From August 2023 the comments on statistics, a short description of selected, recently issued statistical data in the area of monetary statistics and the non-residents sector statistics, are no longer published. They are replaced by Statistical releases.

Comments on the balance of payments and international investment position in 3Q 2019

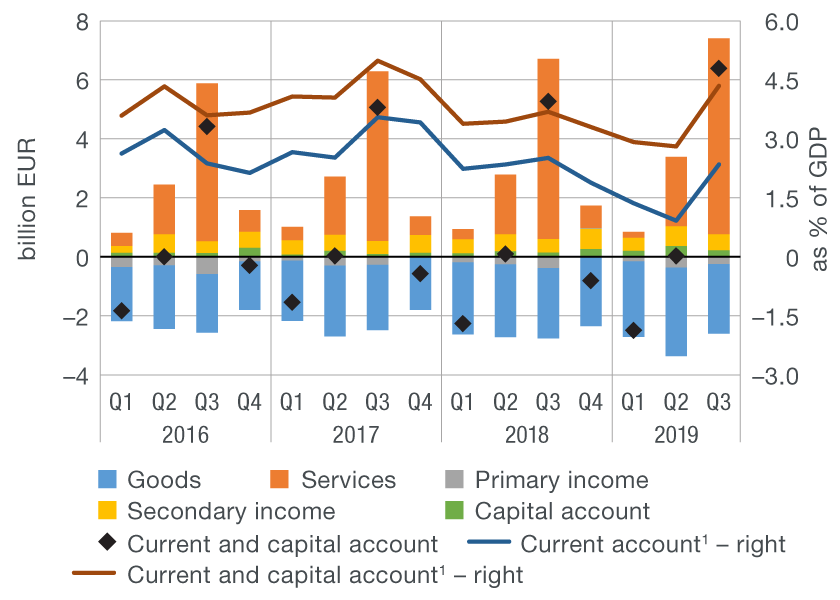

The current and capital account of the balance of payments ran a surplus of EUR 4.8bn in the third quarter of 2019, which is an increase of EUR 0.8bn from the same period in the previous year. The significant improvement of the balance was due to positive trends recorded in all sub-accounts, and especially in foreign trade in services. Observing the last four quarters of the year, the current and capital account surplus stood at 4.3% of GDP at the end of the third quarter, exceeding the 2018 surplus by 1.0 percentage point.

The surplus was in the third quarter of 2019 primarily boosted by growing net exports of services. The positive balance in the services account increased by a significant EUR 0.5bn from the same period in the previous year, mainly thanks to a continued rise in tourism revenues. Tourism revenues increased considerably more in the 2019 peak season (9.1%) than in the same period in 2018 (5.6%). The deficit in foreign trade in goods narrowed slightly by a 0.9% on an annual basis, after having widened significantly by 7.4% in the same period in the previous year. The annual growth rate of goods exports was 7.9%, compared with 8.8% in the same period in 2018. Goods imports slowed down even more, growing at an annual rate of 4.1%, relative to 8.2% in the previous year.

The primary income account deficit decreased by EUR 0.1bn from the same period in the previous year, primarily due to a strong growth in revenues from the compensation of residents temporarily employed abroad. The negative portfolio investment income balance also decreased, although to a lesser extent, due to an increase in revenues from resident investments in foreign securities.

The sum of the secondary income account balance and the capital transaction account balance rose noticeably in the third quarter of 2019 from the same period in 2018 (by EUR 0.2bn), with the rise primarily due to a strong growth in net revenues from transactions with the EU budget. As regards the purpose of funds disbursed to end users, approximately three fifths of the total amount were accounted for by capital revenues. Regarding the end user sector, slightly over a half of EU disbursed funds was related to the government. In addition to transactions with the EU budget, also fuelling the increase in the secondary income account was a further growth in revenues from personal transfers.

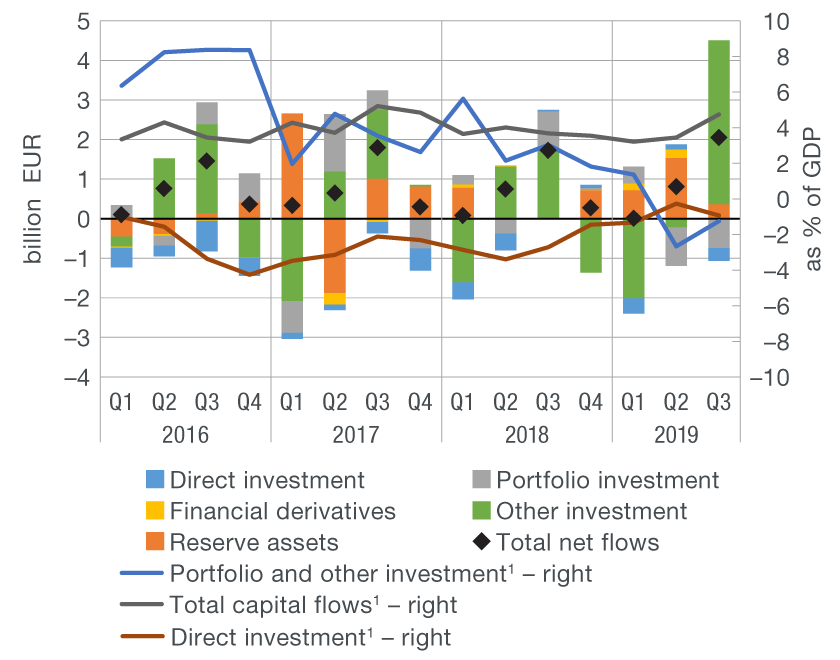

Figure 1 Balance of payments

| a) Current and capital account | b) Financial account |

|

|

1The sum of the last four quarters

Note: In the figure showing the financial account, the positive value denotes net capital outflow abroad and the negative value denotes net capital inflow.

Source: CNB.

The financial account of the balance of payments recorded a net capital outflow of EUR 3.4bn in the third quarter of 2019, an increase of EUR 0.7bn from the same period in the previous year. Broken down by individual accounts, the largest net capital outflow was recorded in the other investment account, while the direct and portfolio investment accounts had net capital inflows. International reserves grew, primarily due to foreign exchange purchases through foreign exchange interventions and, to a smaller degree, to an increase in government deposits.

The strong net capital outflow in the other investment account resulted both from a decrease in liabilities and an increase in the foreign assets of domestic sectors, primarily banks, which considerably improved their net foreign position during the tourist season. In contrast, despite a strong asset growth, backed by resident investments in foreign securities, the portfolio investment account had a net capital inflow. This was because assets grew less than did liabilities due to a bond issued by a large domestic grouping to refinance liabilities to foreign creditors, which also contributed to the already mentioned sharp decrease in liabilities and net capital outflow in the other investment account.

The net capital inflow in the foreign direct investment account (EUR 0.3bn) in the third quarter of 2019 was predominantly due to the retained earnings of foreign-owned domestic enterprises, particularly those engaged in financial intermediation, accommodation and trade. In addition, the inflow of equity investment in Croatia was considerably higher than in the same period in the previous year. The new investment, other than that made in the real estate sector, was also made in manufacturing, primarily in the manufacture of motor vehicles and food products. Domestic enterprises continued to deleverage against affiliated creditors abroad, although at a slower pace than in the same period in the previous year.

Table 1 Balance of payments

1 Excluding the change in the gross international reserves and foreign liabilities of the CNB; the investment of a portion of international reserves in reverse repo agreements results in a simultaneous change in CNB assets (recorded in the reserve assets account) and liabilities (recorded in the other investments account) and thus has a neutral impact both on changes in the central bank's net foreign position and the overall financial account balance.

The sum of the last four quarters.

Note: The positive value of financial transactions denotes net capital outflow abroad and the negative value denotes net capital inflow.

Source: CNB.

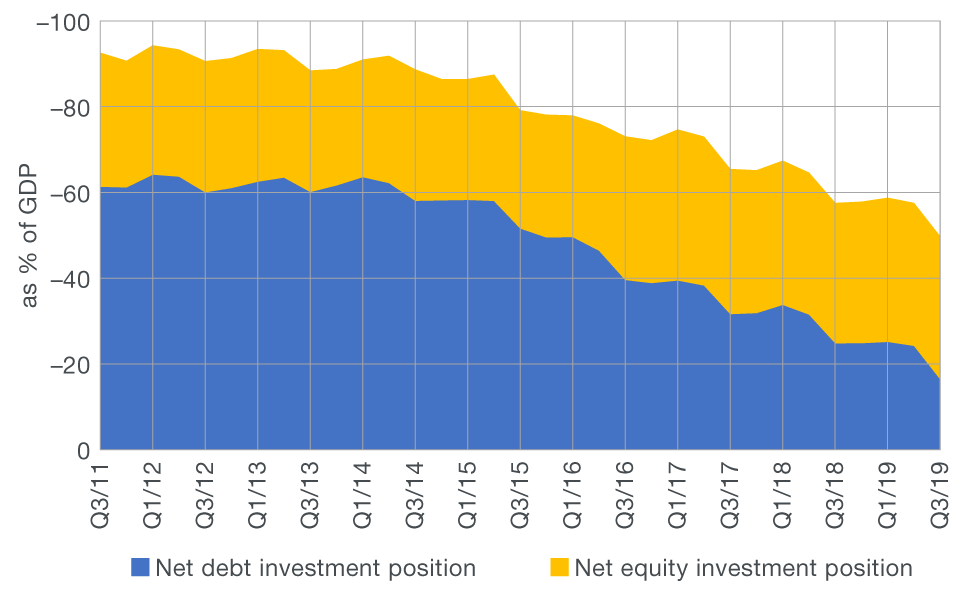

The net capital outflow in the third quarter of 2019 improved Croatia’s net international investment position by a significant EUR 3.8bn. At the end of September 2019, the net international investment position stood at EUR –26.6bn, that is, –49.7% of GDP (Figure 2).

Figure 2 International investment position (net)

Note: The international investment position equals the difference between domestic sectors' foreign assets and foreign liabilities. Net debt investments include financial derivatives.

Source: CNB.

Data revision

Data on the balance of payments and the international investment position are revised in accordance with the commonly used practice, based on subsequently available data.