From August 2023 the comments on statistics, a short description of selected, recently issued statistical data in the area of monetary statistics and the non-residents sector statistics, are no longer published. They are replaced by Statistical releases.

Comments on monetary developments for January 2021

Total liquid assets (M4) decreased slightly in January based on transactions, reflecting the reduction in net domestic and net foreign assets of the monetary system. A breakdown of the components of total liquid assets through the monetary system's liabilities showed an increase in money (M1) and a decrease in quasi-money.

Total placements of monetary institutions to domestic sectors (except the central government) continued to grow on a monthly level, primarily due to the growth of placements to non-financial corporations, but also to households. Loans to households increased to the largest extent due to the increase in housing loans under the impact of loan subsidies, while on the other side cash general-purpose loans continued on their months-long downward path.

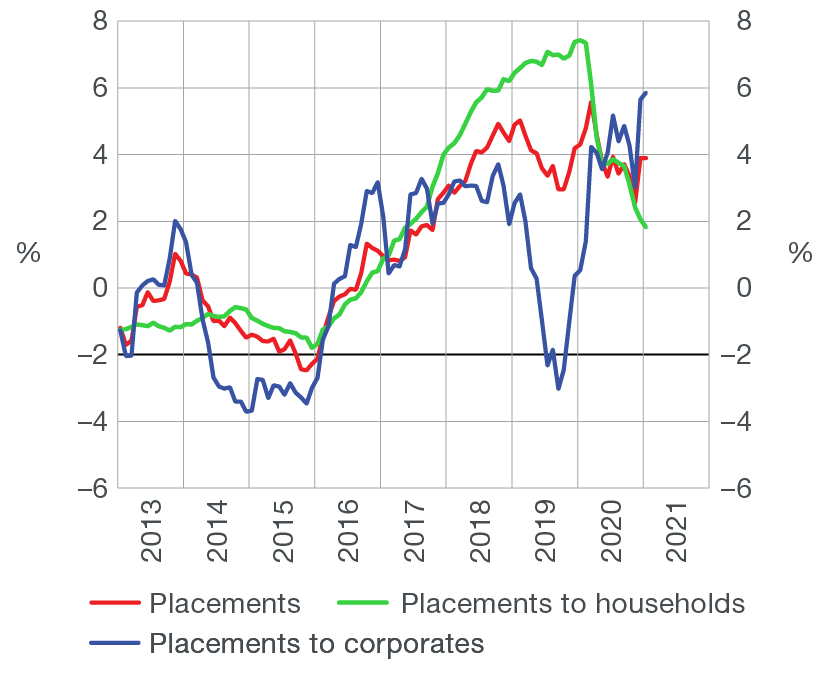

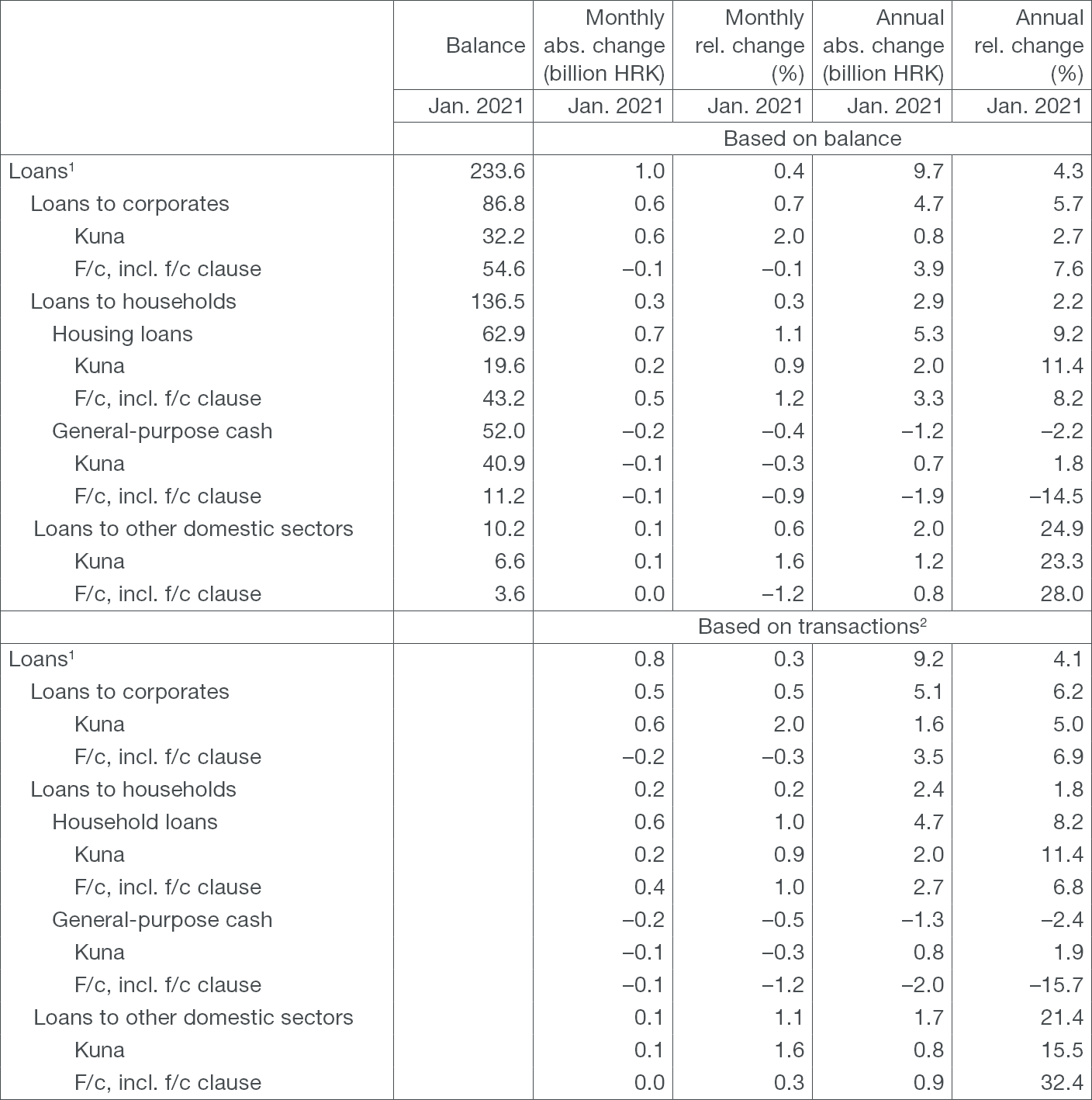

Total liquid assets (M4 [1]) decreased slightly in January 2021 (by HRK 0.5bn or 0.1%, based on transactions) (Table 1), mirroring the slight decrease in both of its components, net domestic assets (NDA) and net foreign assets (NFA) of the monetary system. A breakdown of M4 components through monetary system's liabilities reflects a HRK 1.6bn (1.0%) increase in money (M1 [2]), while quasi-money decreased by HRK 2.1bn (1.0%). The growth in money was primarily aided by the growth in demand deposits of households, but also by a very mild growth in money outside credit institutions, which usually goes down in January under the influence of seasonal factors. On the other side, the decrease in foreign currency deposits of non-financial corporations was the main reason for the decrease in quasi-money (Table 3). On the annual level, the growth of M4 decreased from 9.1% in December 2020 to 8.8% in January 2021 because of the base period effect of an uncharacteristic increase in that monetary aggregate at the beginning of 2020 when it usually registers a decline. However, the annual growth in M4 remained strong. The growth of quasi-money growth slowed down from 3.6% in December 2020 to 2.1% in January 2021, while that of M1 accelerated from 17.0% to 18.7% (based on transactions) (Figure 1).

| Figure 1 Monetary aggregates annual rates of change based on transactions |

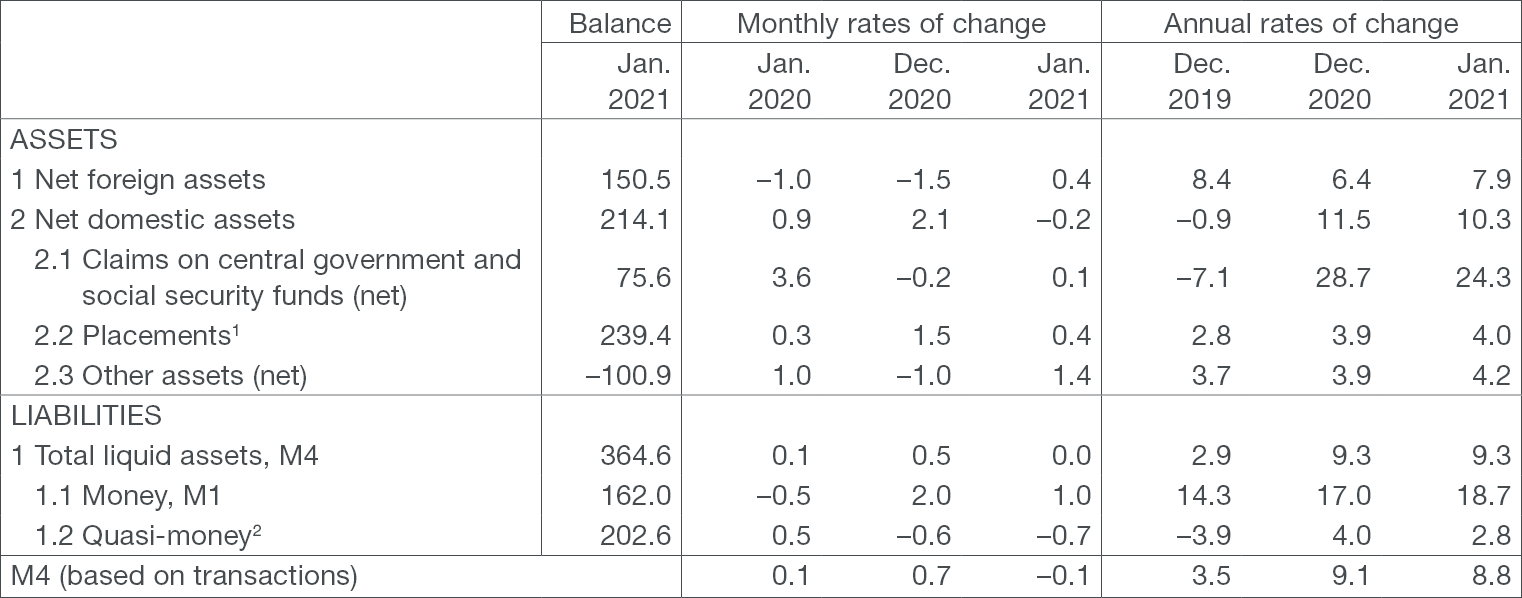

Figure 2 Placements annual rates of change based on transactions |

|

|

| Source: CNB. |

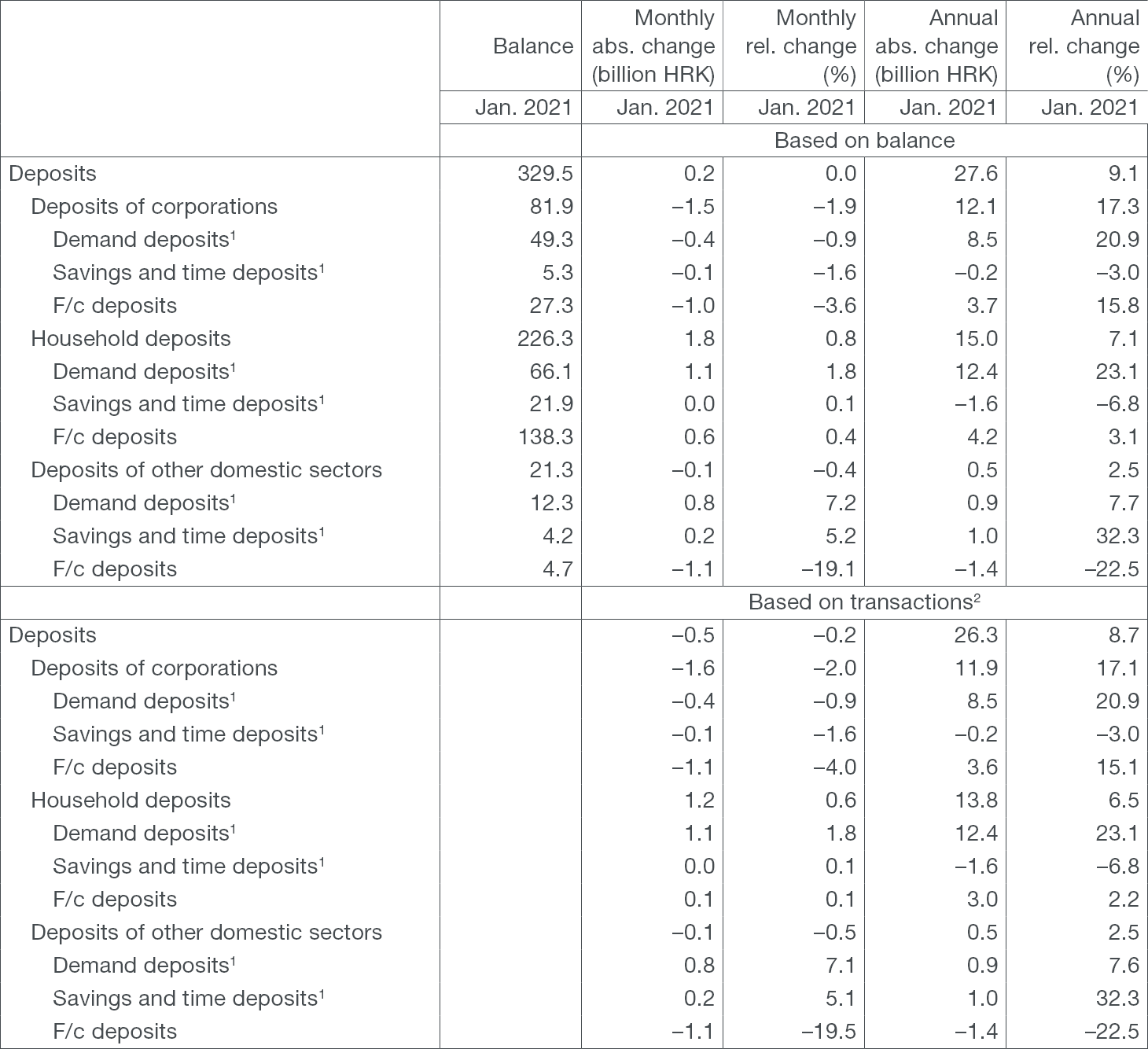

Total placements of monetary institutions to domestic sectors (excluding the central government) increased by HRK 0.7bn on a monthly level (0.3% based on transactions), ending January at HRK 239.4bn. Observed on an annual level, the growth in total placements held steady in January, at 3.9% (based on transactions) (Figure 2), the same level as in the previous month. In the total amount of placements, loans accounted for HRK 233.6bn. Loans granted to non-financial corporations went up by HRK 0.5bn in January (0.5%), their annual growth reaching 6.2% as compared to 6.0% registered in December of the previous year (based on transactions). Household loans continued to grow in January (HRK 0.2bn or 0.2% from the previous month, based on transactions), with housing loans going up by HRK 0.6bn (1.0%) and continuing to reflect the effect of government subsidies, while cash general-purpose loans continued to decline (HRK 0.2bn or 0.5%) (Table 2). Despite the acceleration in the growth of housing loans from 7.5% to 8.2% on an annual level, the growth of household loans slowed down from 2.1% to 1.8% as a result of the deterioration of the fall in cash general-purpose loans from –1.4% to –2.4% (based on transactions).

Table 1 Summary consolidated balance sheet of monetary institutions

in billion HRK and %

1 The sum total of asset items 2.2 to 2.8 of Bulletin Table B1: Consolidated balance sheet of monetary financial institutions.

2 The sum total of liability items 2 to 5 of Bulletin Table B1: Consolidated balance sheet of monetary financial institutions.

Source: CNB.

Table 2 Loans (except the central government) and main components

in billion HRK and %

1 In addition to loans to households and corporates, they also include loans to the local government and other financial institutions.

2 The transactions show changes that exclude the effects of exchange rate changes, securities price adjustments, reclassification and write-off of placements, including the sale of placements in the amount of their value adjustment.

Source: CNB.

Table 3 Deposits (except the central government) and main components

in billion HRK and %

1 Includes only kuna sources of funds of credit institutions.

2 The transactions show changes that exclude the effects of exchange rate changes, securities price adjustments, reclassification and write-off of placements, including the sale of placements in the amount of their value adjustment.

Source: CNB.

For detailed information on monetary statistics as at January 2021 see:

Central bank (CNB)

Other monetary financial institutions