Macroeconomic projections aim to predict and understand the future state of the economy on a broad scale. They include projections of economic growth, inflation, wages, unemployment and trade. Eurosystem and ECB staff produce macroeconomic projections for the euro area and the wider global economy. Macroeconomic projections contribute to the ECB Governing Council’s assessment of economic developments and risks to price stability (ECB). Since joining the euro area, the Croatian National Bank (CNB) produces two basic Eurosystem macroeconomic projections, along with the ECB and other national central banks. These projections are published in June and December. In addition, twice a year, in March and September, the ECB independently updates these projections for the euro area, while the CNB independently updates the projections for Croatia.

Expectations regarding global economic activity did not change significantly in recent months, even though the most recent results point to increasingly strong negative risks. Following a slower growth in the second quarter, the latest confidence indicators suggest further weakening of global activity in the third quarter, which might become increasingly prominent both in the manufacturing and in the services sector. This amplifies the negative risks both to global economic growth and the economic activity in the euro area, which has stagnated since the beginning of the year. Global inflationary pressures, particularly core inflation, remain strong, largely due to elevated services inflation. The decline in crude oil prices has also been more sluggish than expected due to the announced production restrictions, posing an additional risk for global inflation.

The projected growth of the Croatian economy for 2023 remained unchanged from the CNB's June projection and stands at 2.9%. Growth might decelerate to 2.6% in 2024 and 2025. The recent trends, including those in external environment, point to a build-up of negative risks. Economic activity might moderate in the remaining part of the year after a relatively strong growth recorded in the first half of this year, underpinned by a strong inflow of tourists as well as the growth in private consumption and, to a lesser extent, in investment. These expectations partly reflect a slowdown in the dynamics of tourist activity during the summer months, while private consumption is expected to moderate following the sharp increase at the beginning of the year, which is associated with a slower projected growth in real wages and the number of employed persons. On the other hand, investment activity might intensify due to expectations of a larger absorption of EU funds than in the first half of the year. Real growth might slow down to 2.6% in 2024, with a somewhat smaller contribution from investment. Services export growth might also decelerate given that the levels recorded so far have already exceeded their pre-pandemic levels. On the other hand, exports of goods might pick up next year as foreign demand accelerates, while private consumption might continue its steady upward pace, supported by a moderate increase in real income amid labour shortages and a continued decline in inflation. Risks to economic growth have remained elevated, with negative risks prevailing over the short term. On the other hand, medium-term risks appear more balanced. Negative risks stem from a relatively weak external environment, the prolonged conflict in Ukraine and the still-present geopolitical tensions, whose escalation might result in a pronounced slowdown of the global economy and ultimately of the euro area economy and Croatian economy. In addition, the accumulated effects of monetary policy tightening might give rise to a stronger-than-expected deceleration in economic activity. On the upside, private sector investments and labour market trends might prove to be more resilient to the effects of monetary policy tightening than currently expected.

With regard to labour market, employment is expected to continue its upward trend, with a drop in unemployment rate and a rise in both nominal and real wages. A relatively sharp rise in employment in the first half of 2023 is largely due to the acceleration of economic activity in the services sector, particularly in tourism. In the remaining part of the year and for the remainder of the projection horizon, momentum is expected to gradually recede, which is in line with the projected economic developments. Unemployment rate is expected to further decline moderately, partly under the influence of increased employment of foreign nationals. The growth in nominal and real wages is expected to decrease over the remaining part of the projection horizon following the acceleration in the current year, even though their trends will largely depend on the inflation dynamics and pressures exerted by employees related to catching up with potential relative wage lags in some activities during the period of strong price changes, as well as on labour shortages in certain activities.

Following a temporary rise in August due to the increase in energy prices, inflation is expected to continue its declining path and decrease from 10.7% in 2022 to an estimated 8.8% in 2023, before falling further to 4.7% in 2024 and 2.4% in 2025. The decrease in inflation in 2023 is mostly driven by declines in energy inflation, even though the limited supplies of crude oil in the world market have recently pushed inflation up. Food price inflation has also trended down amid still considerably lower energy prices relative to the exceptionally high levels recorded in mid-2022 and the decline in food commodity prices in the global market. Against the backdrop of normalised global supply chains, lower prices of energy and other raw materials should also slow down the rise in the prices of industrial products. In contrast, core inflation (excluding the price of energy and food) might accelerate to 9.4% in 2023. Services inflation remained at high levels in recent months and might grow more than previously anticipated in the whole of 2023. Services inflation is primarily spurred by catering and accommodation services, while factors driving the rise in their prices include, among other things, the previous cost increases caused by the rise in energy and food prices, labour shortages and the ensuing increase in wages, a robust demand for tourist services, as well as the continued process of the convergence of services prices to the average level in the euro area. Risks to inflation projections have remained elevated. In addition to higher energy prices, which have partly materialised in recent months, the risks of a slower decline in inflation include the possibility of a stronger growth in food prices, spurred by potential adverse weather conditions and Russia’s withdrawal from the Black Sea Grain Initiative. Moreover, inflation might also turn out to be higher in the case of a stronger growth in wages, especially in the absence of a decrease in profit margins which would absorb a part of wage cost pressures. On the other hand, a slump in demand, a stronger impact of monetary policy tightening and a more pronounced spillover of the decline in the prices of energy and other raw materials to consumer prices of goods and services might push inflation below its projected path.

The surplus in the current and capital account might increase significantly in 2023 from the levels recorded last year and stand at 2.9% of GDP, after which it is expected to gradually decline. The projected surplus increase in 2023 largely reflects the expected rise in tourism revenues, the increased net inflows of funds from the EU budget and a marked decrease in the value of net energy imports due to the fall in energy prices in the global market. However, the intensified use of EU funds and a robust domestic demand might contribute to the still relatively high growth rate of net imports of other goods. The surplus in the current and capital account might edge down over the remainder of the projection horizon driven by a further growth of the foreign trade deficit, given that domestic demand is still stronger than foreign demand, as well as by decreased net inflows of funds from the EU budget. Specifically, inflows from the EU budget are expected to peak in 2023, which is the deadline for the disbursement of funds allocated under the financial envelope for the 2014 to 2020 period and funds from the EU Solidarity Fund to be used for the reconstruction of earthquake-hit areas.

The European Central Bank (ECB) published its autumn projection for the euro area, available here.

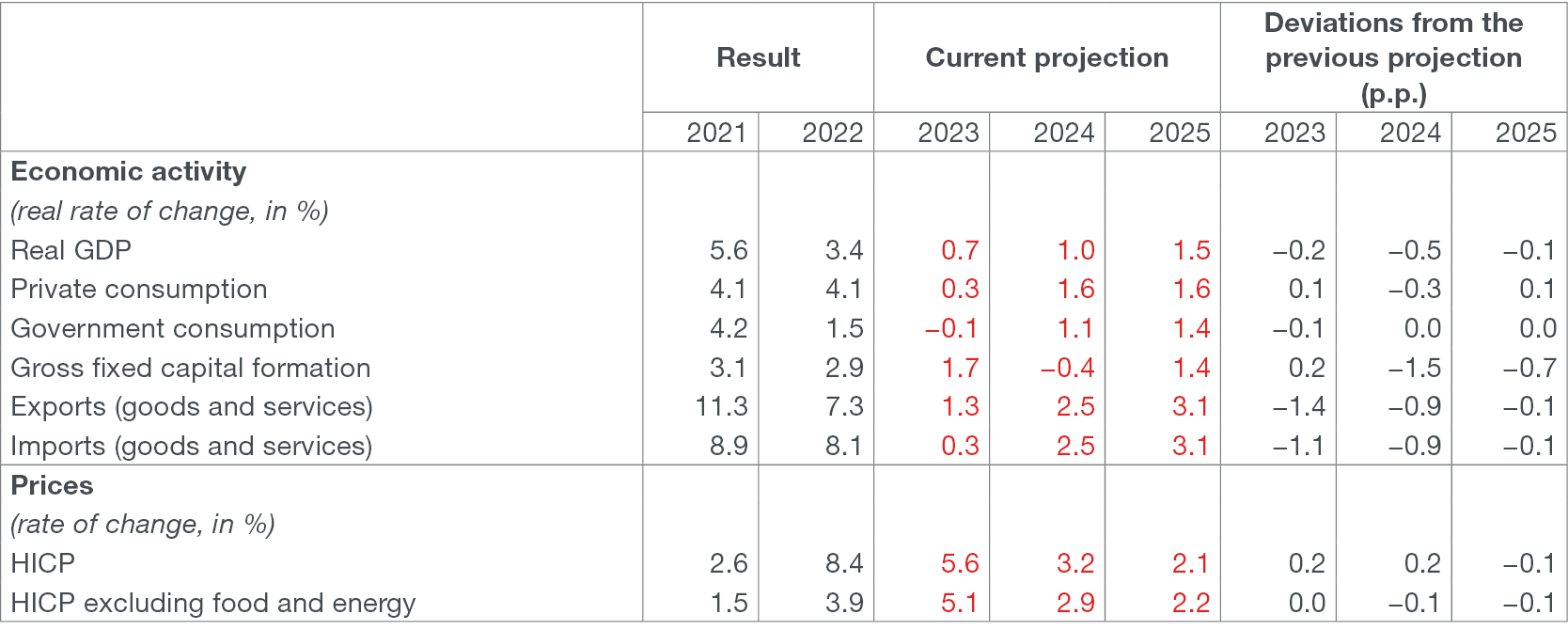

Table with macroeconomic projections for Croatia

(year-on-year change, unless otherwise indicated)

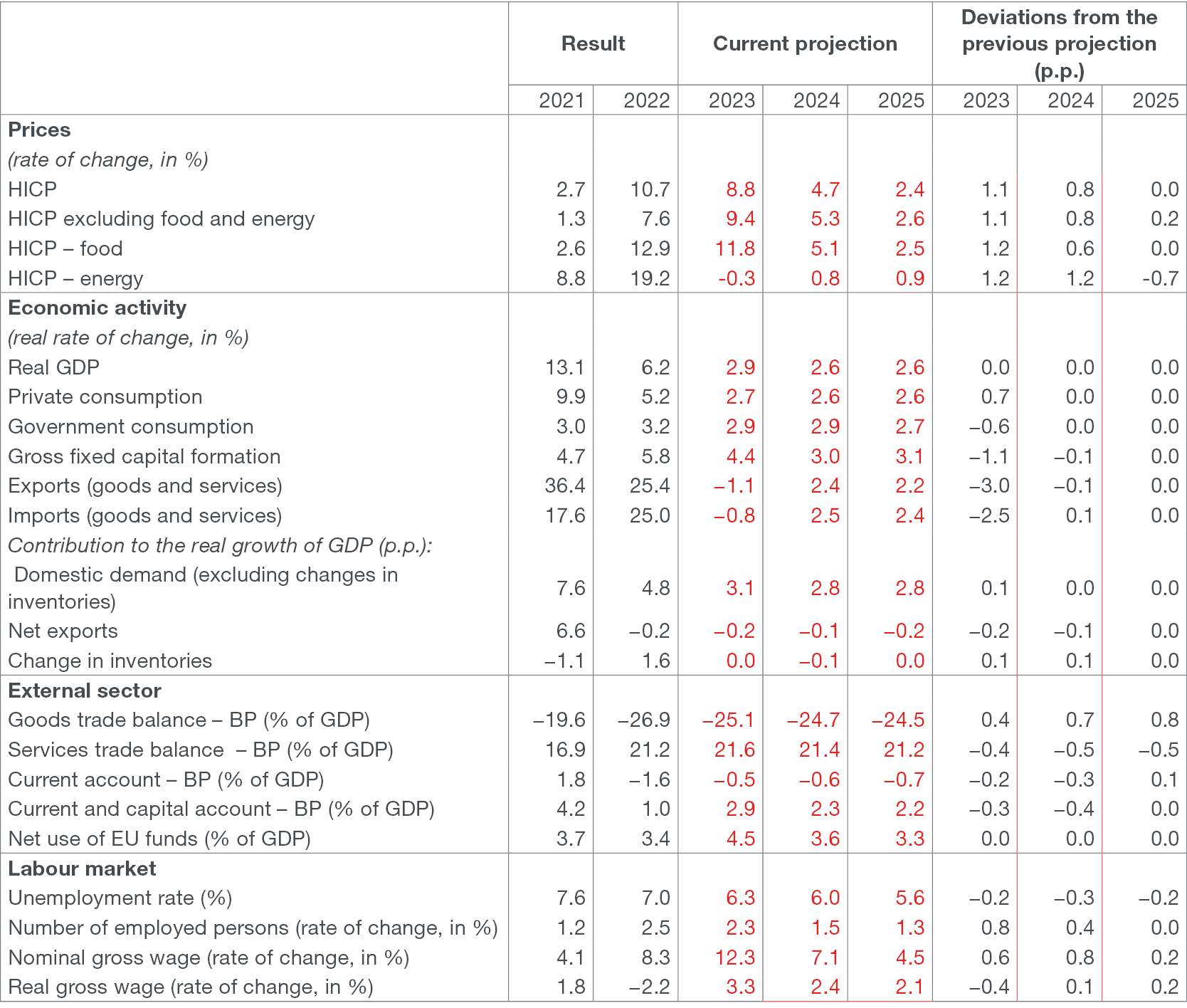

Table with macroeconomic projections for the euro area

(year-on-year change, unless otherwise indicated)