Croatian citizens have achieved the above average result in overall financial literacy in the third internationally coordinated cycle of the survey conducted in 2022 and 2023 according to the methodology of the Organisation for Economic Co-operation and Development (OECD), as shown in the final official report published today by this organisation entitled "OECD/INFE 2023 International Survey of Adult Financial Literacy.

The survey was conducted in 39 countries, including 20 OECD member countries, on almost 69,000 respondents aged 18 to 79. The results for Croatia are based on the survey that was presented to the public by the Croatian National Bank (CNB) and the Croatian Financial Services Supervisory Agency (HANFA) in June 2023. Previously published results for Croatia differ from the results presented in the final report because of the subsequently adjusted OECD methodology, so that Croatia achieved an overall financial literacy result of 62% i.e., on average, Croatian citizens scored 62 out of 100 points.

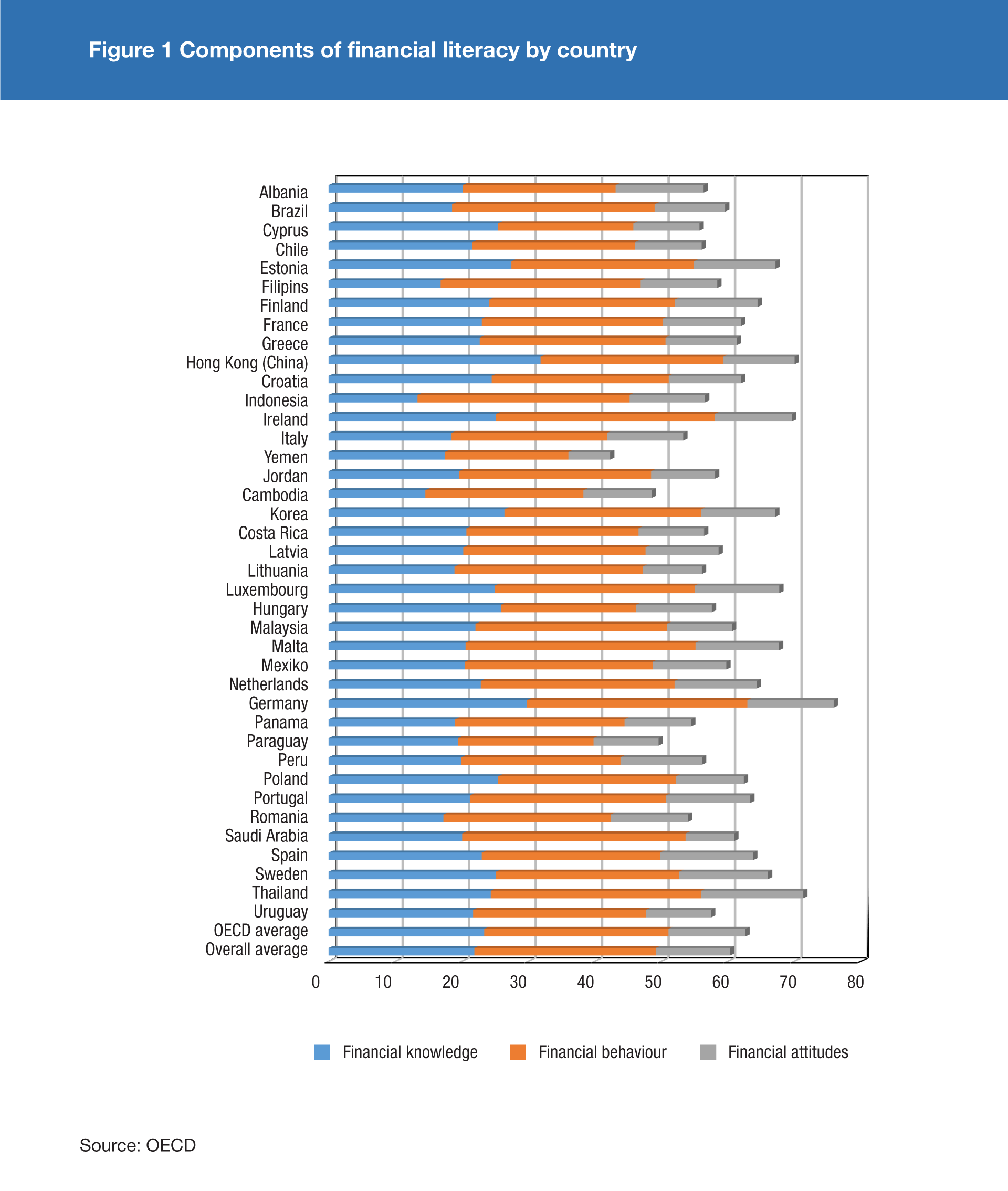

Across all participating countries, the highest level of financial literacy is among the citizens of Germany (76%). Among the EU member states, the citizens of Italy showed the lowest level of financial literacy (53%), while the lowest level across all participating countries was achieved by the citizens of Yemen (42%).

Croatia, with the result of 62%, is above the average of all the countries that have participated in this survey cycle (60%), and slightly below the average of financial literacy in OECD countries (63%) (Figure 1).

Above average high financial knowledge in Croatia

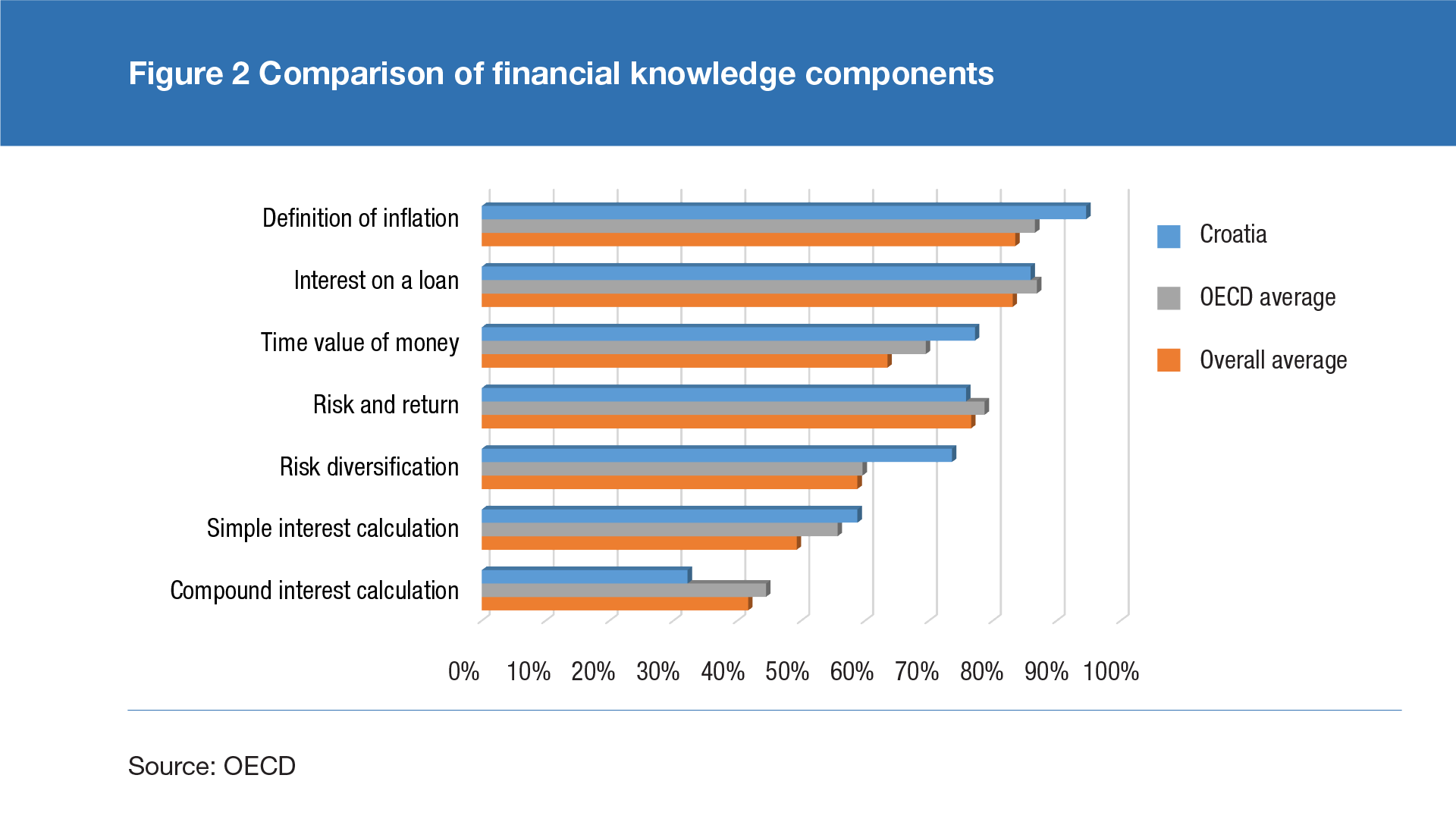

Croatia achieved the best results in the category of financial knowledge (70%), or 3 percentage points above the average across participating OECD countries (67%).

Within the financial knowledge component, Croatian citizens are best acquainted with the definition of inflation, while they showed the poorest knowledge in understanding the simple and compound interest calculation (Figure 2). Furthermore, the compound interest calculation proved to be a challenge among respondents across all participating countries, so that less than a half of all respondents correctly answered the question that required this calculation.

In all participating countries, on average about 84% of adults understand the definition of inflation, but only 63% can apply the concept of time value of money on their own savings. The percentage of adults who understand the time value of money has increased in all countries with comparable data since the previous survey cycle conducted in 2019, potentially due to the context of high inflation levels in many participating countries at the time when the survey took place.

Financial behaviour of Croatian respondents below average

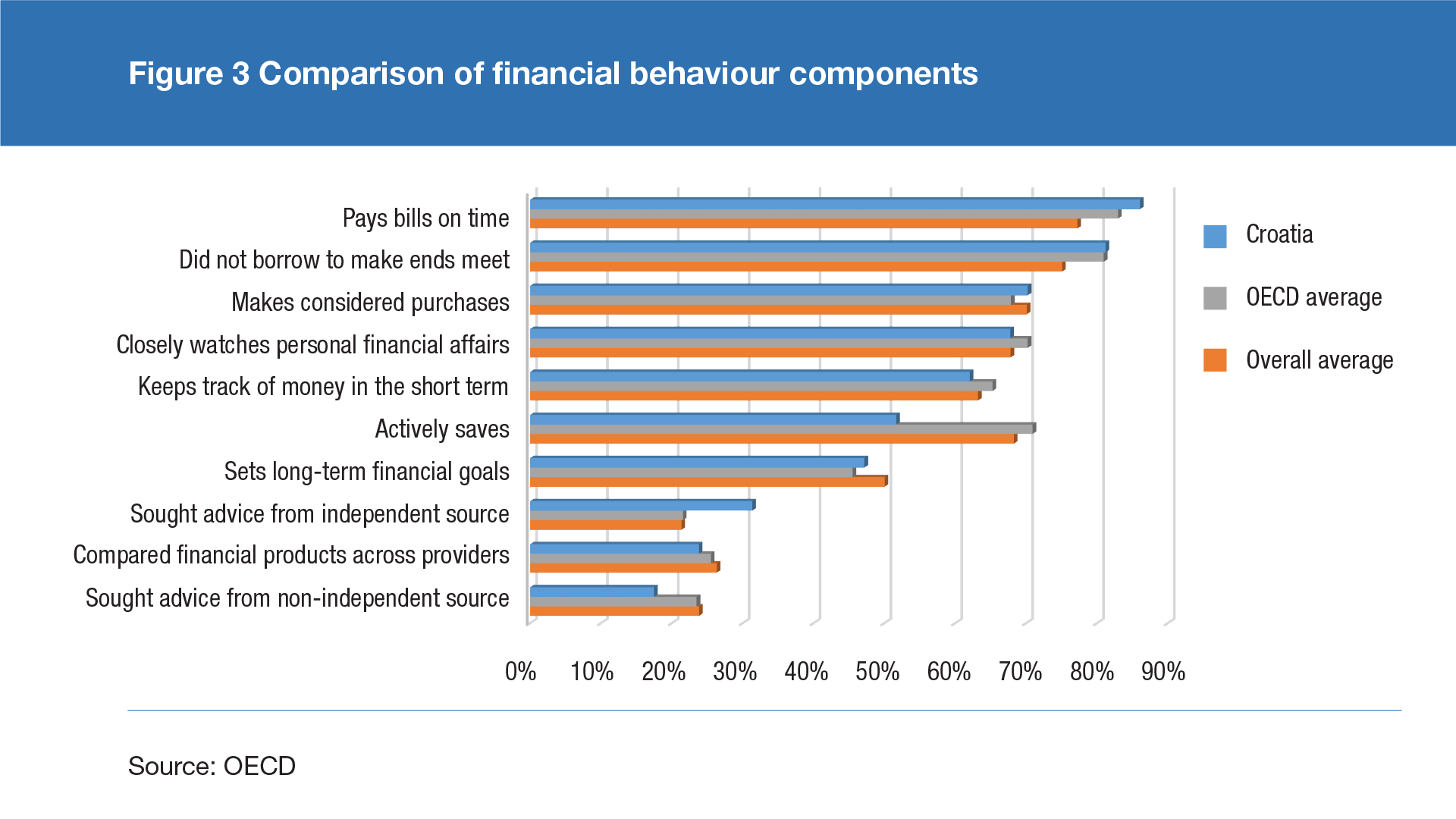

Financial behaviour is the most significant component of financial literacy and includes questions to determine financially savvy behaviour in managing personal finance.

The survey has shown that the citizens in Croatia tend to seek advice with regard to finance from independent sources less than the citizens of the EU and OECD countries (Figure 3).

On the other hand, Croatian citizens pay their bills on time more (by 3.1 percentage points) and make considered purchases more frequently (by 2.4 percentage points).

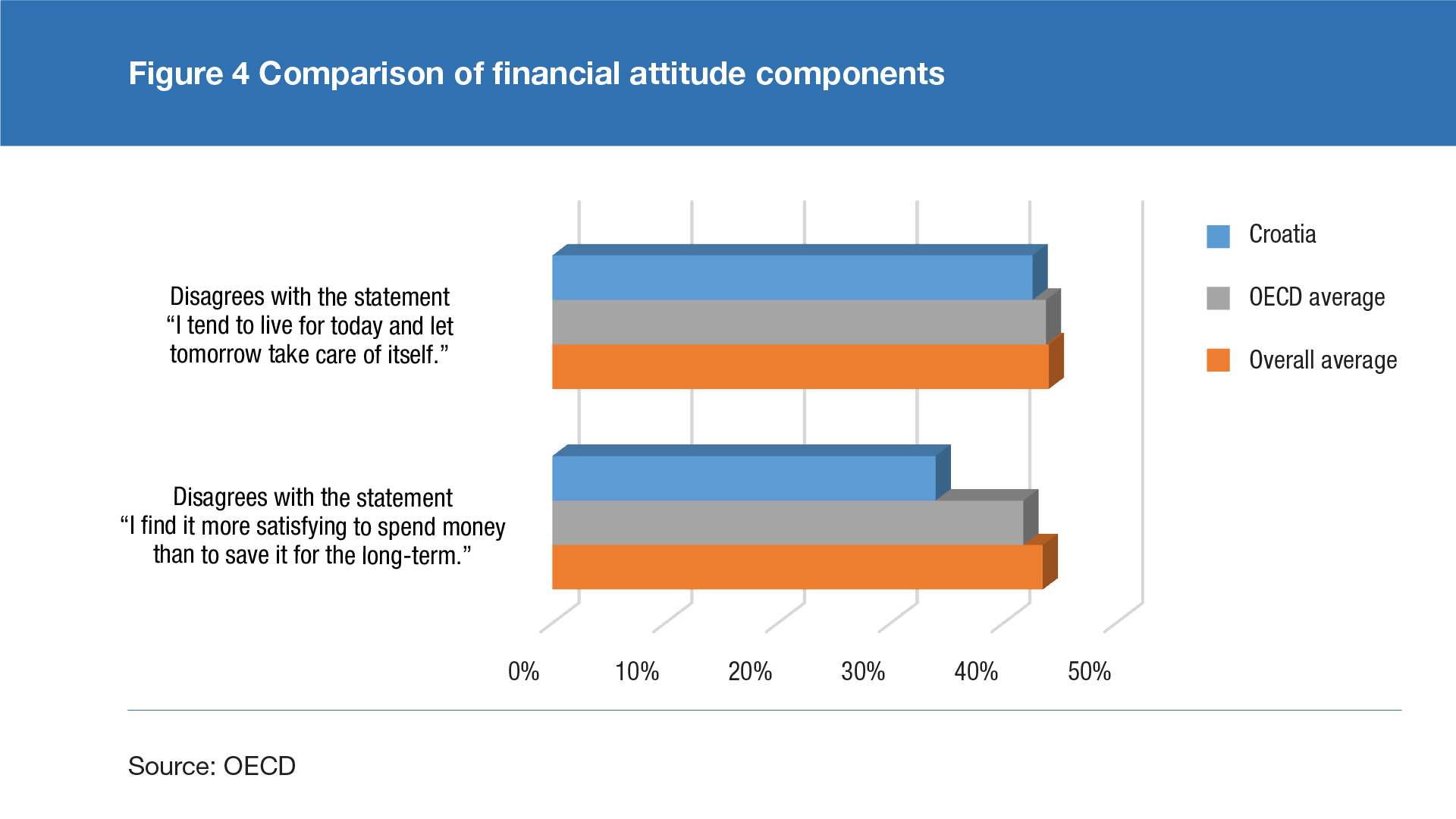

Financial attitudes in Croatia are not in accordance with the principles of financial literacy

Financial attitudes show that a significant number of Croatian citizens still give preference to spending over long-term saving (Figure 4). It is also the only component of financial literacy within which the achieved scores on all questions are lower than the average of the participating countries and the OECD average.

Digital financial literacy

The level of digital financial literacy was measured in the survey for the first time. On average across all participating countries, the digital financial literacy level is below the overall financial literacy level. The average of digital financial literacy across all countries is 53% and the OECD average is 55%.

The highest level of digital financial literacy is among the citizens of Germany and Estonia (64%), and the lowest digital financial literacy level is achieved by the citizens of Albania (39%).

While overall financial literacy in Croatia is somewhat below the OECD average, digital financial literacy is significantly lower, standing at 49%. However, a much smaller number of respondents in Croatia have been a victim of a financial fraud or scam, when compared to the other countries or the OECD average.

An additional momentum of digitalisation in Croatia might lead to an increased risk of the above-mentioned negative experiences due to which this area of financial literacy requires additional improvements, more so because the survey results show that a significant number of citizens in Croatia have not shown sufficient knowledge and skills for a safe application of digital products and services.

The full report is available at the OECD website.