banks, it is evident that the distribution of interest rates among banks may affect their ability to raise the interest rate. In this way, banks with higher interest rates do not have room for growth of interest rates to consumers. However, if it comes to a rise in interest rates, the averages that define maximum interest rates will also follow an upward path.

In case of a more significant increase in rates these limitations would not affect all borrowers equally, the manner of adjustment would depend on the position of the client in the distribution of the interest rate level. The change in interest rates would thus, regardless whether interest rates are indexed to EURIBOR or the NRR, be somewhat less quick for clients closer to the legally allowed interest rate maximum.

Regardless of the advantages of the NRR, such as its seemingly greater stability and predictability, in certain circumstances its application could result in a quick materialisation of interest rate risk. Namely, in case of a stronger increase in deposit rates it could come to a rise in the interest of clients for early termination of time deposit agreements for existing deposits in order to benefit from the new, higher interest rate. Such actions would also cause the growth of the NRR and thus of interest rates to consumers that are indexed to the NRR.

There is one more difference between the NRR and EURIBOR interest rates resulting from the specific circumstances in which they are granted. Namely, at the end of 2015, average euro housing loans indexed to the NRR had a variable part of around 1.9 percentage points and a fixed part of around 3.7 percentage points. On the other hand, the variable and the fixed interest rate part of the comparable euro housing loans indexed to EURIBOR hovered around 0.03 percentage points and 5.6 percentage points respectively. Accordingly, euro housing loans indexed to EURIBOR as a variable rate were in fact granted almost entirely at a fixed interest rate part, that is, the rate which banks can influence through their internal procedures. In this way, banks may decide not not transfer the entire growth of interest rates on their clients, but permanently reduce the share of their margin, i.e. the fixed interest rate, instead. However, this falls exclusively within the realm of a business decision of an individual bank and is not a legal requirement.

The growth of reference rates in the international market is not the only change that could contribute to the materialisation of the interest rate risk. For instance, if the EURIBOR levels remain low and Croatia's risk premium increases, it would come to divergent interest rate movements in these two types of loans. For loans indexed to EURIBOR interest rates would remain unchanged because the fixed part of the loans indexed to EURIBOR locks in the current level of a country's risk premium. From the client perspective this would be a favourable development because they could obtain financing at a rate below the market. In contrast, interest rates on loans indexed to the NRR would probably rise because the NRR implicitly reflects the country's risk premium. Consequently, the higher risk premium would spill over to households.

Of course, an opposite situation is possible as well: in case of the decline of the risk premium the interest rate on loans indexed to the NRR would go down, as expected, due to the fall in the NRR, while the interest rate on loans indexed to EURIBOR would remain unchanged.

Nevertheless, the newly granted loans indexed to EURIBOR, would, as expected, then have a lower fixed part, so the consumers could (as explained earlier) than, according to the current loan supply, charges and conditions applicable, as well as their creditworthiness, refinance their loans at lower interest rates.

Table 1 Comparison of reference interest rate trends

| EURIBOR | NRR (National reference rate) | Interest rate on T-bills |

|

| Rate of change | Fast | Slow | Fast |

| Dependence on developments in the international market | Directly linked | Indirectly linked | Indirectly linked |

| Dependence on developments in the international market | None | Directly linked | Directly linked |

| Hedgeability by instruments of collateral | Developed market | No developed market | No developed market |

Source: CNB.

Finally, it is noteworthy that in contrast to EURIBOR there is no developed market for hedging against risk via financial derivatives. On the other hand, EURIBOR enjoys a developed market of instruments for hedging against interest rate risk. Accordingly, banks can in principle reduce or even completely neutralise the interest rate risk arising from the use of EURIBOR by employing different financial derivatives and offer clients fixed interest rates. The use of instruments to hedge against interest rate risk assumes additional costs that banks may embed into the overall cost of products, i.e. increase interest rates. In practice, consumers do not have access to the derivatives market so the main protection for loans to clients against interest rate risk is the use of loans with fixed interest rate that banks can offer them.

1 EURIBOR is an interest rate determined for the euro currency on the European interbank market. It reflects the policy of the European Central Bank and current market and economic developments.

2 The group of banks whose quotations serve as the basis for EURIBOR calculation may be found http://www.euribor-rates.eu/panelbanks.asp