From August 2023 the comments on statistics, a short description of selected, recently issued statistical data in the area of monetary statistics and the non-residents sector statistics, are no longer published. They are replaced by Statistical releases.

Comments on the balance of payments and the international investment position in 2Q 2018

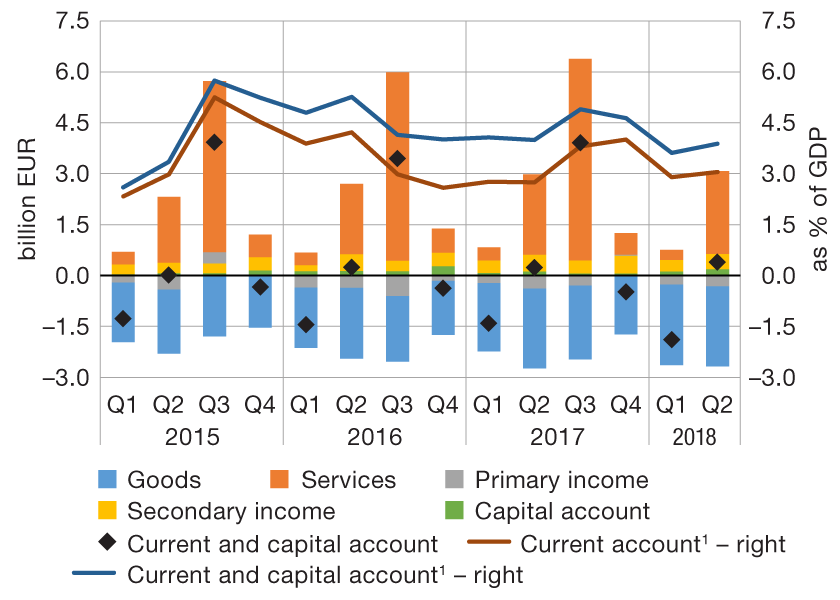

The current and capital account of the balance of payments ran a surplus of EUR 0.4bn in the second quarter of 2018, increasing by EUR 0.2bn from the same period of the previous year. The rise in the net exports of services and a narrower primary income account deficit had a particularly positive effect on the current and capital account balance, while the surplus in the secondary income and capital account saw only a slight increase. At the same time, the goods trade deficit remained at the level recorded in the same period in 2017. Observing the last four quarters, the current and capital account surplus accounted for 3.9% of GDP at the end of the second quarter of 2018, having gone down by 0.8 percentage points from the entire-2017 level. This was mainly due to the deterioration in the balance of foreign trade in goods and services in the first quarter of the current year.

In the second quarter of 2018, the foreign trade deficit remained almost unchanged from the same period in 2017, with a somewhat slower increase in exports (7.7% versus 8.4% in 2017), and a noticeably slower rate of growth in imports (4.4% relative to 10.2% in 2017). On the other hand, favourable results seen in the international trade in services were brought about by a further rise in tourism revenues (of 9.5%). Although the sharp increase of tourist consumption by residents abroad continued (by a half), the balance in trade in services recovered owing to a significantly lower absolute level.

Primary income account balance improved mainly in consequence of lower interest expenditures on the external debt of domestic sectors (particularly the government sector) and growing revenues from compensations to residents working abroad. Income from direct equity investment had a slightly unfavourable impact on the overall primary income account balance as the improved performance of domestic enterprises and banks in foreign ownership was somewhat more pronounced than the growth in the profitability of foreign enterprises in domestic ownership.

The overall secondary income and capital account balance increased slightly in the second quarter of 2018 relative to the same period in 2017 owing to the growth in total net revenues arising from transactions with the EU budget. Capital funds distributed to end users almost doubled, while the amount of funds for current expenditures dropped.

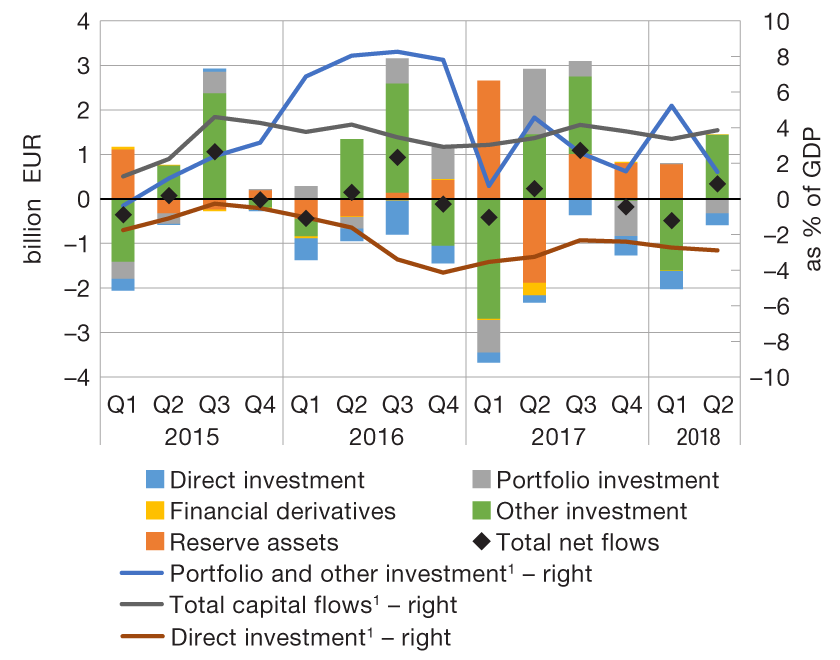

Figure 1 Balance of payments

| a) Current and capital account | b) Financial account |

|

|

1 The sum of the last four quarters

Note: In the figure above showing the financial account, the positive value denotes net capital outflow abroad and the negative value denotes net capital inflow.

Source: CNB.

The financial account of the balance of payments saw a net capital outflow of EUR 0.9bn in the second quarter of 2018, which is an increase of EUR 0.3bn over the same period in 2017. Essentially, the net capital outflow in the second quarter of 2018 is mainly a result of an increase in international reserves deriving from the depositing of funds generated by a foreign bond issue (partly financed by domestic investors) into the account with the CNB and from the purchase of foreign exchange from banks. However, this increase in reserves was offset by the decrease in the volume of international reserves invested in repo transactions, which is recorded as outflow on the other investment account.

Broken down by account, total net capital outflow is a result of developments in the other investment account mitigated by the net capital inflow to the accounts of portfolio and direct investment. Most of the net capital outflow in the other investment account (EUR 1.4bn) originates from a significant decrease in the central bank's liabilities based on the investment of international reserves in repo agreements (of EUR 1.1bn)[1]. The developments in the portfolio investment account were primarily influenced by the new government bond issue in the foreign market worth EUR 750m. However, as domestic investors purchased a considerable amount of bonds not only from that issue, but also from earlier issues of foreign bonds, the total net capital inflow in the portfolio investment account in the second quarter was smaller (EUR 0.3bn). The direct investment account recorded a net capital inflow of EUR 0.3bn in the second quarter of 2018, largely attributable to the inflow of equity investments (primarily in real estate and food industry) and the borrowing of domestic enterprises from affiliated foreign enterprises.

Gross international reserves grew slightly in the second quarter of 2018. This was due to the fact that the increase in reserves, arising from the rise in central government funds deposited with the CNB following a new foreign bond issue and, to a lesser extent, the purchase of foreign exchange from banks, was almost entirely offset by the aforementioned decrease in the volume of repo transactions.

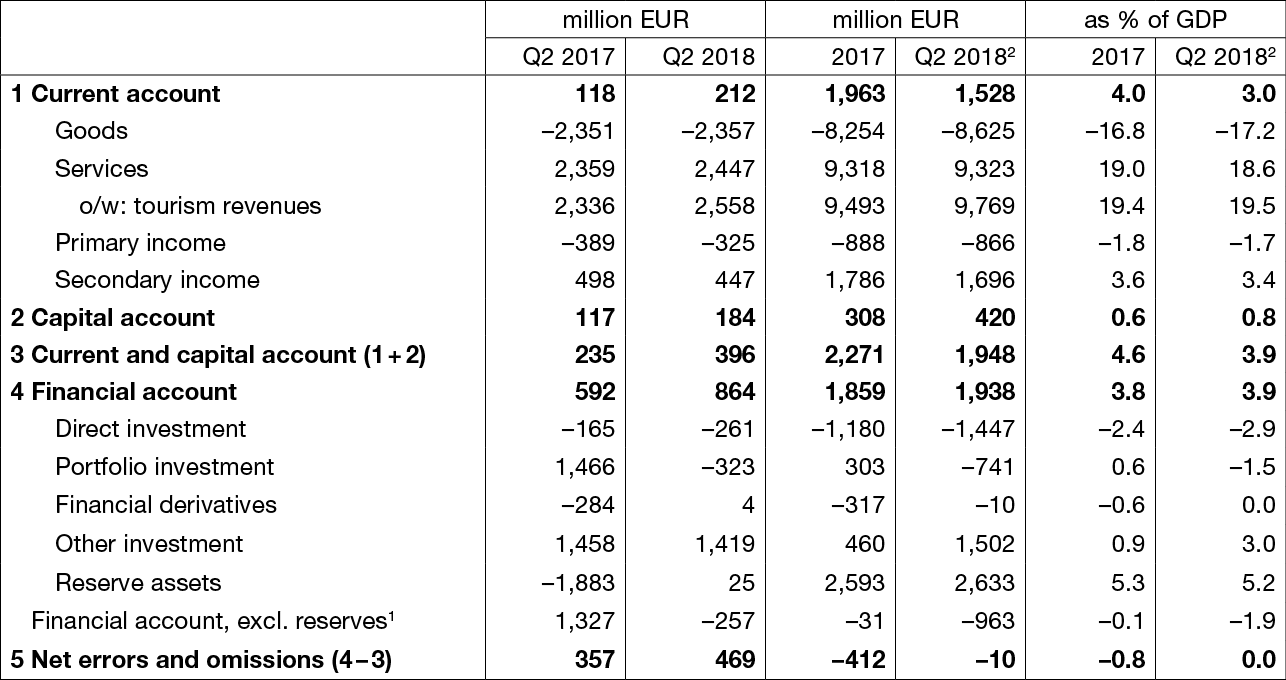

Table 1 Balance of payments

1 Excluding the change in gross international reserves and foreign liabilities of the CNB. Investment of a part of international reserves in reverse repo agreements results in a simultaneous change in assets (recorded in the account of reserve assets) and liabilities (recorded in the account of other investment) of the CNB and thus has a neutral impact both on changes in the net foreign position of the central bank and the overall financial account balance.

2 The sum of the last four quarters.

Note: The positive value of financial transactions denotes net capital outflow abroad and the negative value denotes net capital inflow.

Source: CNB.

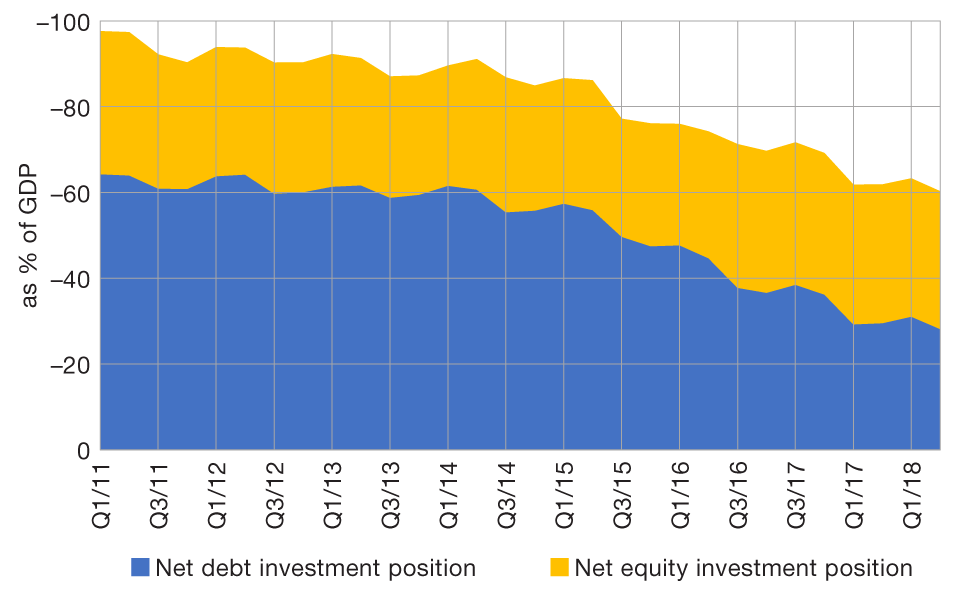

Net capital outflow resulted in the improvement of Croatia's net international investment position of EUR 1.1bn in the second quarter of 2018. Overall, the net international investment position stood at EUR –30.2bn at the end of June 2018, or –60.3% of GDP (Figure 2).

Figure 2 International investment position (net)

Note: The international investment position (net) equals the difference between domestic sectors' foreign assets and liabilities. Net debt investments include financial derivatives.

Source: CNB.

Sources of data:

Detailed balance of payments data

Detailed data on the international investment position

-

Investment of a part of international reserves in reverse repo agreements results in a simultaneous change in assets (recorded in the account of reserve assets) and liabilities (recorded in the account of other investment) of the CNB and thus has a neutral impact both on changes in the net foreign position of the central bank and the overall financial account balance. ↑