Macroprudential Diagnostics No. 5

Introductory remarks

The macroprudential diagnostic process consists of assessing any macroeconomic and financial relations and developments that might result in the disruption of financial stability. In the process, individual signals indicating an increased level of risk are detected based on calibrations using statistical methods, regulatory standards or expert estimates. They are then synthesised in a risk map indicating the level and dynamics of vulnerability, thus facilitating the identification of systemic risk, which includes the definition of its nature (structural or cyclical), location (segment of the system in which it is developing) and source (for instance, identifying whether the risk reflects disruptions on the demand or on the supply side). With regard to such diagnostics, instruments are optimised and the intensity of measures is calibrated in order to address the risks as efficiently as possible, reduce regulatory risk, including that of inaction bias, and minimise potential negative spillovers to other sectors as well as unexpected cross-border effects. What is more, market participants are thus informed of identified vulnerabilities and risks that might materialise and jeopardise financial stability.

Glossary

Financial stability is characterised by the smooth and efficient functioning of the entire financial system with regard to the financial resource allocation process, risk assessment and management, payments execution, resilience of the financial system to sudden shocks and its contribution to sustainable long-term economic growth.

Systemic risk is defined as the risk of an event that might, through various channels, disrupt the provision of financial services or result in a surge in their prices, as well as jeopardise the smooth functioning of a larger part of the financial system, thus negatively affecting real economic activity.

Vulnerability, within the context of financial stability, refers to structural characteristics or weaknesses of the domestic economy that may either make it less resilient to possible shocks or intensify the negative consequences of such shocks. This publication analyses risks related to events or developments that, if materialised, may result in the disruption of financial stability. For instance, due to the high ratios of public and external debt to GDP and the consequentially high demand for debt (re) financing, Croatia is very vulnerable to possible changes in financial conditions and is exposed to interest rate and exchange rate change risks.

Macroprudential policy measures imply the use of economic policy instruments that, depending on the specific features of risk and the characteristics of its materialisation, may be standard macroprudential policy measures. In addition, monetary, microprudential, fiscal and other policy measures may also be used for macroprudential purposes, if necessary. Because the evolution of systemic risk and its consequences, despite certain regularities, may be difficult to predict in all of their manifestations, the successful safeguarding of financial stability requires not only cross-institutional cooperation within the field of their coordination but also the development of additional measures and approaches, when needed.

1 Identification of systemic risks

Having stagnated in the last quarter of 2017, real economic activity increased very slightly in the first quarter of 2018, mainly due to an acceleration in personal consumption. In contrast, for the first time after a long period, exports made a negative contribution to economic growth, primarily as a result of a decrease in the exports of goods, while industrial production also recorded a slight decline from the beginning of the year (see Bulletin No. 244). The available monthly indicators for the second quarter suggest a potential acceleration of growth, whereas the CNB expects economic activity to retain a growth rate similar to that in the previous year (see Macroeconomic Developments and Outlook No. 4). A similar trend could continue in the medium term, while important structural imbalances are expected to continue to diminish, primarily general government debt and external debt, which has a positive impact on the overall vulnerabilities of the domestic economy.

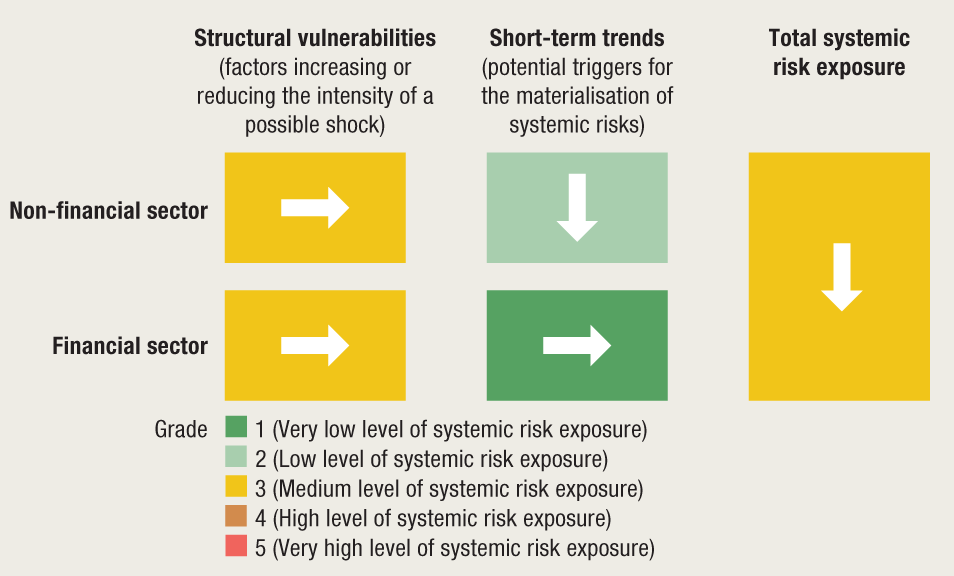

As regards general systemic risks, the exposure of the system slightly declined during the period of favourable cyclical movements compared with the analysis from the previous publication (see Financial Stability No. 19), but it has remained at a moderate level (Figure 1). The favourable direction of overall exposure was determined by short-term developments in the non-financial sector stemming from an improved liquidity position, although the already mentioned structural weaknesses of the domestic economy have remained significant and still make it vulnerable.

Figure 1 Risk map for the second quarter of 2018

Notes: The arrows mark changes relative to the risk map for the first quarter of 2018, published in Financial Stability No. 19.

Source: CNB.

General government debt continued to decline during the first few months of this year. A decline in fiscal sustainability risk was recognised by the rating agency S&P, which upgraded Croatia's credit rating in March this year, and by Fitch Ratings, which had upgraded it in January. With the easier access to international financial markets and considerably improved borrowing conditions, the years-long successful refinancing of public debt continued, which has further reduced interest expenditures, improved the fiscal position and reduced the risk exposure of the government sector. However, despite the progress achieved towards establishing long-term sustainability of public finances, the public debt-to-GDP ratio is still relatively high, which, combined with the high level of total external debt, constitutes a significant structural risk. Accordingly, the structural vulnerabilities of the non-financial sector have remained moderate, with the domestic economy still highly vulnerable to a possible deterioration in international financing conditions.

Structural vulnerabilities within the financial system, arising primarily from a high level of concentration of the banking sector, banks' exposure concentration and the currency and interest rate structure of loans granted to the private sector, are assessed as moderate (Figure 1). Although important structural indirect risks for banks (currency and interest rate-induced credit risks) have continued to decrease because of the rise of financing in domestic currency, at a fixed interest rate as well (or a variable interest rate that protects clients from interest rate risk for a longer initial period), they also increase direct risks for banks. Specifically, a reversal of the downward trend in interest rates could have an adverse impact on banks in terms of increasing their interest rate risk and maturity mismatch risk.

In contrast, the high level of capitalisation of the banking sector, the accumulation of liquidity and capital surpluses and a continuing decrease in reliance on cross-border financing have strengthened the banking sector's resilience. While the general vulnerability of the banking sector to simulated stress conditions has declined, the difference between the resilience of individual credit institutions has been growing (see Chapter 7 Stress testing of credit institutions in Financial Stability No. 19).

Current developments in the non-financial sector are mainly positive. The vulnerabilities of the non-financial corporate sector have been shrinking, primarily due to a decline in the aggregate debt of non-financial corporations[1] and lower interest expenditures. As shown by data presented by FINA, good business performance by enterprises resulted in the strengthening of their balance sheets and the improvement of their liquidity positions. However, despite the identified improvements, the uncertainties surrounding the restructuring of the Agrokor Group still remain, and the final model of the settlement and its implementation will have a decisive impact on the development in risks in this sector.

The vulnerability of the household sector has decreased slightly due to favourable labour market developments, which led to an increase in disposable income and real wages. The mild increase in total bank placements to households was coupled with a decrease in their currency and interest rate risk exposure, resulting primarily from the continuing growth of kuna lending and lending at a fixed interest rate over longer periods. This has also been a result of the CNB's active measures and recommendations (see Information list with the offer of loans to consumers and Recommendation to mitigate interest rate and interest rate-induced risk in long-term consumer loans). However the share of loans with variable interest rates in total loans has remained dominant, making borrowers potentially vulnerable to a potential interest rate growth.

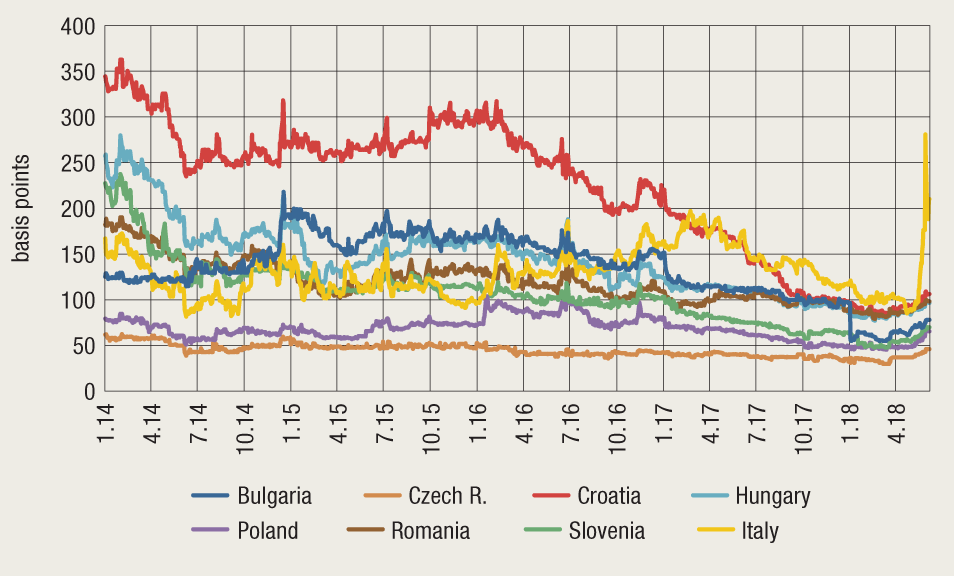

As regards adverse short-term external developments, which have not had a significant impact on Croatia, attention should be drawn to the increased political uncertainty in Italy due to the parliamentary elections held in March this year, which has markedly increased the price Italians have to pay to borrow. This is indicated by a significant widening of CDS spreads for Italian government bonds. Croatia’s risk premium has risen only slightly compared with the end of 2017, like the premiums of most other Central and Eastern European Countries. However, the CDS spread for Croatia has remained at its historical low, although it is still among the highest in the group of peer Central and Eastern European Countries (Figure 2).

Consequently, the external component of the financial stress index slightly deteriorated, but due to the strengthening of the domestic banking sector's resilience, short-term developments of the financial sector's systemic risks have remained unchanged. The risk of a spillover of the increased risk premium of Italian banks onto the domestic banking sector is rather low due to the relatively small net exposure of the domestic banking sector to Italy and the relatively low general dependence of the domestic banking sector on cross-border financing.

Figure 2 CDS spreads on five-year bonds of selected countries

Source: S&P Capital IQ.

2 Potential triggers for risk materialisation

The identified vulnerabilities show that the most significant potential triggers that may lead to risk materialisation are primarily related to developments in the external environment, and to a lesser extent also to the uncertainties surrounding the ownership and operational restructuring of the Agrokor Group (see Financial Stability No. 19).

Potential triggers from the external environment include a possible deterioration in international financing conditions, a general increase in global risk aversion, free trade restrictions and an increased propensity to protectionism. Such adverse global market trends would have the most serious consequences for countries with accumulated structural imbalances, including Croatia.

Growing instabilities in international financial markets, triggered by political and geopolitical uncertainties, increased risk aversion or a stronger tightening of monetary policy in major global economies could lead to an increase in interest rates and, in turn, boost the cost of borrowing both for the government and for private sectors in Croatia. Such trends would have a negative impact on their expenditures, worsen the long-term sustainability of public finances and increase the debt servicing burden in the private sector. This could further weaken economic activity and investments and, finally, have an adverse effect on the banking sector. In addition, the reescalation of the migration crisis and stricter state border control could produce negative effects on goods trade and tourism.

Rising investor concern regarding potential international trade restrictions and the strengthening of global protectionist measures can additionally accelerate the growth of global risk aversion. A shift towards protectionist policies in major global economies could influence other countries through trade channels, including Croatia. Furthermore, such trends could have an impact on the economic growth of Croatia's main trading partners and have an additional negative effect on domestic economic trends.

It should also be noted that, in addition to a deterioration in international market conditions and high public and private debt levels, the latest ECB Financial Stability Review refers to other key risks to the financial stability of the euro area. They primarily include potential obstacles to providing financial intermediation services, due to the fact that structural limitations in euro area countries continue to make a significant impact on bank profitability, and a potential emergence of liquidity risk in the non-banking financial sectors, which could spill over onto the whole system. The materialisation of these risks, triggered, for example, by adverse economic trends in euro area countries, could also affect the domestic economy.

3 Recent macroprudential activities

3.1 Continued application of the countercyclical capital buffer rate for the Republic of Croatia for the third quarter of 2019

Although lending activity has continued its mild recovery, an analytical assessment of the evolution of cyclical systemic risks suggests that there are still no pressures requiring corrections by the CNB. As shown by data for the first quarter of 2018, GDP growth and a continued decrease in the nominal debt of the non-financial corporations and households resulted in the further reduction of the standardised credit-to-GDP ratio. The credit gap calculated on the basis of this standardised ratio has thus remained negative, as confirmed by the specific indicators of relative indebtedness based on a narrower definition of loans (claims of domestic credit institutions, considered in relation to the quarterly, seasonally adjusted GDP ). Accordingly, the Croatian National Bank issued in June the Announcement of the application of the countercyclical buffer rate for the Republic of Croatia for the third quarter of 2019 of 0%.

3.2 Recommendations of the European Systemic Risk Board (ESRB) published in the first half of 2018 and action based on the recommendations

3.2.1 Decision on the reciprocity of the macroprudential policy measure adopted by the relevant authority of Finland (OG 41/2018)

Following the ESRB's amendment to the Recommendation on the assessment of cross-border effects of and voluntary reciprocity for macroprudential policy measures (ESRB/2018/1), in May 2018 the CNB issued the Decision on the reciprocity of the macroprudential policy measure referred to in the Recommendation of the European Systemic Risk Board of 8 January 2018 amending Recommendation ESRB 2015/2 on the assessment of cross-border effects of and voluntary reciprocity for macroprudential policy measures (ESRB/2018/1).

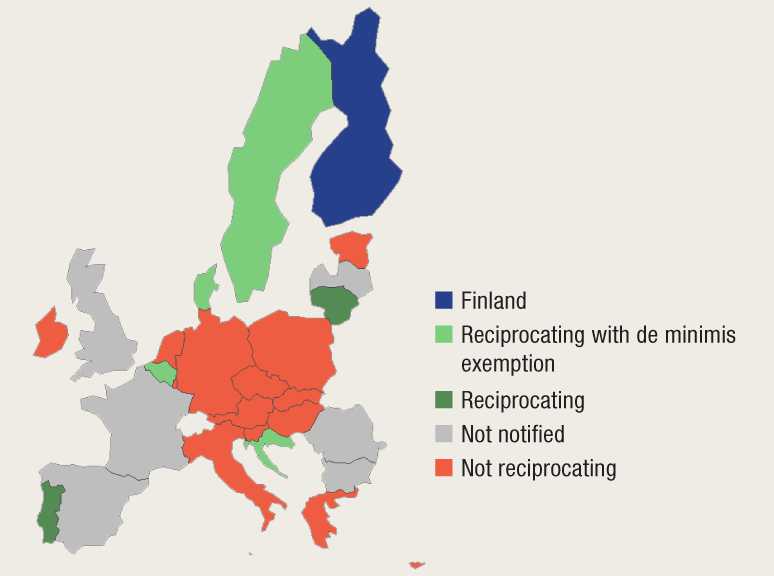

This Decision prescribes the reciprocity of the macroprudential policy measure adopted by the macroprudential authority of Finland, as recommended by the ESRB. The Croatian National Bank thus acknowledged and prescribed the reciprocation of a 15-percent floor for the average risk weight for exposures in Finland of credit institutions using the internal ratings-based approach for mortgage loans to the Finnish household sector secured by residential immovable property located in Finland. Exceptionally, a de minimis exemption applies to credit institutions whose exposure to the household sector in the Finnish mortgage market does not exceed EUR 1bn. Croatia currently applies this exemption to all banks.

The reciprocity of this measure has also been acknowledged by Belgium, Denmark, Sweden, Lithuania and Portugal, while a certain number of countries decided not to acknowledge the reciprocity of this measure due to a low level of exposure to Finland (Figure 3).

Figure 3 Reciprocation of the macroprudential policy measure adopted by the relevant authority of Finland by EU member states

Source: ESRB, CNB (as at 4 June 2018).

3.2.2 Recommendation ESRB/2015/1 on recognising and setting countercyclical buffer rates for exposures to third countries

Pursuant to Recommendation of the ESRB of 11 December 2015 on recognising and setting countercyclical buffer rates for exposures to third countries (ESRB/2015/1), the ESRB is to be submitted in the second quarter of each year a list of material third countries and, if necessary, notified of recognising and setting countercyclical buffer rates for exposures to identified third countries. Deciding on countercyclical capital buffer rates for third country exposures is also laid down in the Credit Institutions Act.

In line with the predefined analytical framework and schedule as well as the established criteria, at the end of the second quarter of 2018, the CNB reassessed the material exposures of Croatian banks to third countries, according to data available by the end of 2017. The analysis showed that, as in the previous year, only Bosnia and Herzegovina can be identified as a material third country for the Croatian banking sector. In addition, although Bosnia and Herzegovina recorded a moderate increase in lending activity, there is currently no potential cyclical pressure that would require an increased level of caution from the regulatory point of view. In June 2018 the ESRB was notified of the identified material third country.

3.2.3 Recommendation ESRB/2017/6 on liquidity and leverage risks in investment funds

Having analysed risks arising from an increasingly large role of investment funds in financial intermediation that may strengthen the impacts of a potential financial crisis, the ESRB, in February 2018, issued to the European Securities and Markets Authority (ESMA) and the European Commission the Recommendation on liquidity and leverage risks in investment funds (ESRB/2017/6). The Recommendation relates to the five areas for which, as determined by the ESRB, the ESMA should provide guidance to national supervisory authorities as regards the application of the existing macroprudential measures or possible changes to the legislative framework. These areas include: liquidity management tools, additional provisions to reduce the likelihood of excessive liquidity mismatches, stress testing, reporting by undertakings for collective investment in transferable securities and the usage of financial leverage.

In order to improve liquidity risk management, the ESRB recommended the introduction of a number of additional tools for liquidity management in cases of reductions of market liquidity, additional regulatory requirements and stress testing of investment funds. The Recommendation also provides for the establishment of a harmonised UCITS reporting framework, in order to facilitate the supervisory authorities' monitoring and assessment of their potential contributions to risks to financial stability, as well as the adoption of guidelines on a common framework for the risk assessment of financial leverage and the setting, calibration and limitation of financial leverage limits in the EU.

3.3 Overview of macroprudential measures in EU countries

Table 1 below shows macroprudential measures currently applied by EU countries in order to ensure the financial stability of the system as well as an overview of macroprudential measures applied in Croatia (Table 2), including those outside the CNB’s mandate as the competent authority for macroprudential measures, and their amendments in relation to the latest issue of Macroprudential Diagnostics No. 4.

In the first half of 2018 three EU countries introduced new macroprudential measures (marked green in Table 1) and several countries tightened the already existing measures. This tightening of macroprudential policy was for the most part related to the upswing of the credit cycle and the growth in real estate prices, especially that in residential real estate prices (for more details, see Financial Stability No. 19, Box 2 Trends in the European residential real estate market, and Box 3 Application of macroprudential measures related to the residential real estate market in the EU and EEA).

Table 1 Overview of macroprudential measures in EU countries

Disclaimer: of which CNB is aware

Note: The listed measures are in line with EU regulations, namely with Regulation (EU) No 575/2013 on prudential requirements for credit institutions and investment firms (CRR) and Directive 2013/36/EU on access to the activity of credit institutions and the prudential supervision of credit institutions and investment firms (CRD IV). The definitions of abbreviations are provided in the List of abbreviations at the end of the publication. Measures that have been activated since the previous version of the table are shown in green.

Sources: CNB, ESRB and notifications from central banks and websites of central banks as at 4 June 2018.

For more details see: https://www.esrb.europa.eu/national_policy/html/index.en.html.

Table 2 Implementation of macroprudential policy and overview of macroprudential measures in Croatia

Note: The definitions of abbreviations are provided in the List of abbreviations at the end of the publication. Measures that have been activated since the previous version of the table are shown in green.

Source: CNB.

-

It should be noted that statistical data slightly overestimate the decrease in the indebtedness of the non-financial corporate sector, as there is a problem of covering the sale of bank claims on non-financial corporations to other creditors. ↑